Is Recession Still on the Menu?

Submitted by Atlas Indicators Investment Advisors on September 30th, 2023

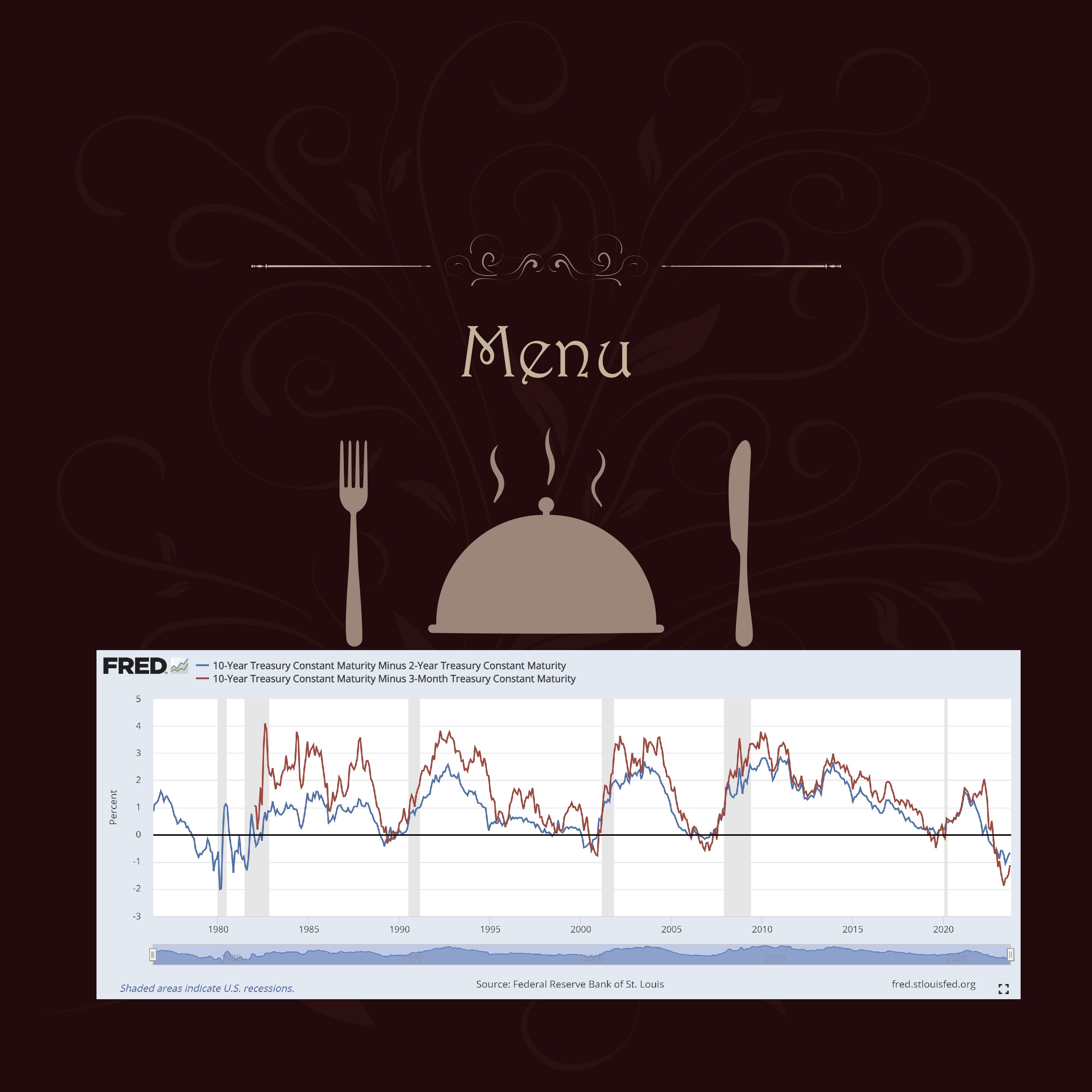

Interest rates are crucial to economic activity. They impact the costs and therefore the incentives of financing the three pillars of the American economy: consumption, investment, and government spending. Borrowing is done over various durations, from short to long. Costs of loans are typically found on a menu known as a yield curve.

For the ease of explanation, let’s say this menu has a couple of columns. On the left is one for short-term lending; on the right, another for long-term. Rates on the left-hand side are usually lower because lenders get their money back relatively quickly. Think about lending a friend money for a day; you probably won’t ask for a lot of money in return for the favor. But if the need to borrow is longer, extra risk is being taken. For instance, there’s no telling how the economy will fare in years from now, so the risk of being paid back is greater. Also, you are giving up other opportunities for which that money could be used. In short, the yield curve helps investors decide how much extra they want to earn when lending money.

Sometimes restaurants have too much supply of something and need to sell it for less than normal in order to get it out of the kitchen before it spoils. They call these “specials.” From time to time, the yield curve also has specials. Due to the inverse nature of yield and bond prices, when rates rise, bond prices fall. Currently, short term bonds are paying more than longer-term maturities; this is a special sale even though they are less risky.

Specials of this sort are typically warning signs. According to this article from the San Francisco Fed, an inverted yield curve “…reliably predicts low future output growth and indicates a high probability of recession,” and “is one of the most reliable predictors of future economic activity among a wide range of economic and financial indicators and, as such, is closely watched by professional forecasters and policy makers alike.” As you can see above, recessions tend to follow inversions of the yield curve. In fact, the San Francisco Fed says an inversion has correctly predicted all nine recessions since 1955 with just one false positive in the mid-1960s.

These researchers go on to say that the downturns tend to begin within 6-24 months after the inversion. The current “special” started in July of last year. It has also been a rather deep inversion. We won’t know for sure if this time is different for about another nine months (July 2024), so for now we have to conclude a recession remains on the menu.