Friday

Is Recession Still on the Menu?

Submitted by Atlas Indicators Investment Advisors on September 30th, 2023

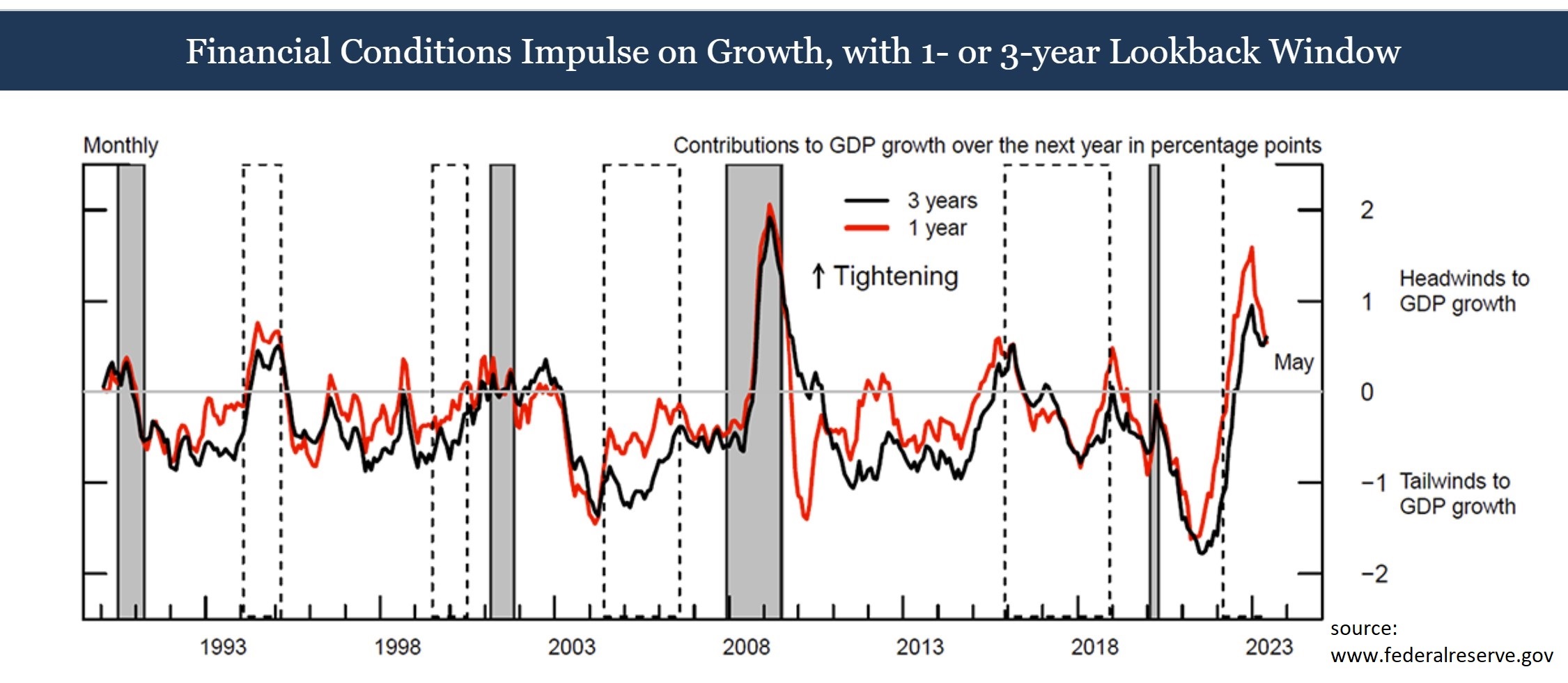

Interest rates are crucial to economic activity. They impact the costs and therefore the incentives of financing the three pillars of the American economy: consumption, investment, and government spending. Borrowing is done over various durations, from short to long. Costs of loans are typically found on a menu known as a yield curve.

