Laboring Through Data for You

Submitted by Atlas Indicators Investment Advisors on October 2nd, 2025

Welcome to Friday, jobs day. Your federal government may be shut down, but Atlas is not. A quick glance at the economic calendar will show you that the Bureau of Labor Statistics is supposed to release the September 2025 labor report later this morning. This would in turn cause Atlas to send you a note about the release’s details. That initial condition was not met this morning, so that specific note from Atlas will be delayed. But that hasn’t stopped Atlas from producing some thoughts on the labor market this morning anyway.

A few days ago, the private payroll provider ADP released their September 2025 report. As it turns out, their data show 32,000 jobs were lost in the month. The details show some favor for larger firms as those with greater than 500 employees added to their rosters (up 33,000 jobs), while those with 499 or less saw the payroll count decline. There were some regional challenges as well: the Midwest shed 67,000 jobs while the other three major regions gained.

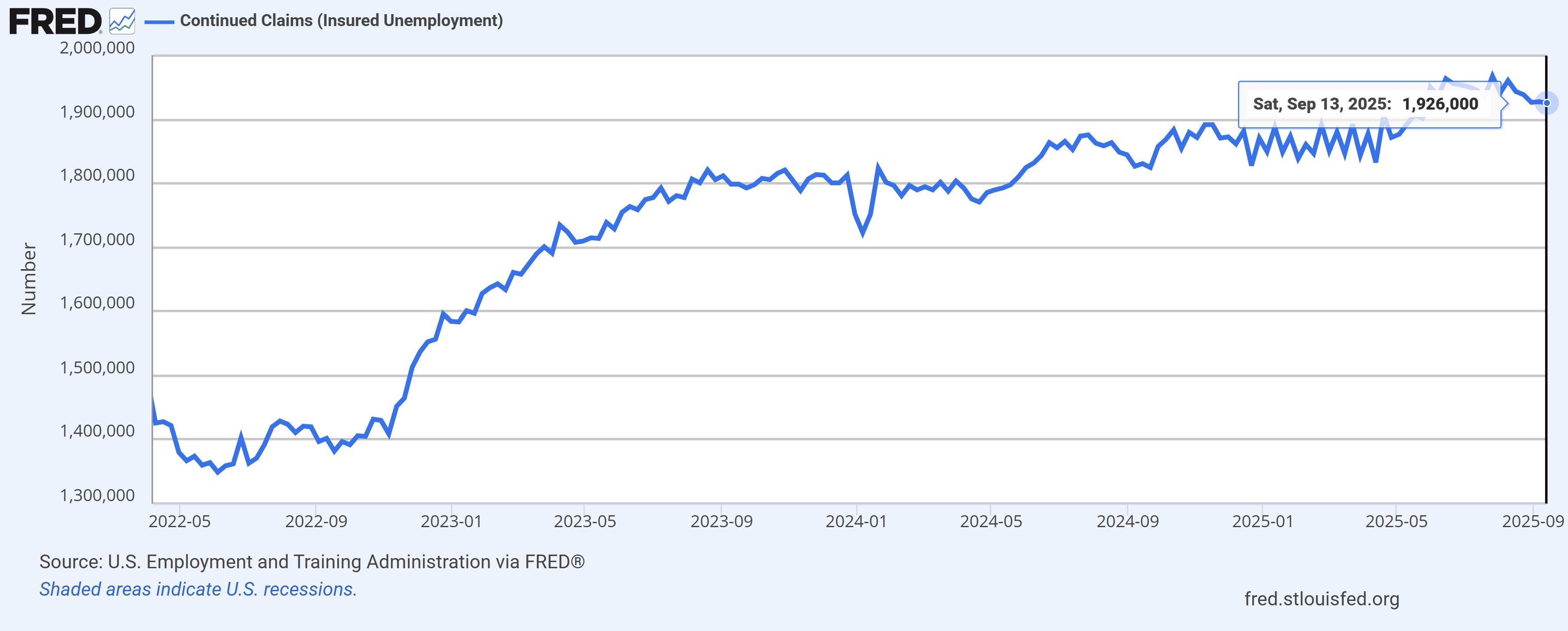

While weekly jobless claims, due out yesterday from the Department of Labor, weren’t reported but we can still look at the trends from prior releases to get some clue into the state of the market. Initial claims fell 14,000 in the last report, a positive. But as you can see above, the continuing claims remain elevated versus levels at the start of the year. These are folks who have remained without work beyond the initial period in which they request unemployment benefits.

There are still other ways to consider the labor market. For instance, the Indeed Job Posting Index remains above its pre-pandemic level by roughly 4% but is also down 7% from a year earlier. Or the Institute for Supply Management’s reports on both manufacturing and services each contain employment data. They suggest manufacturing hiring dipped again in September but did so at a slower pace while services followed a similar pattern.

America’s employment backdrop is softening. It is hard to imagine if the government released statistics today that the report would say otherwise. This is likely giving the Federal Reserve more justification for another rate cut later this month. Of course, they will also need to pay attention to their other mandate: inflation. Like the labor data due out today, the most watched figures for price changes are also produced by government entities. Atlas will do its best to cobble together some talking points about recent changes to inflation if the leaders in the Beltway haven’t reopened the government in time for inflation-related data.