Philly Plus

Submitted by Atlas Indicators Investment Advisors on July 31st, 2023

Philadelphia is a significant city in American history. Delegates from 12 of the 13 original colonies met as there as the First Continental Congress on September 5, 1774, for a meeting which lasted until October. Fast forward nearly two centuries and American Bandstand (AB) premiered there in March 1952.

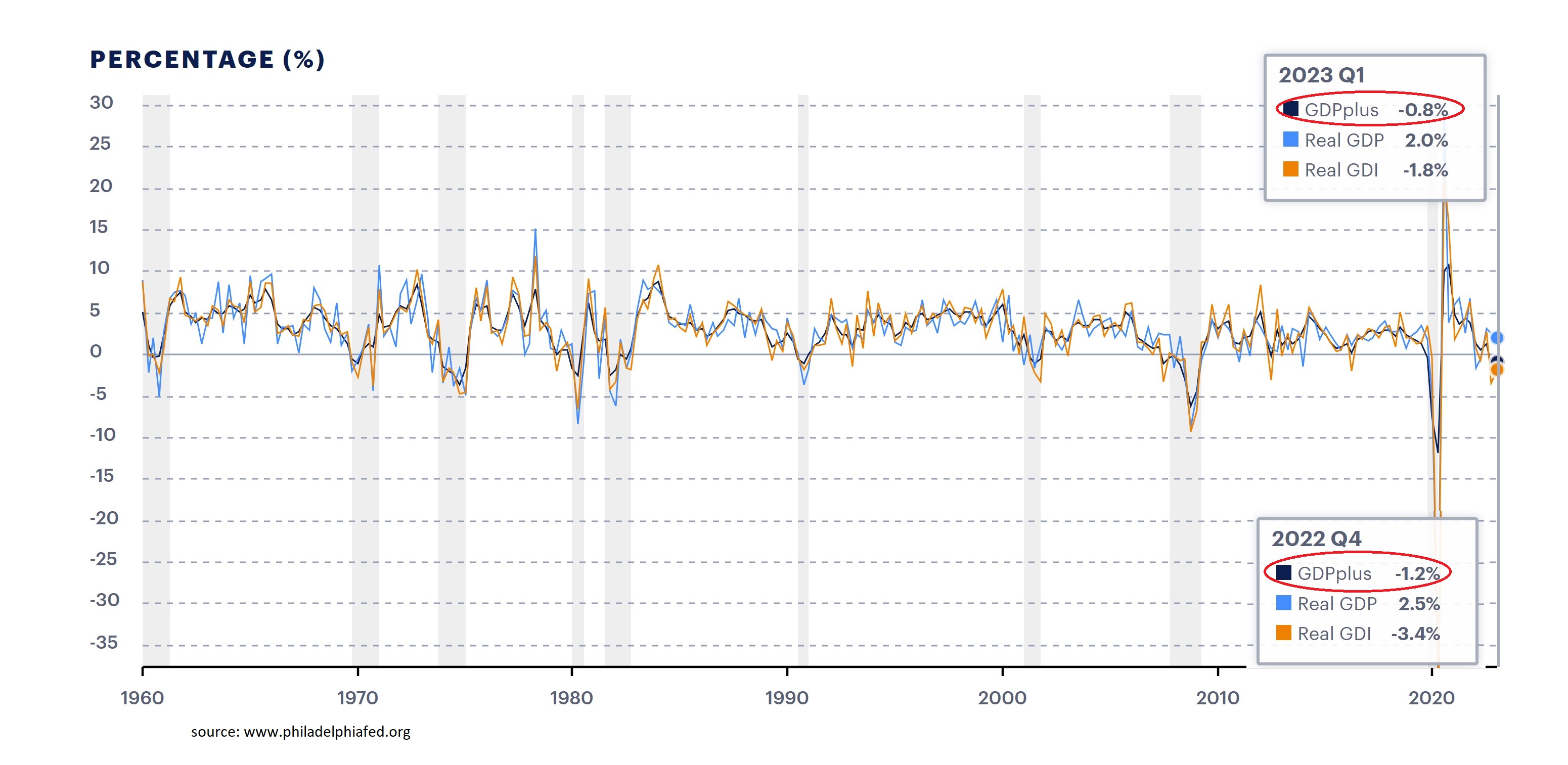

Thirty-eight years before the start of the Top 40 music show, a Federal Reserve Branch opened in Philadelphia. Like the other 11 regional locations of the central bank, employees of this office conduct research on both the local and national economy. One ongoing study they offer is known as GDPplus (the black line above). Simply, this measure looks at both Gross Domestic Income (the orange line) and Gross Domestic Product (the blue line) simultaneously, creating an index which offers information that the individual components may fail to include otherwise. While its history (which started in 2013) is not as long as that of Philadelphia, it does offer data which dates back decades.

As you can see above, there have been nine official recessions (the gray vertical bars) since 1960. They all have one thing in common above: GDPplus dipped below the zero line on the chart, something it did during the pandemic-related downturn of 2020 and again most recently in fourth quarter of 2022. When GDP contracted for two consecutive quarters to start last year, GDPplus did not follow, but it remained in that territory as of the most recent quarterly data (Q1 2023) after returning there to end last year. Exceptions cannot be discounted completely, but this would be the first time since Dick Clark was hosting AB if we escape a setback this time.

Adding to the confusion, the yield curve is now more negative than any year since the Philadelphia Phillies lost to the Los Angeles Dodgers in the World Series. That was 1981 when the difference between interest paid on a 10-year treasury bond and a two-year treasury note was more negative. Earlier this month, the so-called twos-tens spread was inverted by over 1.0 percent. Obviously, the Dodgers were a solid team back in ‘81, and they have a pretty good record this year. Some readers might not mind at least a partial rhyme to that era, but we’re all rooting for an exception to the GDPplus record.