Certainly Uncertain

Submitted by Atlas Indicators Investment Advisors on June 30th, 2025

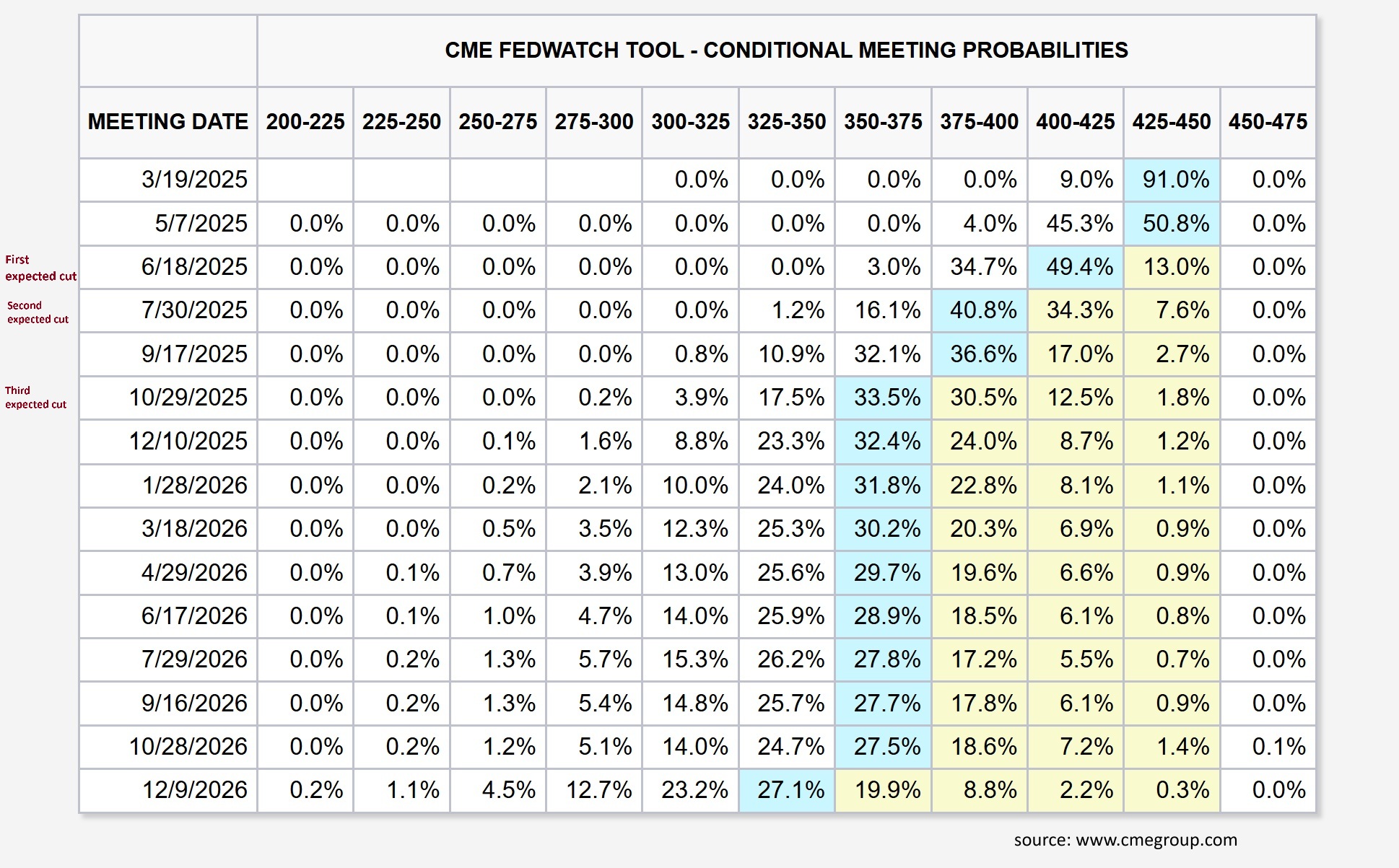

Federal Reserve Chair Jerome Powell addressed the press Wednesday following the Federal Open Market Committee’s decision to keep the overnight interest rate unchanged. During the Q&A, he offered an assessment of the economic outlook in light of recent tariff increases. Powell emphasized that while the U.S.