Playing Catch Up

Submitted by Atlas Indicators Investment Advisors on October 14th, 2022

Atlas is a small company. We don’t have departments filled with economists. Nor do we employ data scientists to sift through the cacophony of noise generated daily on social media or in traditional news outlets. Instead, we parse broad economic indicators, hoping to glean an understanding of the economy as it evolves. For most of this year, the word deceleration has been used regularly in these morning notes.

Suddenly our more influential readers* seem to be catching on. Earlier this week we noted that the National Association for Business Economists downgraded their expectations of this year’s economic growth rate. Then one of America’s most recognizable business leaders, Jamie Dimon, noted that a recession is a growing possibility in the next six to nine months. Similarly, the International Monetary Fund downgraded its forecast for next year’s global growth rate. Things are getting serious.

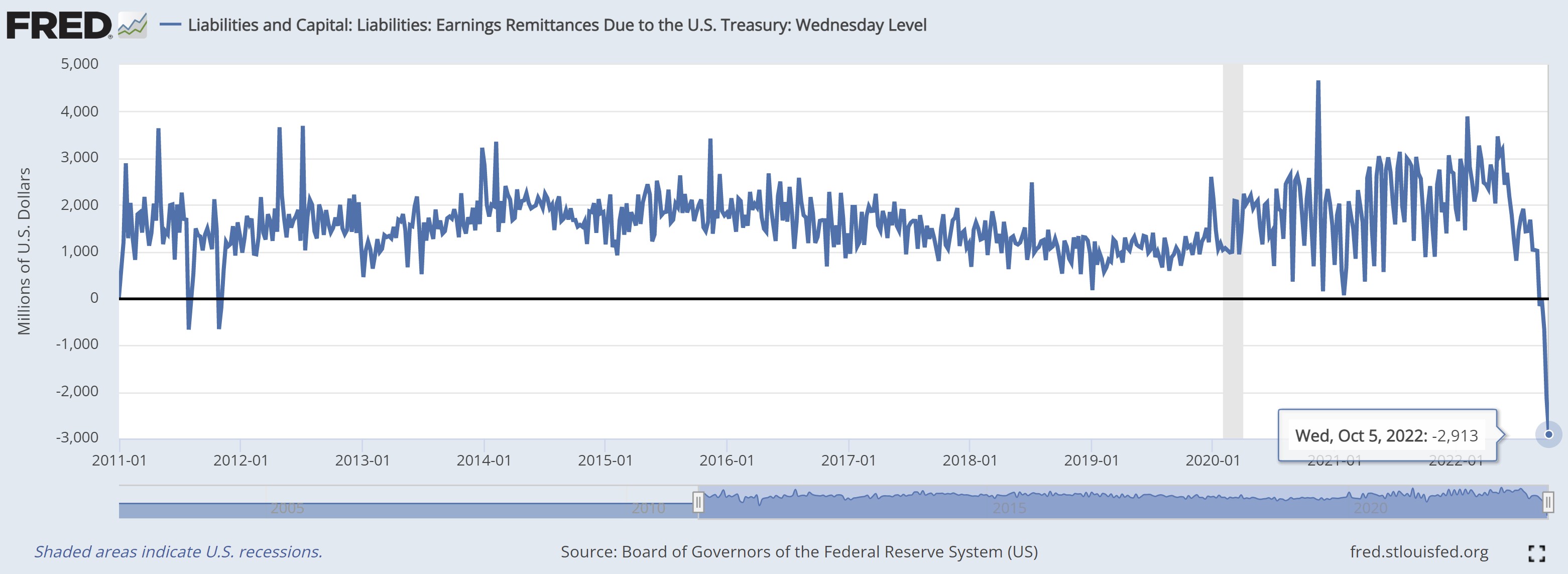

The global economy is facing major headwinds. Inflation is still well beyond levels acceptable to our Federal Reserve. As a result, the central bank is behaving aggressively to keep price pressures from growing further. Interestingly, their actions have forced the prices of the bonds they hold to lose value. On October 5th, they reported a $2.9 billion loss to the U.S. Treasury (see chart above). Additionally, goods have been piling up in the warehouses of retailers, suggesting losses there as well, since demand is not matching current levels of supply, especially in the important area of computer chips. And oh yeah, don’t even mention geopolitical risks.

There’s no forecast in any of this from Atlas. We aren’t economists. Instead, Atlas observes and tries hard to remain objective when detailing to our readers what is going on in the world. For now, we only see an economy that has yet to show signs of reacceleration. When it does, however, our notes will reflect the change.

*Atlas does not send our notes to any of the mentioned people or organizations, but if you forward them to these influencers, thank you.