Business Cycle

Canary in a Copper Mine

Submitted by Atlas Indicators Investment Advisors on May 31st, 2023

While there are more humane approaches to detecting carbon monoxide available today, coal mines used canaries beginning in 1911 at the advice of Scottish scientist John Haldane. Carbon monoxide is a colorless and odorless gas that causes suffocation when it is concentrated in the air, so having a way to detect it in a mine was lifesaving if you weren’t a songbird. Once the chi

What’s So Boring About Beige?

Submitted by Atlas Indicators Investment Advisors on April 27th, 2023Manufacturing a Narrative

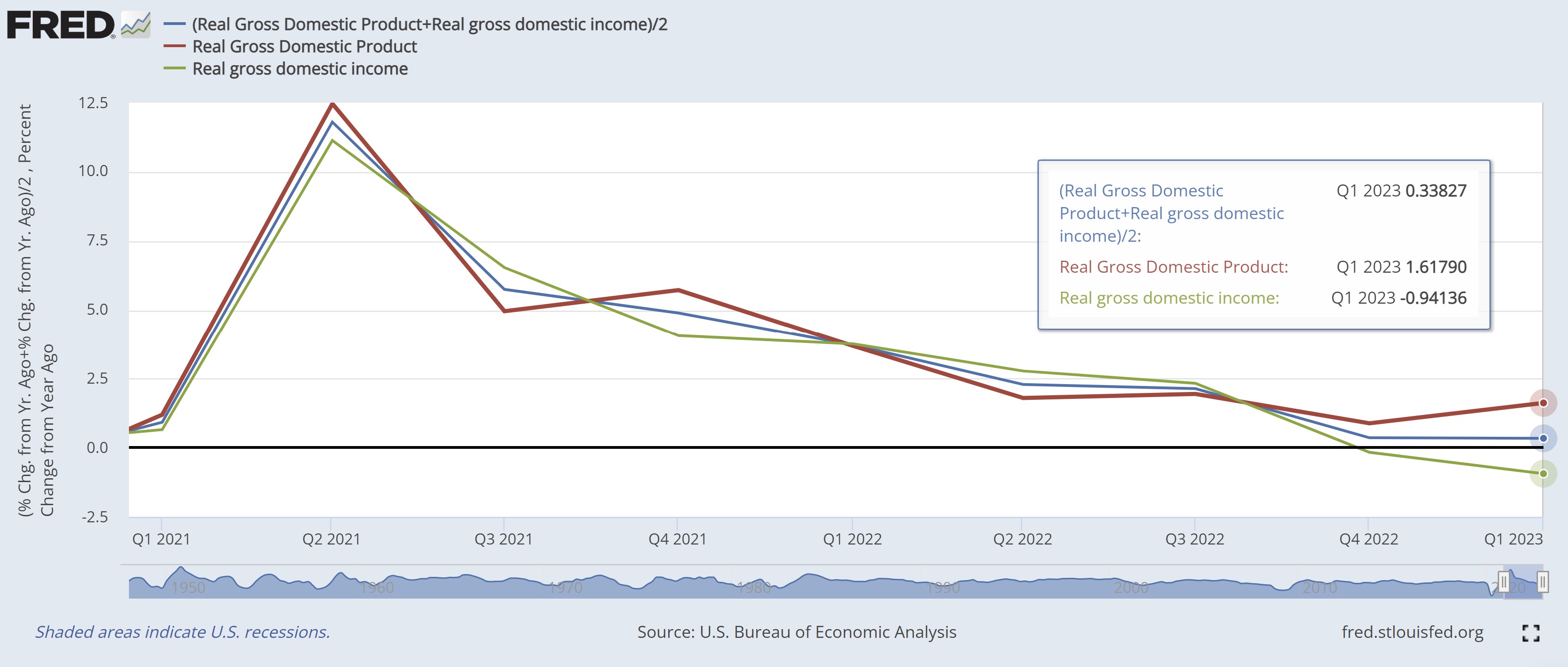

Submitted by Atlas Indicators Investment Advisors on March 10th, 2023

Telling stories is what humans do. No two people have an exact telling about the same event. Thoughts on the economy are no different. There is a “Truth” but none of us have the luxury of knowing all. Instead, we each have our own truths. These aren’t intentionally deceptive. Instead, they become manufactured and colored by our own experienc

