Doo-doo-doo-doo

Submitted by Atlas Indicators Investment Advisors on March 31st, 2023

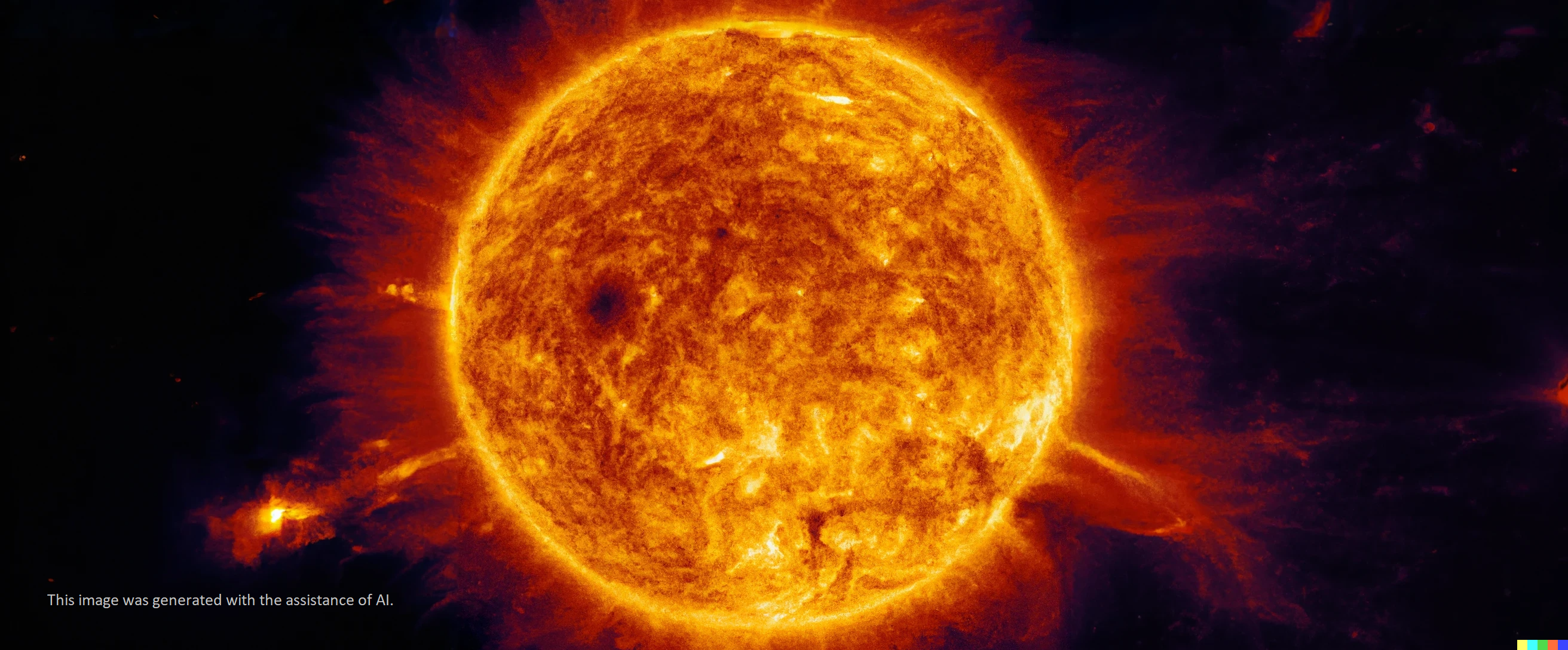

Unsure if we could use the name of a Beatles song as a title for a note to our audience, Atlas went with Doo-doo-doo-doo, but make no mistake, here comes the sun. Our planet’s original energy source is spewing solar winds our direction and a second round of them could be arriving today! Just last week scientists at NASA’s Solar Dynamic Observatory spotted a coronal hole estimated to be 30 times larger than earth. As it rotated away from earth, a second large one appeared that is 18-20 times the size of earth, and it is sending solar winds traveling approximately 1.8 million miles an hour.

Solar winds have a cycle to them. They peak roughly every 11 years, and it is peak season for them now. It could give us auroras in places away from earth’s poles, but they also have the potential of disrupting our modern ways by taking down power grids and GPS systems. According to this article from the economist.com, a coronal mass ejection reached Canada and took Quebec’s electrical grid down for about nine hours in March 1989. Fortunately, scientist interviewed for this Business Insider piece do not expect the latest event will cause any disruptions.

Economic cycles go through events which can also disrupt. We seem to be in one now. So far, the banking challenges facing America and Europe seem to be relatively minor, but it might still be too early to suggest further difficulties aren’t ahead. Like the sun, the cycle will keep turning, and it might reveal something more menacing. After all, periods of deceleration like the one we’re in now make our economy more susceptible to shocks. America continues to digest a year’s worth of interest rate hikes and quantitative tightening handed down by the Federal Reserve and the knock-on effects of these policy changes. But like the sun, an economy is in constant motion, so even in the worst moments of a contraction, we are all well-served to remember that ice will begin slowly melting. Smiles will return to the faces of consumer even if it feels like it’s been years. It’s alright.