The Answer My Friend

Submitted by Atlas Indicators Investment Advisors on April 29th, 2025

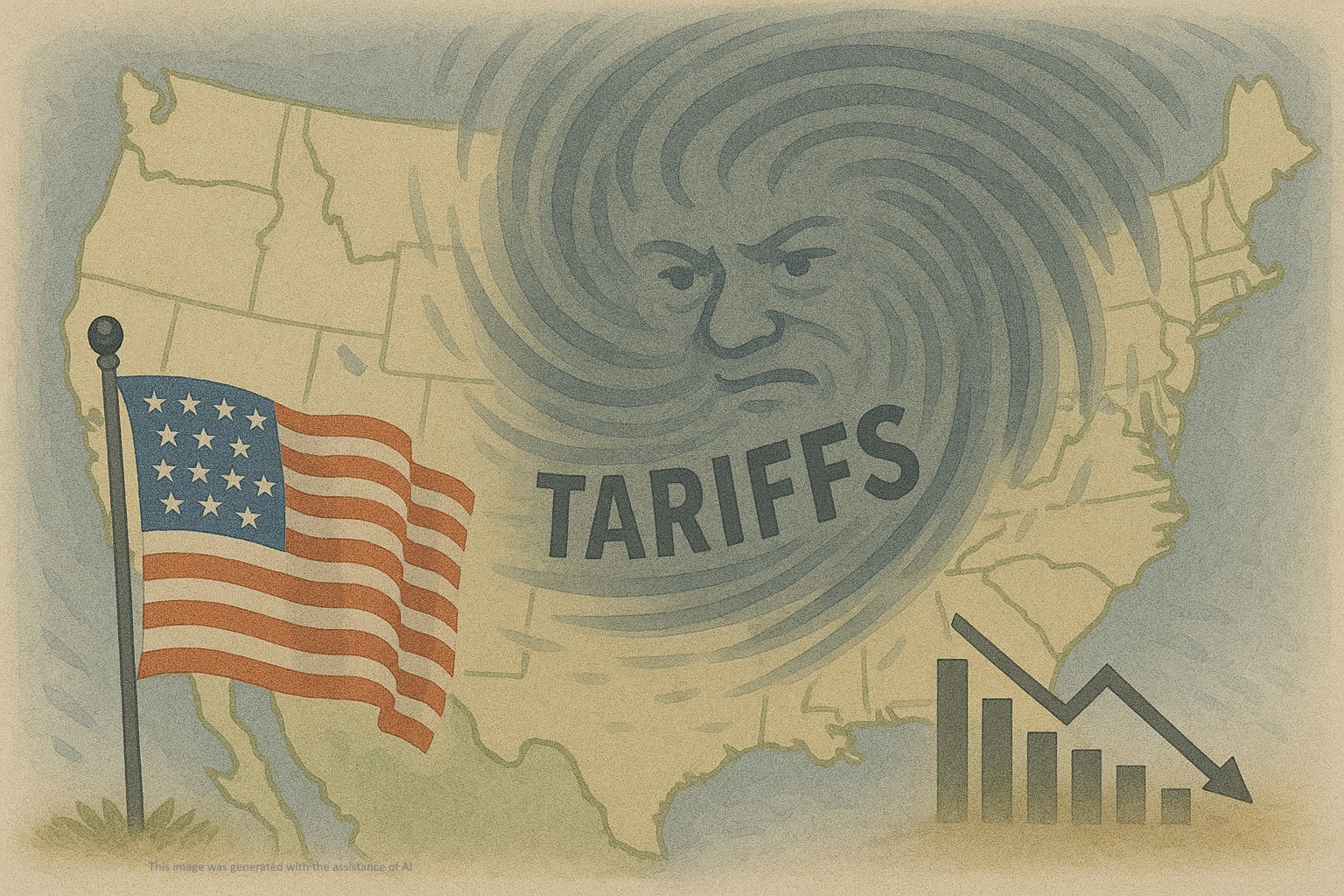

The hurricane center is sunny and calm, but the wall around it blows fiercely with its opposing sides tearing in opposite directions. When the wind blows off and on it is hard to decide how to trim your sails or even seek shelter. The same goes with orders and tariffs, especially capital goods orders. As with hurricanes, the direction’s strength is the question, effect is the answer.

In the northern hemisphere, the right side of a hurricane experiences the strongest winds because the storm’s forward motion adds to its wind speed, creating a net increase in force. This side also generates the biggest storm surges. After a brief period of calm while in the eye of the storm, the left side of the hurricane hits, whipping things around in the opposite direction.

Like residents living in areas prone to hurricanes, markets prefer periods of stability. Lately, however, there’s been a thrashing force impacting how individual actors (e.g., people and businesses) behave. The economic impact of on-again, off-again tariff policies can be likened to the two sides of a hurricane's eye. Currently, the economy faces the initial turbulence of uncertainty. Anecdotally, there are stories of companies changing the timing of capital investments, households curbing spending, and inflationary pressures mounting as tariffs likely increase prices on goods ranging from cars to electronics to food.

There have been moments of calm, like in the eye of a storm, when tariffs are paused or exemptions are granted. I doubt Bob Dylan or even your local weatherman can figure this one out. Thus far, any periods of calm have been short lived with the world currently bracing for the coming impacts of the tariffs President Trump announced Wednesday. Hurricanes eventually move on and what is left tends to be a mess, and arguments about who is ultimately going to pay for the damage and removal of debris drag on. The answer does seem to be blowing in the wind.