Snow Way Out

Submitted by Atlas Indicators Investment Advisors on March 10th, 2023Misleading Indicators

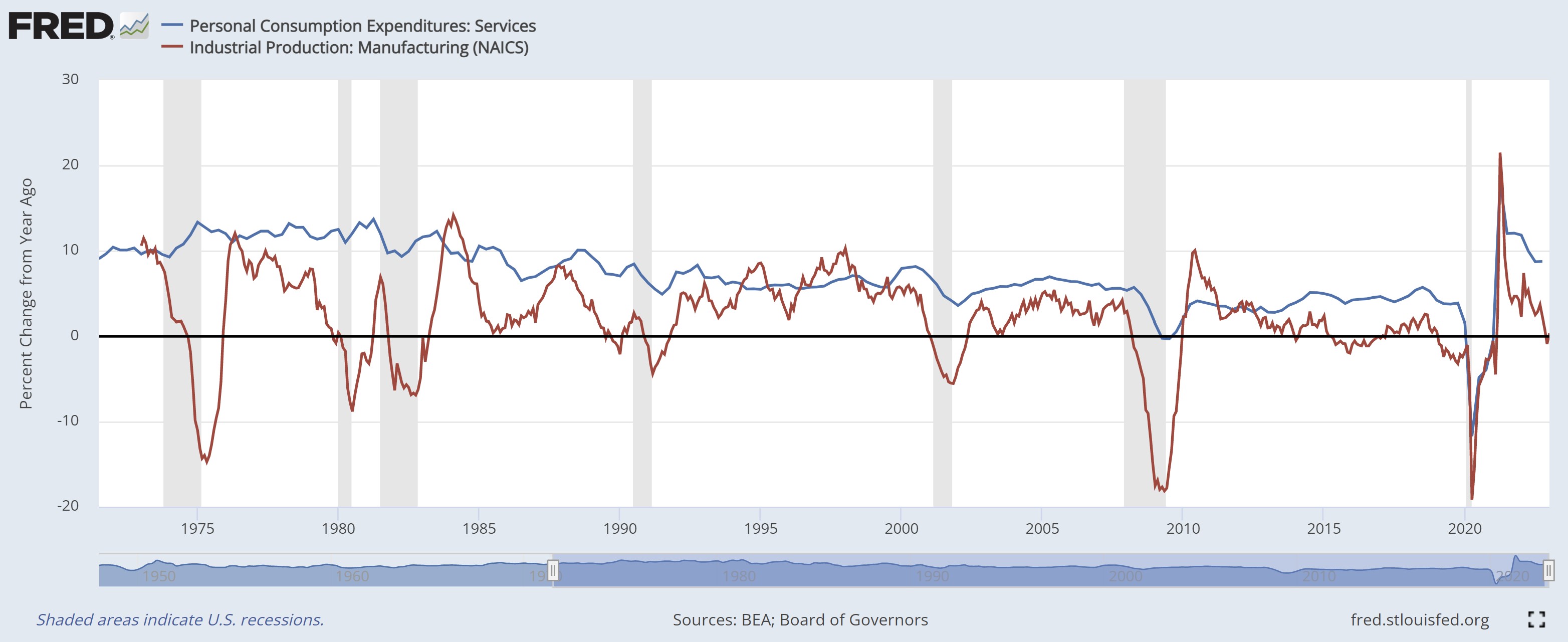

Submitted by Atlas Indicators Investment Advisors on February 23rd, 2023

Economic indicators come is three varieties, differentiated by their timing. Some offer an insight into the future. We call these leading indicators; for instance, new orders data help us see a bit over the horizon. Others tell us more about the here and now; these are coincident indicators like industrial production or personal income. Finally, there are lagging indicat

