January 2018 Consumer Price Index

Submitted by Atlas Indicators Investment Advisors on February 21st, 2018

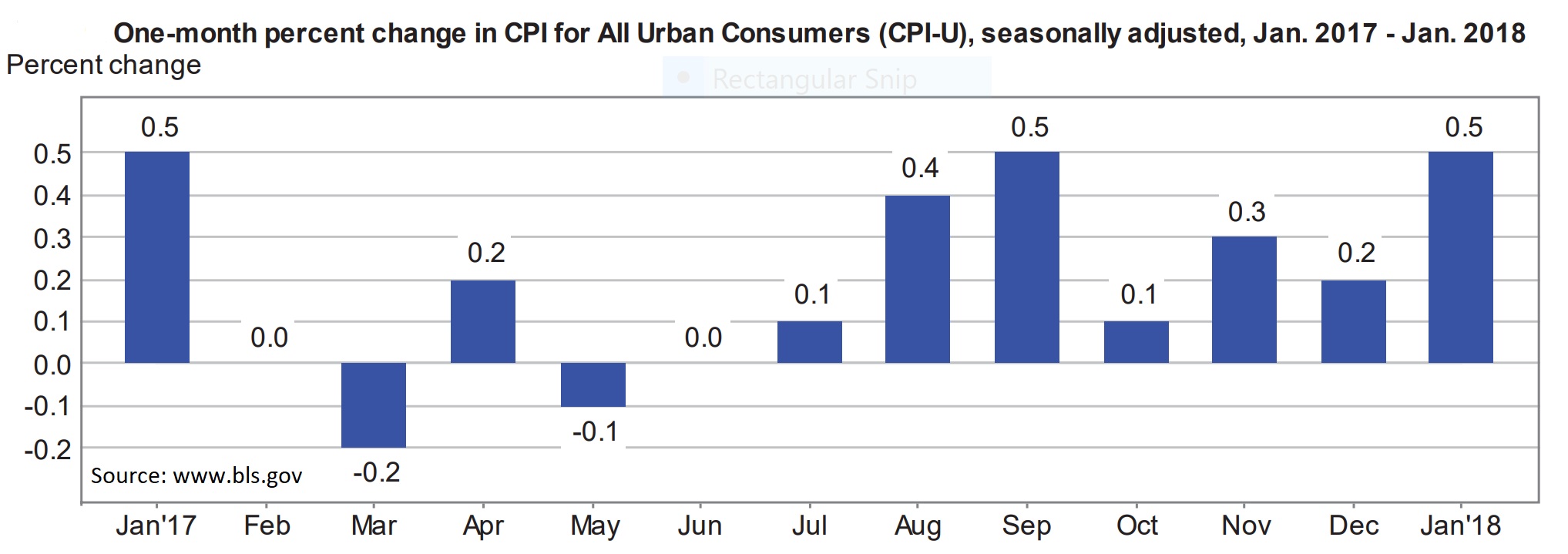

Hints of inflation are wafting through the economy per data from the Bureau of Labor Statistics. Their widely-watched Consumer Price Index (CPI) jumped 0.5 percent to start this year. January’s year-over-year statistic posted 2.1 percent, matching December’s tally. Core-CPI (excluding food and energy) managed an uptick of 0.3 percent to start 2018, and its year-over-year tally held steady at 1.8 percent.

A broad collection of components moved higher in January, suggesting higher prices are growing somewhat pervasively. Apparel jumped 1.7 percent in the period, breaking a three-month streak of falling prices. Transportation services increased 0.8 percent and medical care services were 0.6 percent higher. Shelter costs continued increasing, rising 0.2 percent in January and 3.2 percent versus a year earlier. Used vehicles increased 0.4 percent, but new automotive prices edged down 0.1 percent. Finally, commodity prices excluding energy rose 0.4 percent but are still down 0.7 percent on a year-over-year basis.

Food and energy both increased. Eating away from home was 0.4 percent more expensive than a month earlier. Meanwhile, food at home edged up 0.1 percent. Whether you drove to a restaurant or the local market, the gasoline used to get there rose 5.7 percent.

Inflation could be the primary economic story for 2018, especially since our central bank just seated a new Chairman of the Federal Open Market Committee, Jerome Powell. Worldwide market participants will watch to see how the new leader of the world’s most influential central bank will react to inflation data as more information becomes available throughout the year. Of course, there have been other periods during the current economic expansion when inflation appeared to be accelerating, but it never materialized in a meaningful way. Chairman Powell is scheduled to speak on Capitol Hill at the end of this month; he’s sure to reveal some of his perspective on rising prices then.