Manufacturing a Narrative

Submitted by Atlas Indicators Investment Advisors on March 10th, 2023

Telling stories is what humans do. No two people have an exact telling about the same event. Thoughts on the economy are no different. There is a “Truth” but none of us have the luxury of knowing all. Instead, we each have our own truths. These aren’t intentionally deceptive. Instead, they become manufactured and colored by our own experiences and biases.

Manufacturing plays a large role in Atlas’ understanding of the economy. Regular readers know how we believe this segment of output tends to move along the contours of the business cycle. Perhaps it is truer to suggest the business cycle ebbs and flows according to the influence of America’s factory segment.

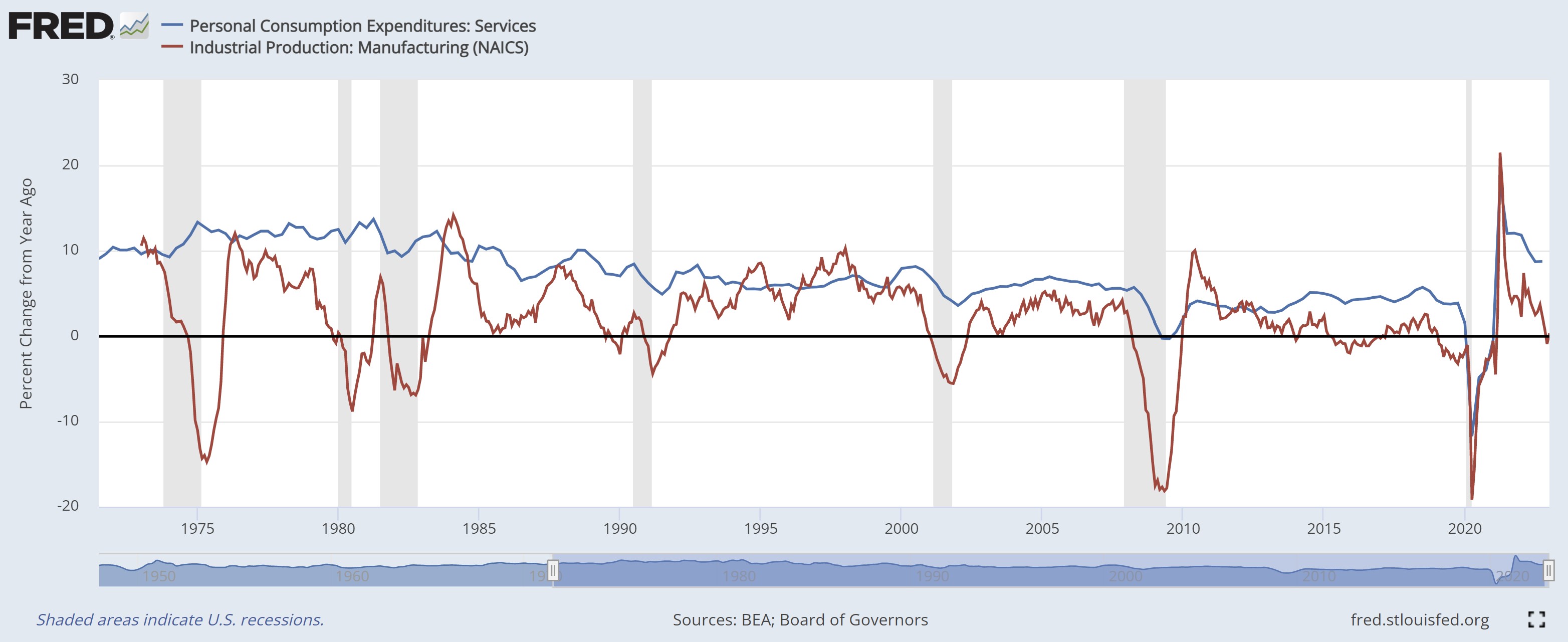

The chart above helps illustrate the influence manufacturing has on our economy. Above are two lines representing the two important components of output: consumers (the blue line) and manufacturing (the red line). Consumption represents a much larger proportion of output, but as you can see, its upward and downward swings are more subtle. Going back to the beginning of the chart, consumption never dropped below zero on a year-over-year basis in the first five recessions. This start date was used because that’s as far back as the Federal Reserve’s Industrial Production data on manufacturing goes. Only the latest two see the blue line’s trend fall below zero, and those two include the Great Financial Crisis (GFC) and Covid, two unique circumstances.

A similar pattern developed in the labor market. According to findings from the Economic Cycle Research Institute, the goods-producing sector accounted for between 70 percent and 134 percent of job losses during the recessions from 1948 through 2001. There were instances when service jobs were added during the recession, but manufacturers were dropping workers from their payrolls. The last two recessions were skewed a little differently as the financial segment of the economy was hit particularly hard in the GFC and many service firms were forced to close their doors in the earliest stages of this Covid-era.

Narratives are manufactured daily about a whole host of things, the economy included. Atlas tries remaining objective while creating the ones in these morning notes. There has been a downward shift in the influential manufacturing market. If we start seeing it show up meaningfully in labor statistics, it will only serve to further our current narrative. The possibility of a recession seems to be growing ever nearer.