Stephen Stills a Johnny Paycheck

Submitted by Atlas Indicators Investment Advisors on June 28th, 2023

In the late 1970s, Johnny Paycheck released his iconic song, "Take This Job and Shove It," resonating with workers back then who felt trapped and dissatisfied in their employment. Fast forward to today, and the dynamics of the job market have undergone a significant transformation. With recent shifts in the economy, we find ourselves needing to change the tune of Paycheck's famous anthem to "Take this Job and Love It." Given the cyclical nature of labor, we may even find a need to channel Stephen Stills and his classic “Love the One You’re With.”

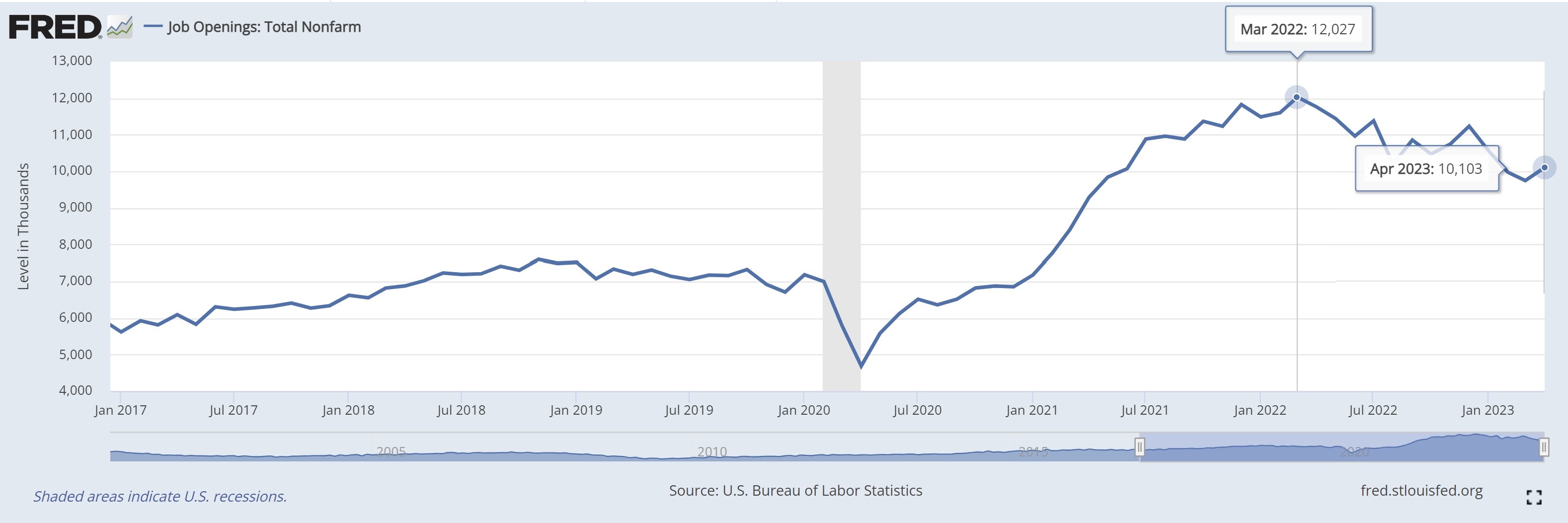

In March of last year, job openings reached record highs, and the labor market seemed to be buzzing with opportunities. Many workers were motivated to seek better prospects, sometimes even using Paycheck's song as a rallying cry against unsatisfactory conditions. However, the tide might be turning, and we find ourselves in a situation where job openings are becoming less abundant (see chart above).

Other indications of the changing labor market are cropping up. There has been a rise in continuing claims for unemployment insurance. When people find it increasingly difficult to line up work, they often turn to unemployment benefits to support their households. If the difficulty continues, then they reapply and that phenomenon is showing signs of trending upward; as of the end of May, these so-called continuing claims are up 27.1 percent from a year ago. Additionally, the Conference Board reports a falling number of people claiming jobs are plentiful. This statistic fell four percentage points to 43.5 percent in May.

Having a job when one needs to work is a gift. It becomes even more valuable during difficult labor market conditions, especially if you know others who’ve lost work. Perhaps the next song on the song parody play list will be a take on a Stephen Stills’ classic but it will be about loving the job you got.

Perhaps it could start something like this:

If your down and under used

And you don’t remember who you report to

Promotions kept at bay

And payday feels far away

Well, there’s a rose in a fisted glove

But patient, don’t push and shove

And if you can’t be with the one you love, honey

Love the job you’ve got

Love the job you’ve got