Dropped In

Submitted by Atlas Indicators Investment Advisors on July 31st, 2023

Surreal might best describe the feeling Mickey Newbury describes in his 1967 song “Just Dropped In.” The song has been recorded by a lot of artists, suggesting what a fabulous song it really is. Jerry Lee Lewis recorded it in May of the year it was written. Kenny Rogers got into the Billboard top 10 for the first time singing it as a member of The First Edition. Tom Jones got in on it as well. Personally, I like this version from Mickey. In short, the writer is looking to find out what condition his condition is in.

Economies have conditions too. Surreal often seems like the right adjective to describe things compared to the pre-pandemic era. Experimental monetary policies are still affecting conditions globally even as our central bank tries its best to unwind them via new experimental policies. We’ve been through a deluge of money printing and stimulus, and now the Federal Reserve is trying to minimize inflationary damages by soaking up excess liquidity. It is still unclear what sort of long-term effects this will have on output in America and the world for that matter.

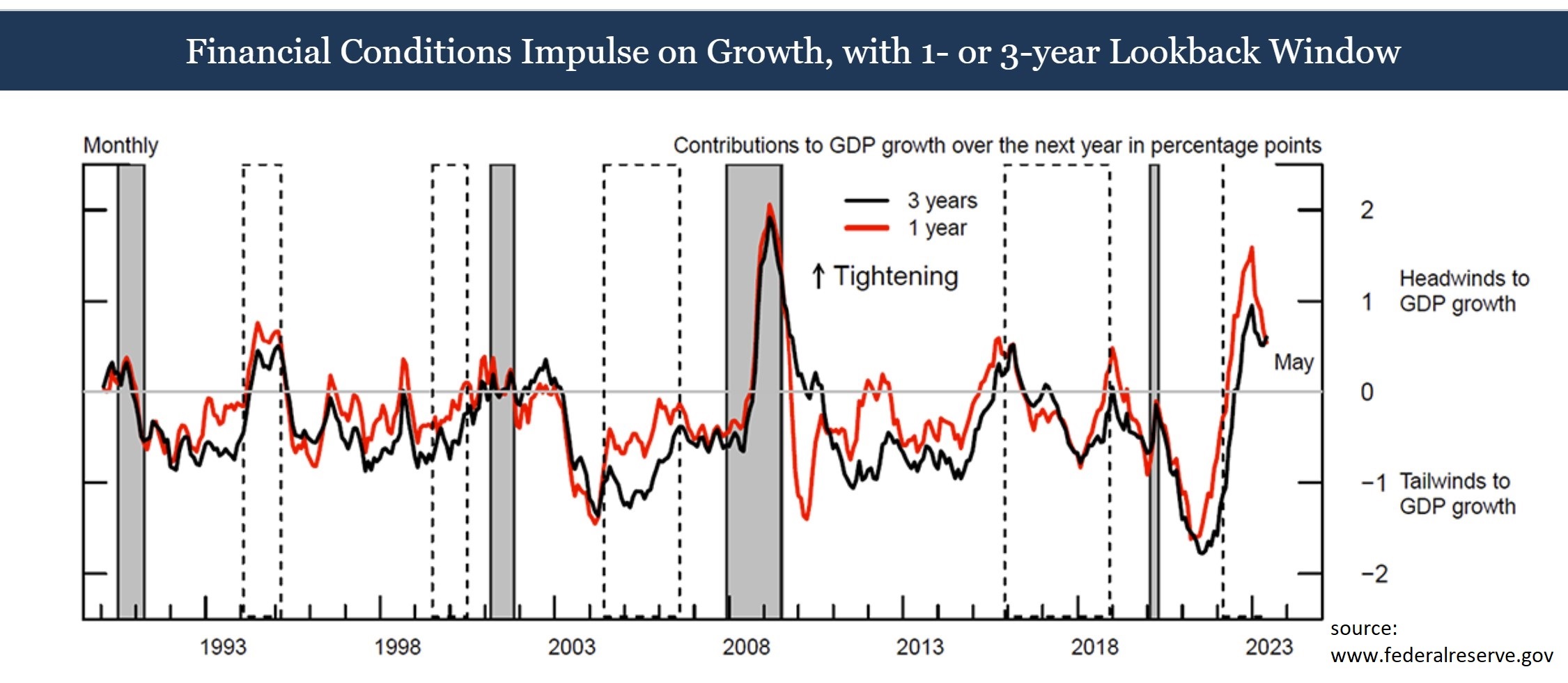

So what condition are the American conditions in? Economists at the Federal Reserve just created their own Financial Conditions Index (FCI). Looking above, conditions are rather tight. In fact, the only other time it was at the current level was during the Great Financial Crisis. The good news, however, is that the curve could be dropping into better levels, but they remain a distant trip from normal, let alone levels which are considered tailwinds for the economy.

Like the orchestral backup for Mickey Newbury, the financial landscape is a symphony of asset prices and interest rates influenced by those pulling the strings. Done correctly, we may all benefit from the synchronous vibrations. Done incorrectly, it could make for a difficult time that feels like the clock isn’t moving fast enough.