Friday

Misleading Indicators

Submitted by Atlas Indicators Investment Advisors on February 23rd, 2023

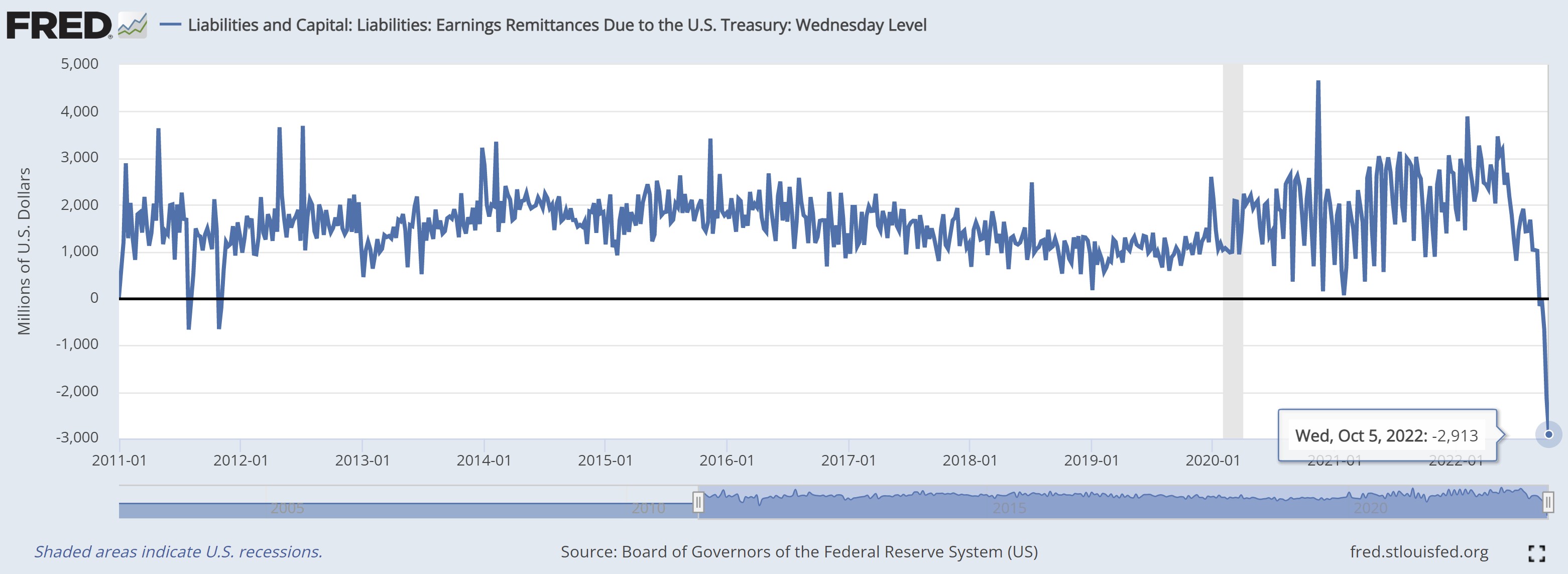

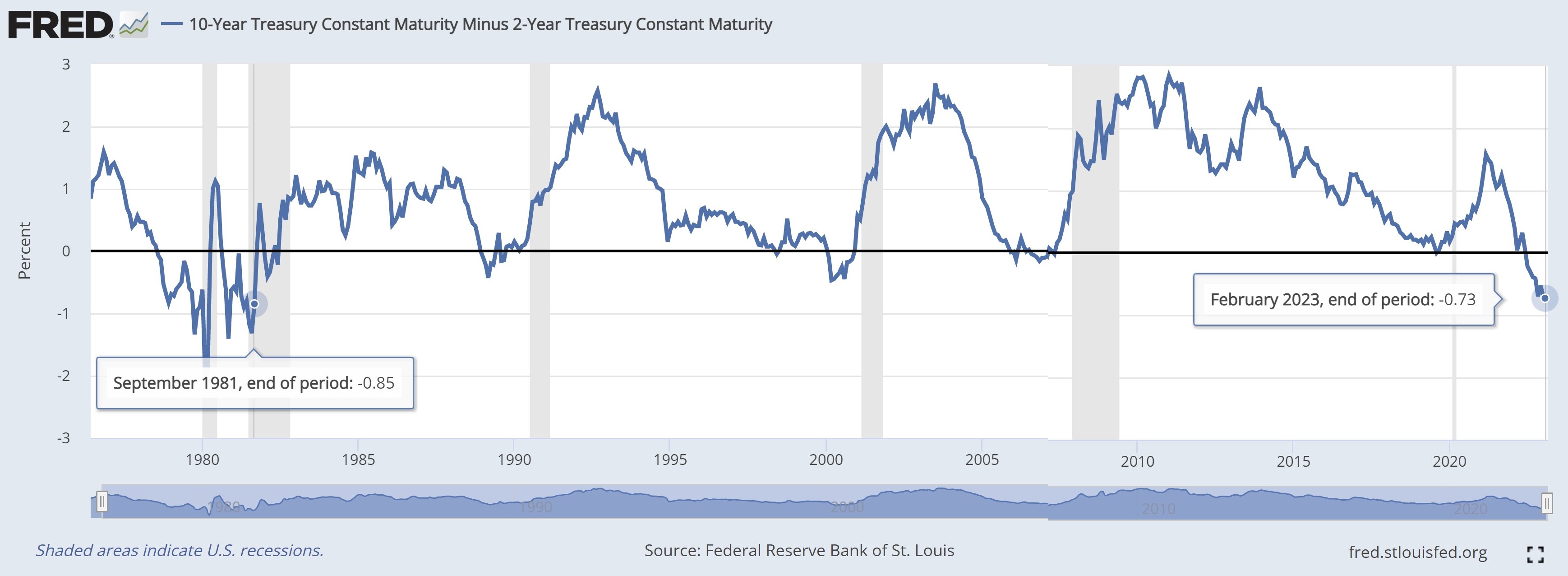

Economic indicators come is three varieties, differentiated by their timing. Some offer an insight into the future. We call these leading indicators; for instance, new orders data help us see a bit over the horizon. Others tell us more about the here and now; these are coincident indicators like industrial production or personal income. Finally, there are lagging indicat

Net Energy Gain

Submitted by Atlas Indicators Investment Advisors on December 22nd, 2022

Energy is foundational to the global economy. Wars have been waged over it. Debates about changes to sources have soured many family dinners over the recent years. When production gets expensive, that acts like a brake on overall output since there are few viable substitutes; a larger share of consumers’ wallets is diverted to keep lights on and cars running. In sh

Winter Solstice

Submitted by Atlas Indicators Investment Advisors on December 22nd, 2022

We haven’t quite reached the shortest day of the year in the Northern Hemisphere, but we are getting close. It’s been nearly six months since the longest day of 2022 passed us. We don’t fret when the days begin shortening, nor trot out world-ending conspiracies once the nights become longer than the days immediately following the autumnal equinox. But why not?

Dire Straits

Submitted by Atlas Indicators Investment Advisors on December 22nd, 2022Bad to Better

