Holding Down Expectations

Submitted by Atlas Indicators Investment Advisors on November 6th, 2022

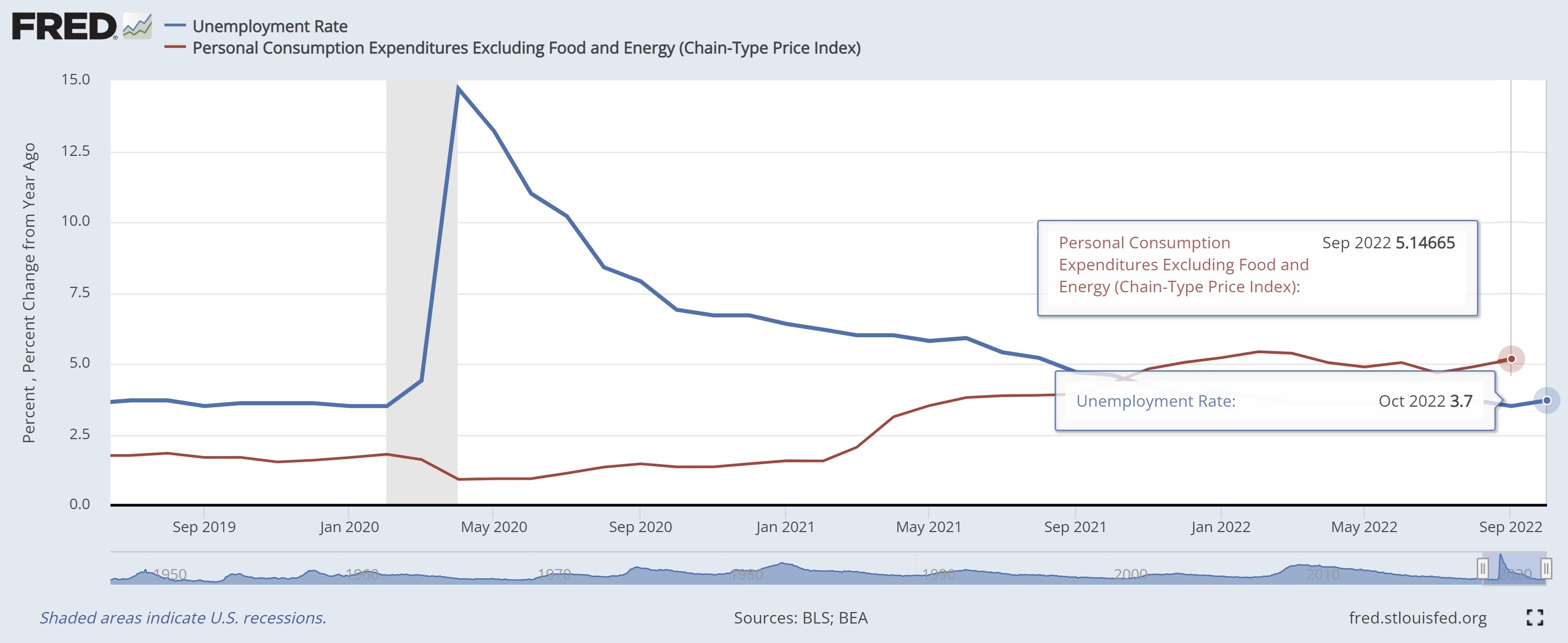

Every six weeks the Federal Reserve Open Market Committee meets to discuss monetary policies and to make any changes to it which they deem necessary. Their latest two-day meeting ended last Wednesday with the 12-person committee unanimously voting to raise the overnight lending rate banks charge each other by 0.75 percentage points; the range for this type of loan now stands at 3.75 - 4.0