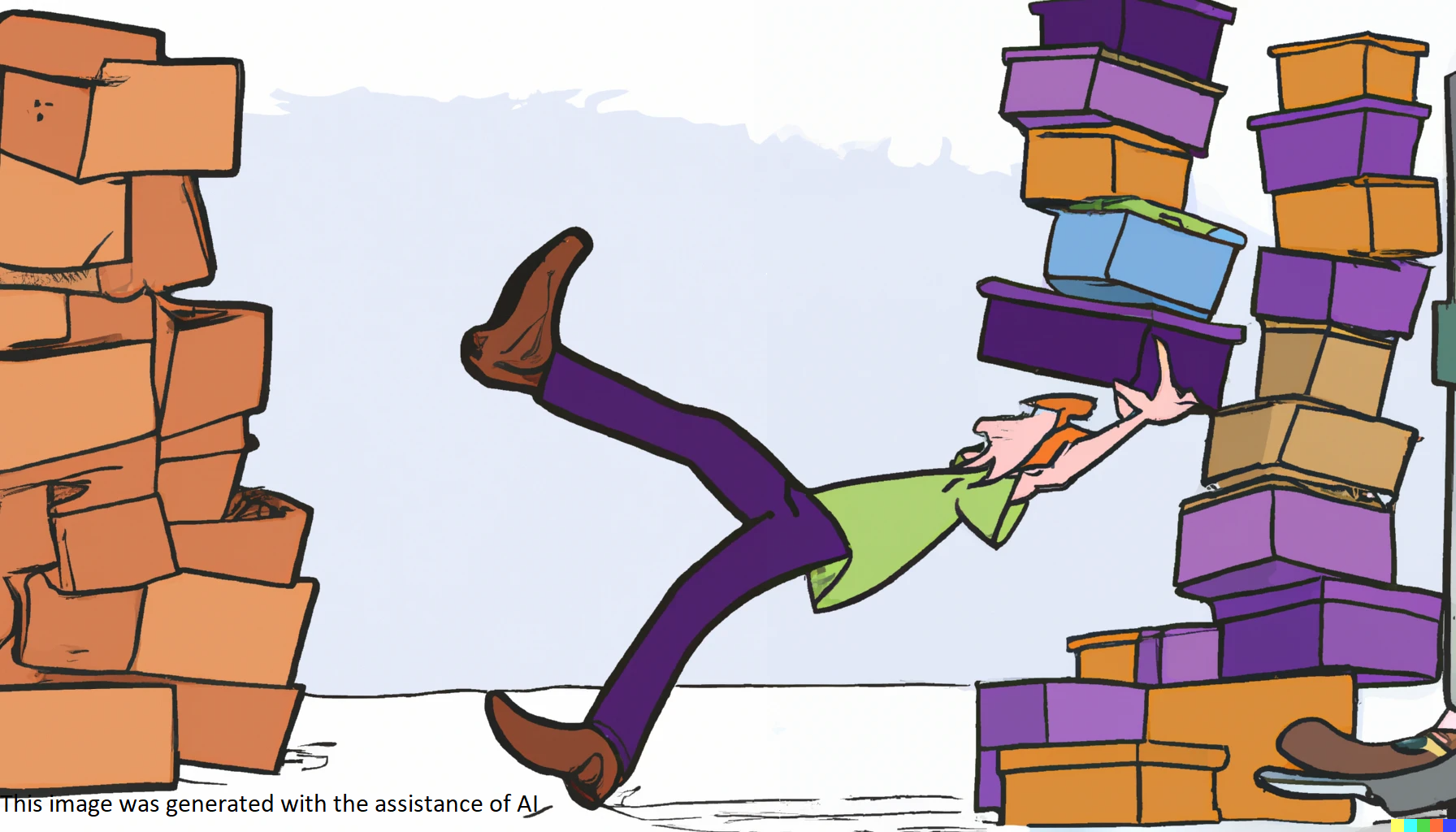

Clumsy Shoe Salesman

Submitted by Atlas Indicators Investment Advisors on May 31st, 2023

Labor is in short supply. Just take a look at the current unemployment rate of 3.4 percent (tied for the lowest level going back decades). As a result, firms need employees to increase their productivity. Think about this challenge from the perspective of a clumsy shoe salesman. He is overwhelmed with customers, so he comes out from the back of the store with a stack of shoes.

On his latest return to the showroom, boxes begin falling. The first shoe to drop obviously points to a shortage of labor since the salesman would not be dropping so many if he just had some help. Then there’s inflation. Customers are in his store and willing to shop, but they seem reluctant to buy as many pairs because prices weren’t this expensive a year ago. Not only will fewer sales affect his bottom line, they will have ramifications all the way up the production chain. But wait! There’s more! Perhaps he needed a bank loan to afford the stock on his shelves. His customers, feeling the bite from inflation, may also have started to accumulate their own debt. And of course, all of this while the cost of borrowing is on the rise, making servicing the debt pinch harder than a new pair of shoes. All these factors are adding further wobble to his stack of boxes.

Like the shoe salesman, there are many potential candidates for the “next shoe to drop.” Speaking of candidates, a whole new balancing act is unfolding in the political sphere as our nation gears up for an election which is “just” 536 days away as of Friday, May 19th. Between now and then, workers might become more available given the developing upward trend in weekly initial unemployment claims (they’ve been rising recently and tend to be a leading indicator for monthly employment figures). Environmental issues continue to mount. Nation debt concerns are heating up in Washington D.C. Then there is the ongoing war between Russia and Ukraine which is now over a year old and offers many potential shoes itself.

Falling shoes hardly suggest the end of the world. We may be facing a recession, hopefully brief, but Atlas does not think this should be depressing. Once on the ground, order can begin to be restored. All of us will be provided an opportunity to grab a pair, get them on our feet, lace ‘em up, tie ‘em tight, and take off running again.