Submitted by Atlas Indicators Investment Advisors on December 22nd, 2022Trends never move in straight lines. This is certainly observable in markets. Styles experience the same phenomenon. Perhaps the kernel of a trend is revealed at a fashion show, but it takes the greater population a little time to embrace the new look. A similar pattern is emerging for the globe as it tries trending back to something more normal from the depths of the pandem

The Sssssssurvey Sssssssaysssss

Submitted by Atlas Indicators Investment Advisors on October 31st, 2022

Family Feud is a gameshow which started in 1976 and aired through 1985. After a few years hiatus, it returned in 1988, only to end again in 1995. Then as the last century came to a close, it managed to make another comeback, one which has lasted through today. It pits two families against each other, competing to determine answers to survey questions previously asked to a grou

Stuck

Submitted by Atlas Indicators Investment Advisors on October 20th, 2022Playing Catch Up

Submitted by Atlas Indicators Investment Advisors on October 14th, 2022Antifeatures

Submitted by Atlas Indicators Investment Advisors on October 6th, 2022

Software runs our world. Whatever apparatus you’re reading this note on has programs and operating systems which allow you to receive and delete (hopefully not too quickly) this note. Some of the code runs in the background doing things I’ll never understand, but other parts of it create feature or functionality designed to be useful to us as users. Occasionally, a