Drying Out

Submitted by Atlas Indicators Investment Advisors on September 30th, 2023

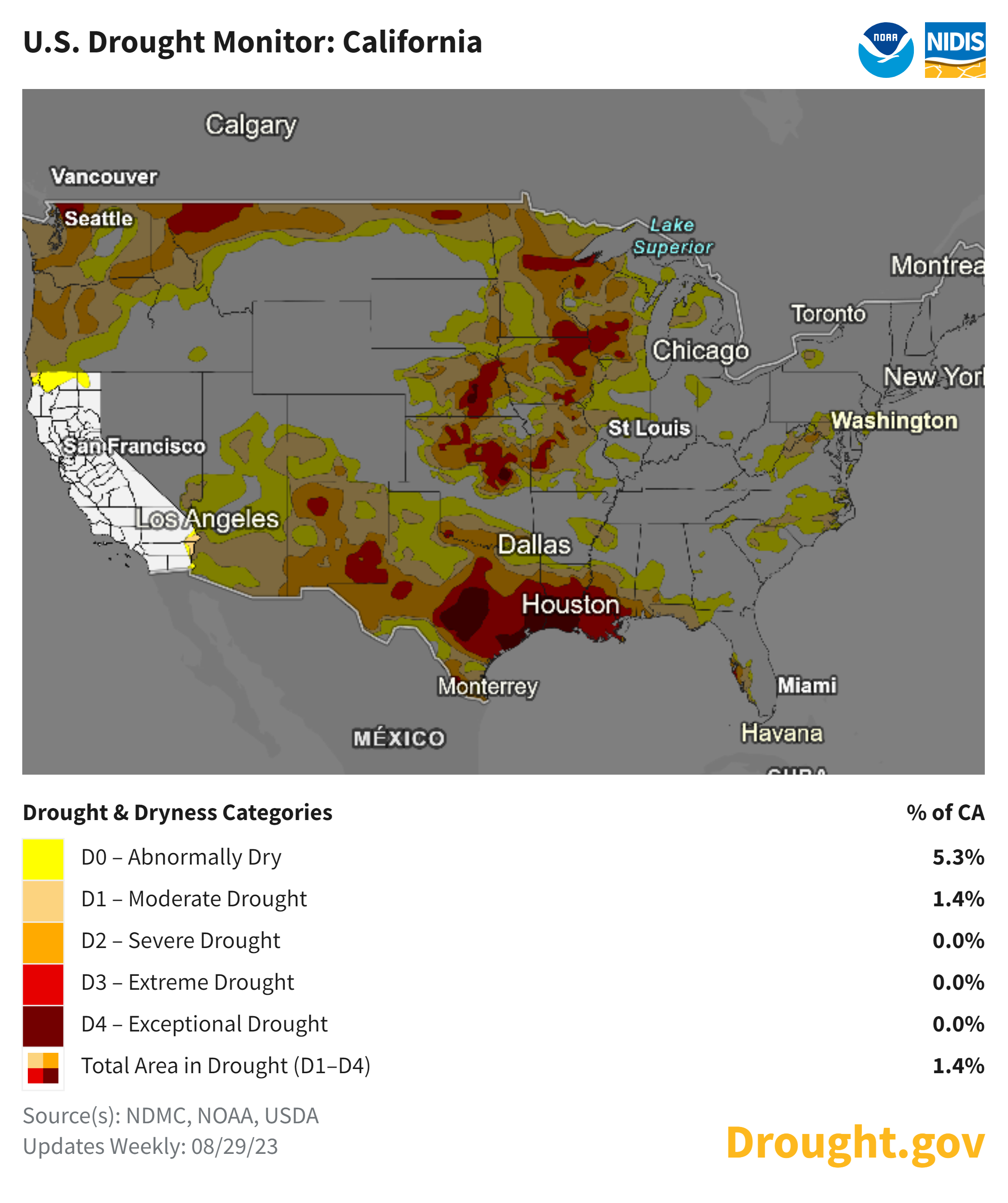

Are we in a drought or not? It depends on where you live. According to the map above, virtually all of California is not. Those living to the southeast of the Golden State are not so lucky. How did this come to be? An excess of rain last year in California helped. However, the West Coast probably shouldn’t act as if the current state of water will last forever. Instead, planning for a not-so-rainy day might make more sense.

As Covid-19 took hold of the global economy, savings balances in America were flooded with cash from the government. As it borrowed and the Fed printed money, bank accounts filled like reservoirs and balances piled up like snowpack. Since then, spending has been abundant even though the handouts haven’t persisted.

It is often difficult in economics to assign as specific causal relationship, but the folks over at the San Francisco branch of the Federal Reserve make a compelling case that the effects from various stimulus packages are winding down. They do so by monitoring how savings have been dwindling in the nation. Households dissaved, causing cash balances to decline. While not at pre-pandemic levels, balances are quickly approaching the old mark.

Researchers at the San Francisco Fed (see their article here) estimate less than $200 billion of the excess savings is left. You’re right, $190 billion is a lot of money, but it is less than 10 percent of the $2.1 trillion in excess savings on Americans’ balance sheets in August of 2021. They estimate that at the current pace of consumption, all of the money put away for a rainy day will be spent by the end of this month. The folks from San Francisco are the optimists at the Federal Reserve. According to this research note from the Federal Reserve researchers in Washington D.C., the savings were depleted by March 2023.

The dwindling savings are akin to receding water levels. There may not be another "rainfall" in the form of economic stimulus, so unless behavior is modified, Americans may find themselves staring at a parched riverbed. Consumption is the American way, and that is unlikely to change. Individuals might be well-served, however, by taking measures to store both water and cash in preparation for future dry spells.