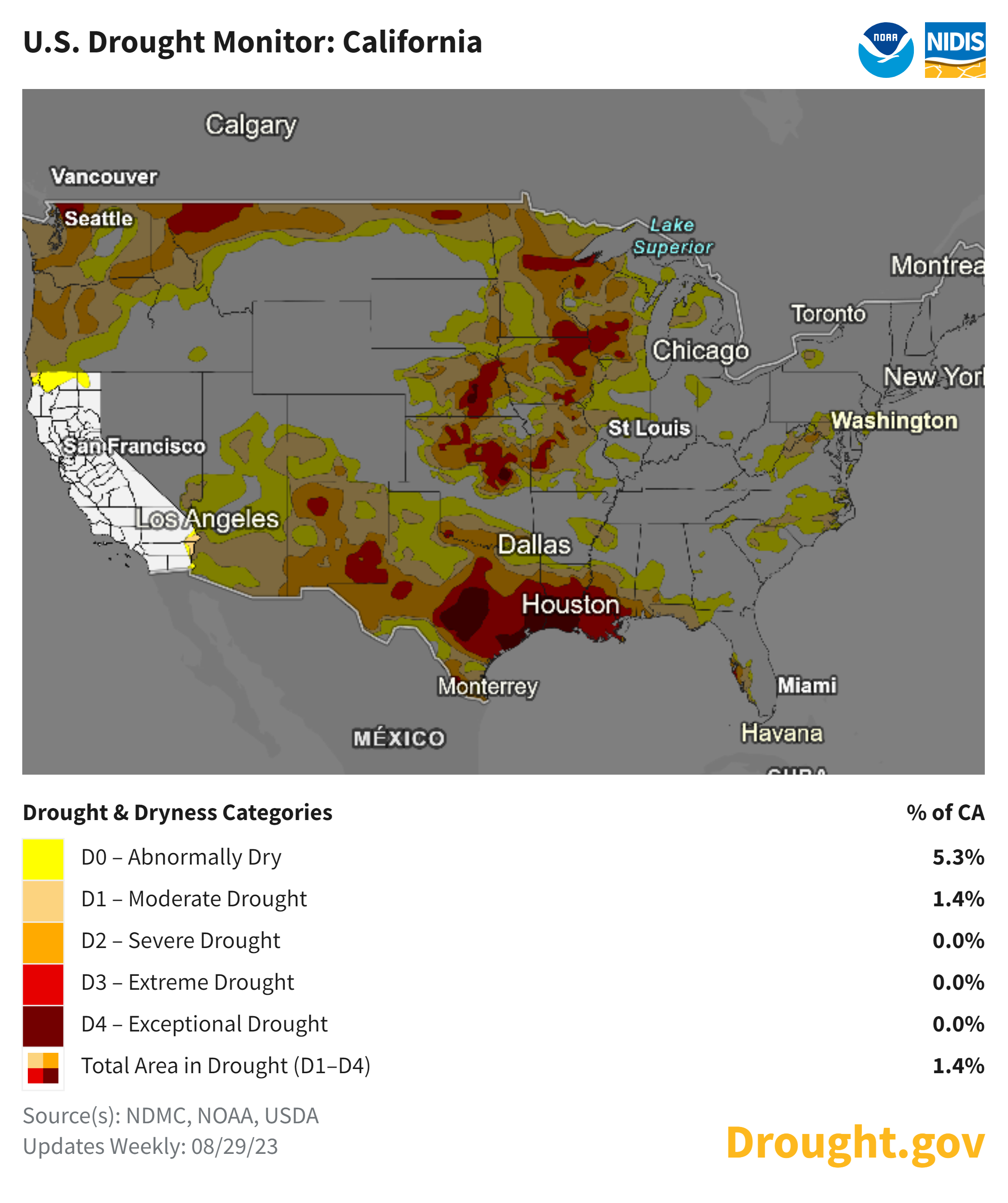

Drying Out

Submitted by Atlas Indicators Investment Advisors on September 30th, 2023

Are we in a drought or not? It depends on where you live. According to the map above, virtually all of California is not. Those living to the southeast of the Golden State are not so lucky. How did this come to be? An excess of rain last year in California helped. However, the West Coast probably shouldn’t act as if the current state of water will last

How Long Does It Take to Boil an Economy?

Submitted by Atlas Indicators Investment Advisors on September 30th, 2023

We all know the old saw about slowly boiling a frog. It is a cruel idea but demonstrates how the consequences of steady, yet destructive behaviors can sneak up on us if we aren’t careful. America has been growing its levels of debt for years. Some have worried about the outcome while others are more sanguine. For now, those remaining calm have been on the right sid

Avoiding the Sack

Submitted by Atlas Indicators Investment Advisors on August 10th, 2023

It’s preseason, but the National Football League has started its 2023 season. There was a game on last night and more to come in the next few days. Quarterbacks are arguably the most important player on the field. They lead, execute strategies, and take blame when things don’t go their team’s way. The role requires them to be under constant pressure fro