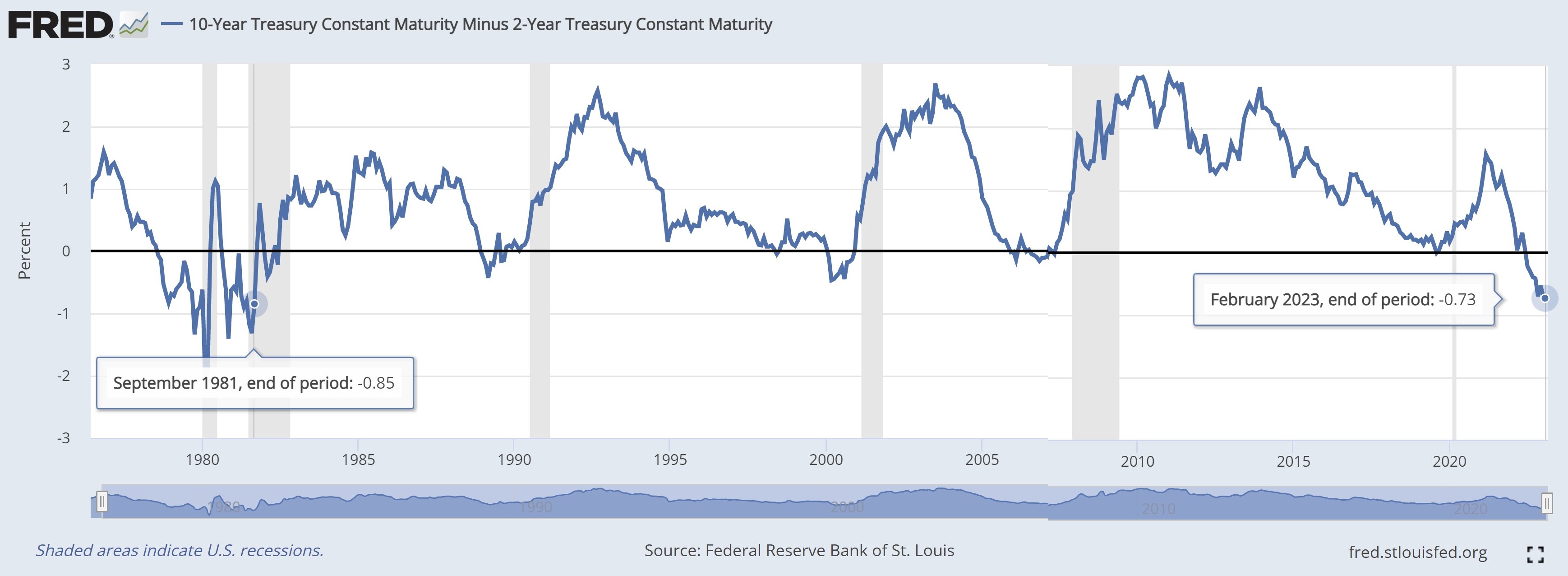

Annus Horribilis

Submitted by Atlas Indicators Investment Advisors on January 3rd, 2023

Superlatives are easy to use but difficult to defend, so Atlas won’t use one here. We are willing, however, to use a technical phrase when describing 2022: it sucked. Right out of the gate, the market peaked on the first trading day of the year and then trended lower for the remainder. A similar pattern developed in the bond market. Providing the other bookend for

Winter Solstice

Submitted by Atlas Indicators Investment Advisors on December 22nd, 2022

We haven’t quite reached the shortest day of the year in the Northern Hemisphere, but we are getting close. It’s been nearly six months since the longest day of 2022 passed us. We don’t fret when the days begin shortening, nor trot out world-ending conspiracies once the nights become longer than the days immediately following the autumnal equinox. But why not?

Dire Straits

Submitted by Atlas Indicators Investment Advisors on December 22nd, 2022Bad to Better

Submitted by Atlas Indicators Investment Advisors on December 22nd, 2022Trends never move in straight lines. This is certainly observable in markets. Styles experience the same phenomenon. Perhaps the kernel of a trend is revealed at a fashion show, but it takes the greater population a little time to embrace the new look. A similar pattern is emerging for the globe as it tries trending back to something more normal from the depths of the pandem