Balancing Act

Submitted by Atlas Indicators Investment Advisors on August 31st, 2025

The Federal Reserve heavily influences the American economy. Every six weeks the Federal Open Market Committee (FOMC) gathers to determine the correct course for monetary policy; they do this by setting the Fed Funds Rate (the amount charged for overnight loans between banks). In short, they are trying to strike a balance between controlling inflation and supporting the labor market and thus economic growth. These efforts were handed down to them via dual mandates (i.e., price stability and full employment). These goals are often at odds with one another, so if the FOMC chooses to favor one, the other tends to suffer.

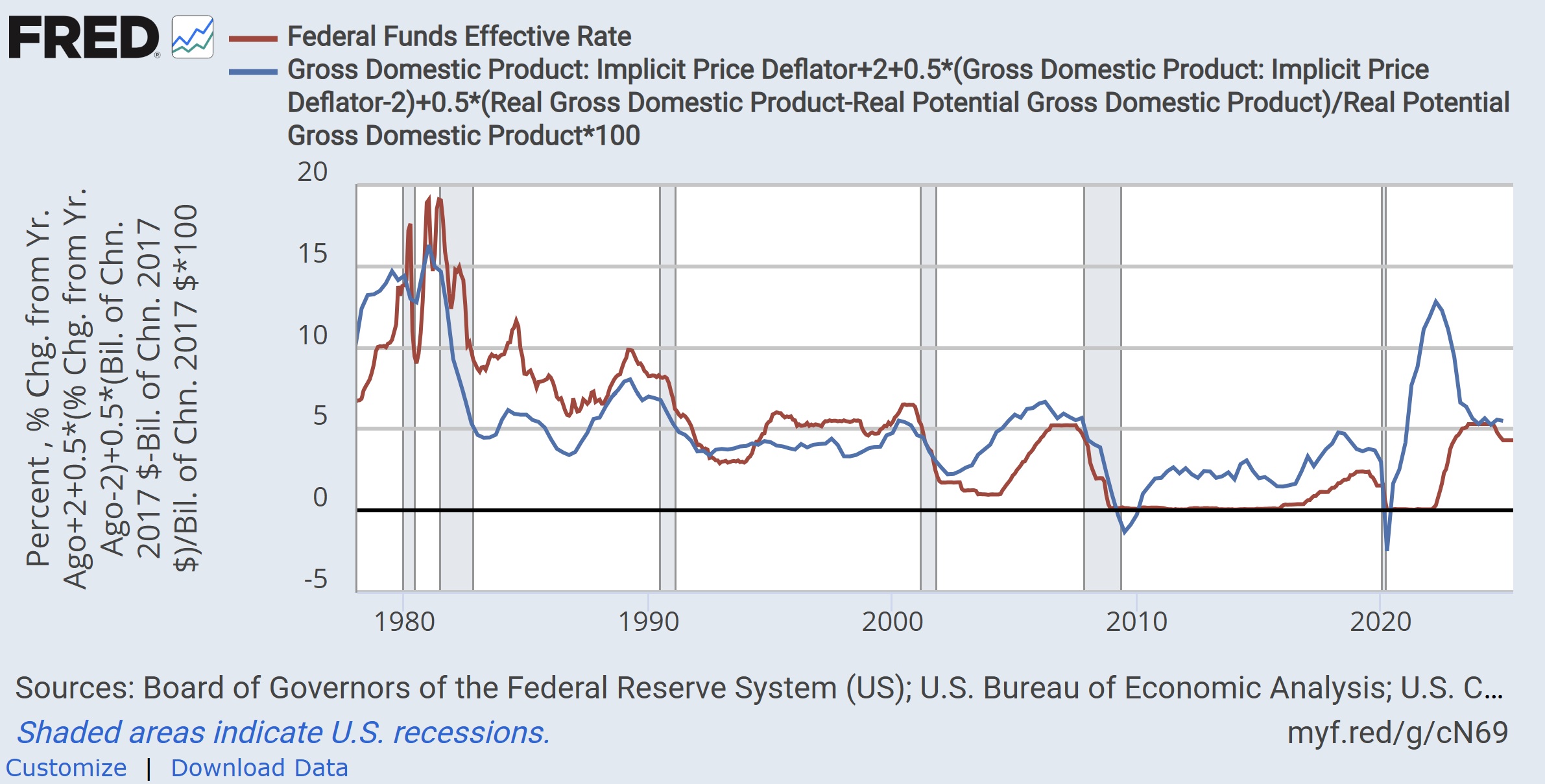

Enter the Taylor Rule. While this is not an explicit tool used by the FOMC, the Taylor Rule is a relatively simple formula that helps frame where the Fed Funds Rate “should” be priced. Think of it like a compass which directs which way policy decisions should head. It was developed in the 1990s by economist John Taylor and considers two factors: inflation and the output gap (i.e., the difference between output and potential output). Generally, when inflation is above their 2.0% target, it suggests that the Fed Funds Rate should be higher (keeping things from overheating further). Conversely, it suggests lowering rates when the economy is performing below capacity. Pretty simple, right?

There are times when the FOMC and Taylor Rule are aligned. Then there are others when they deviate greatly. Take the period immediately following the Covid-19 shutdown. It’s represented above by the big gap between the blue and red lines on the right side of the chart. As you can see, the rule suggested that the policy should have been for a much higher rate while the FOMC Chair, Jerome Powell, was suggesting inflation was transitory. Admittedly, the 12.8% overnight rate that was called for in April of 2022 is difficult to imagine.

That was then. Today, the rule and the policy are much more aligned. Nevertheless, the Fed is experiencing some pressure to lower rates. President Trump has been quite vocal about it, and last Wednesday July 30th, two FOMC members joined his chorus; both happened to be his appointees. This is the first time since 1993 that two of the Fed Governors dissented. Nevertheless, the FOMC voted to leave the rate unchanged.