More Than a Spoonful of Heat

Submitted by Atlas Indicators Investment Advisors on August 3rd, 2023Philly Plus

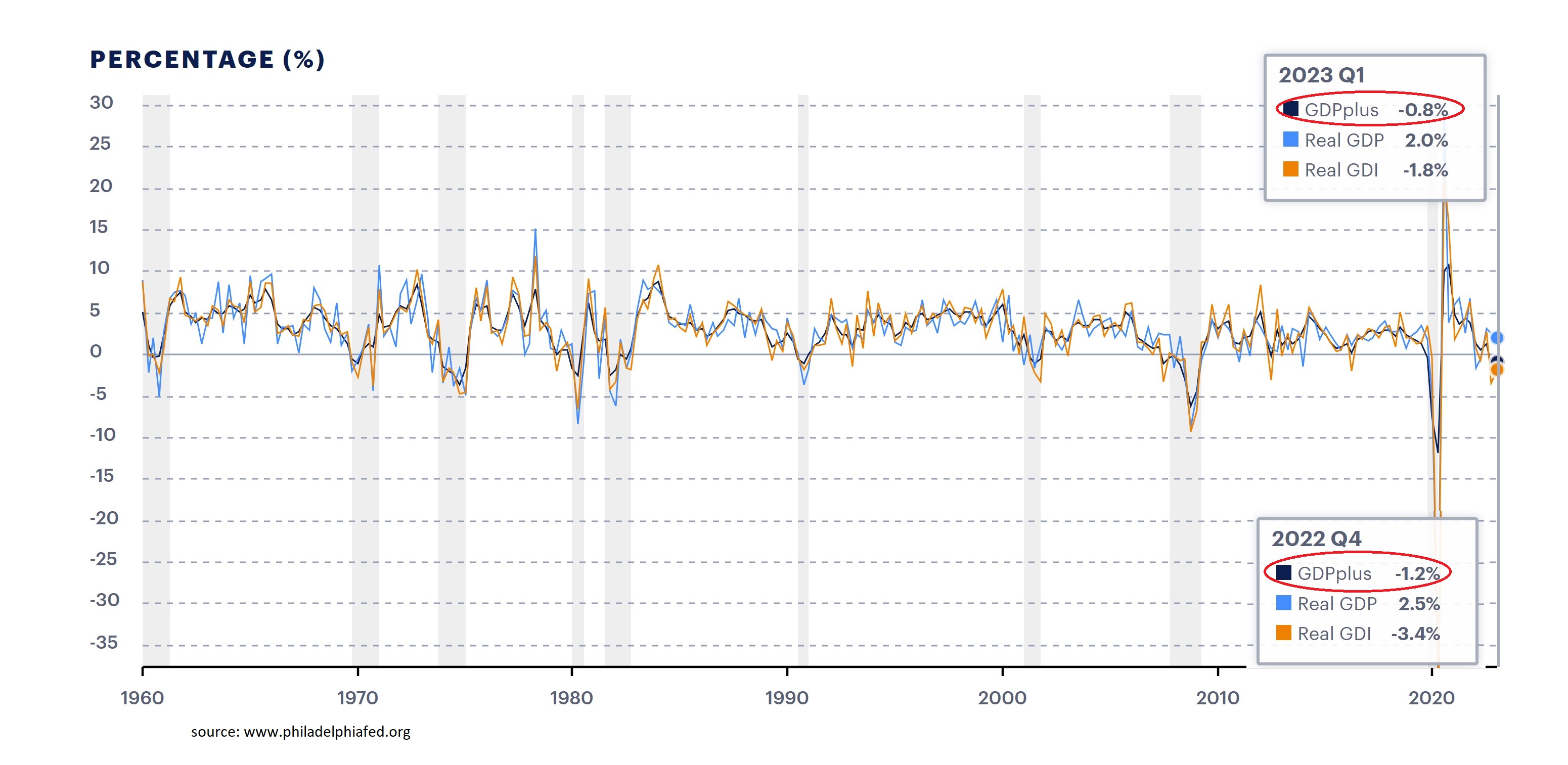

Submitted by Atlas Indicators Investment Advisors on July 31st, 2023

Philadelphia is a significant city in American history. Delegates from 12 of the 13 original colonies met as there as the First Continental Congress on September 5, 1774, for a meeting which lasted until October. Fast forward nearly two centuries and American Bandstand (AB) premiered there in March 1952.

Metal for the Pedal

Submitted by Atlas Indicators Investment Advisors on July 31st, 2023

America’s Electro-Harmonix and its sister company in Russia, Sovtek, have manufactured one of the most popular guitar pedals ever: the Big Muff Pi. This equipment offered three coveted characteristics to artists: reliability, a distinct sound, and relatively low cost. In the 1970s, David Gilmour of Pink Floyd used it on two albums: Animals and The Wall.

Dropped In

Submitted by Atlas Indicators Investment Advisors on July 31st, 2023Just Peachy

Submitted by Atlas Indicators Investment Advisors on July 3rd, 2023

Search online for factoids about water, and you’ll find they flow like a mighty river. Did you know it is the only substance on earth to naturally exist in all three states? Yep, you can always find it somewhere as either a gas, liquid, or solid. It is also essential to life, making up about 60 percent of each human as well as occupying 71 percent