December 2019

Revised Third Quarter 2019 Productivity and Unit Labor Costs

Submitted by Atlas Indicators Investment Advisors on December 19th, 2019Productivity contracted in the third quarter of this year according to revised data from Bureau of Labor Statistics (BLS). Their measure of output per labor hour fell 0.2 percent from July through September 2019 (originally down 0.3 percent).

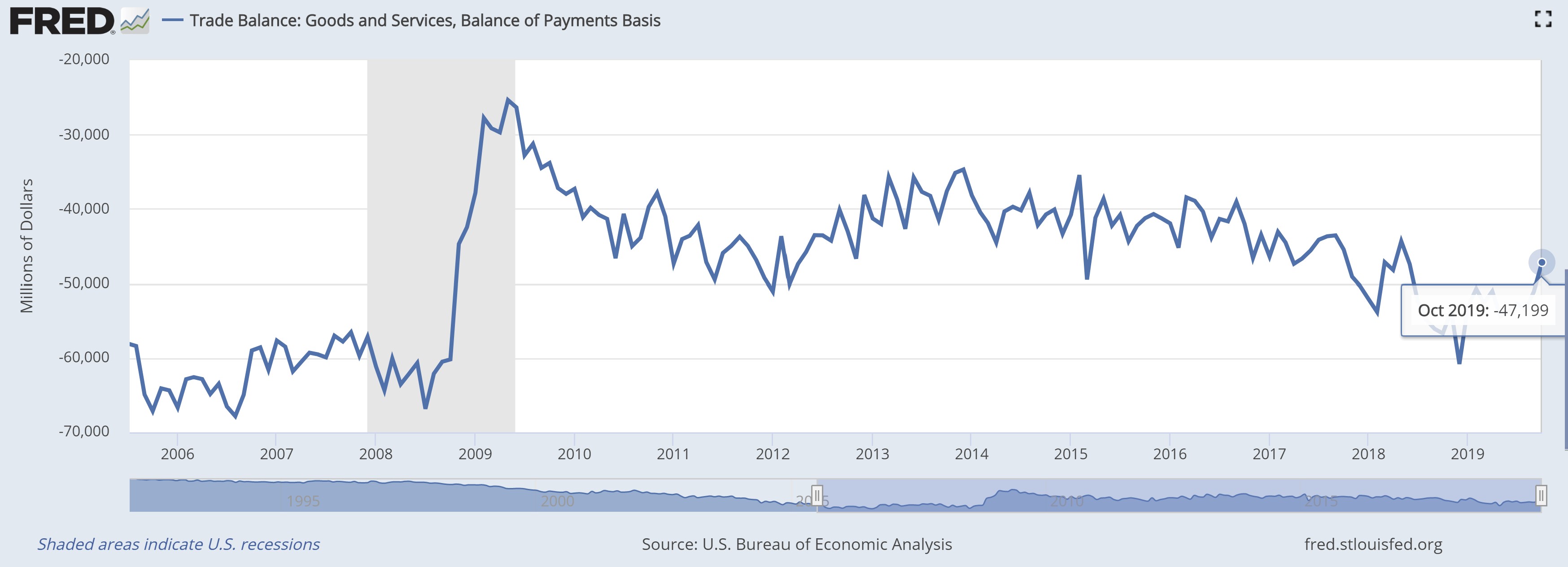

October 2019 Trade Deficit

Submitted by Atlas Indicators Investment Advisors on December 16th, 2019

America’s trade deficit shrank in October 2019 according to the Bureau of Economic Analysis. The shortfall improved to $47.2 billion from the revised $51.1 billion (originally $52.5 billion) chasm in September. While on the surface this indicator looked better, the cause of the improvement is not constructive as both sides of the trade ledger declined in the period.

November 2019 Institute for Supply Management

Submitted by Atlas Indicators Investment Advisors on December 16th, 2019

America’s economy was split in November 2019 according to the Institute for Supply Management (ISM). The nation’s manufacturing base continued to contract, falling for a fourth consecutive period. However, non-manufacturing pushed its string of expansions further, reaching 118 months of growth in a row.

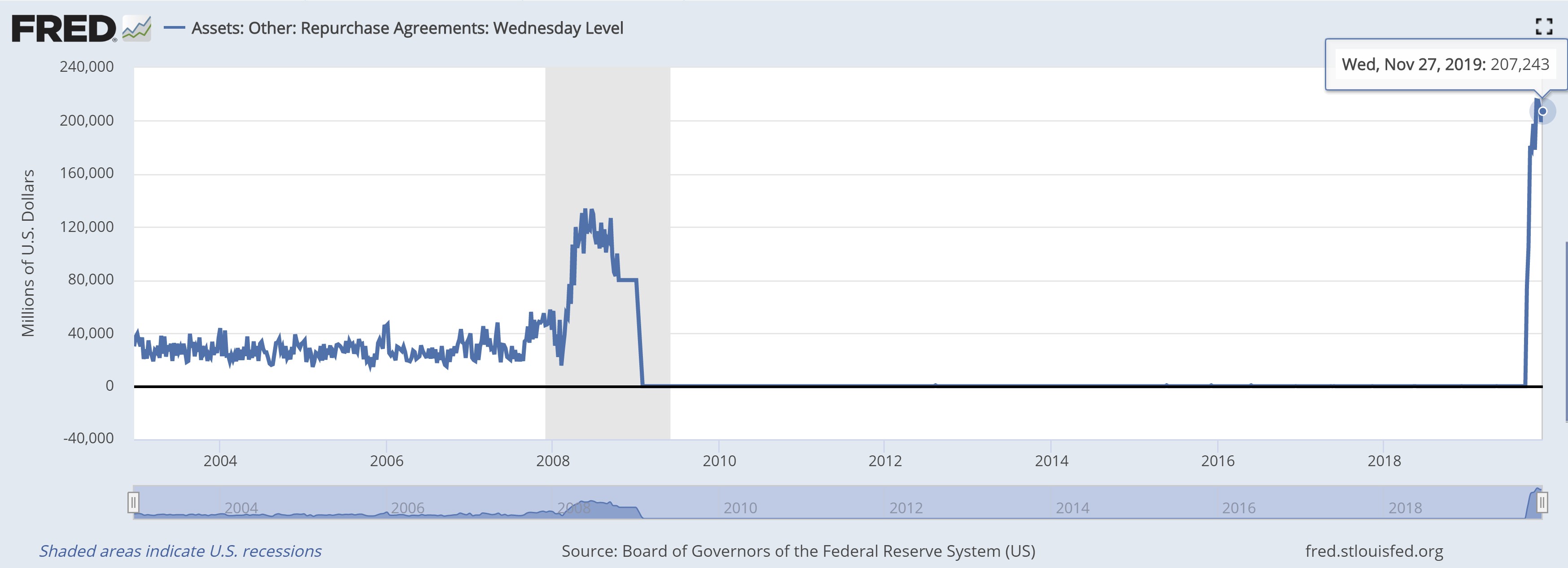

Quantitative Pleasing

Submitted by Atlas Indicators Investment Advisors on December 12th, 2019

Last Friday we published this note about the recent disruption in the repurchase agreement (repo) market. This is a short-term lending resource for various financial institution (banks and non-banks alike) to borrow cash by temporarily selling high-quality assets and promising to buy them back

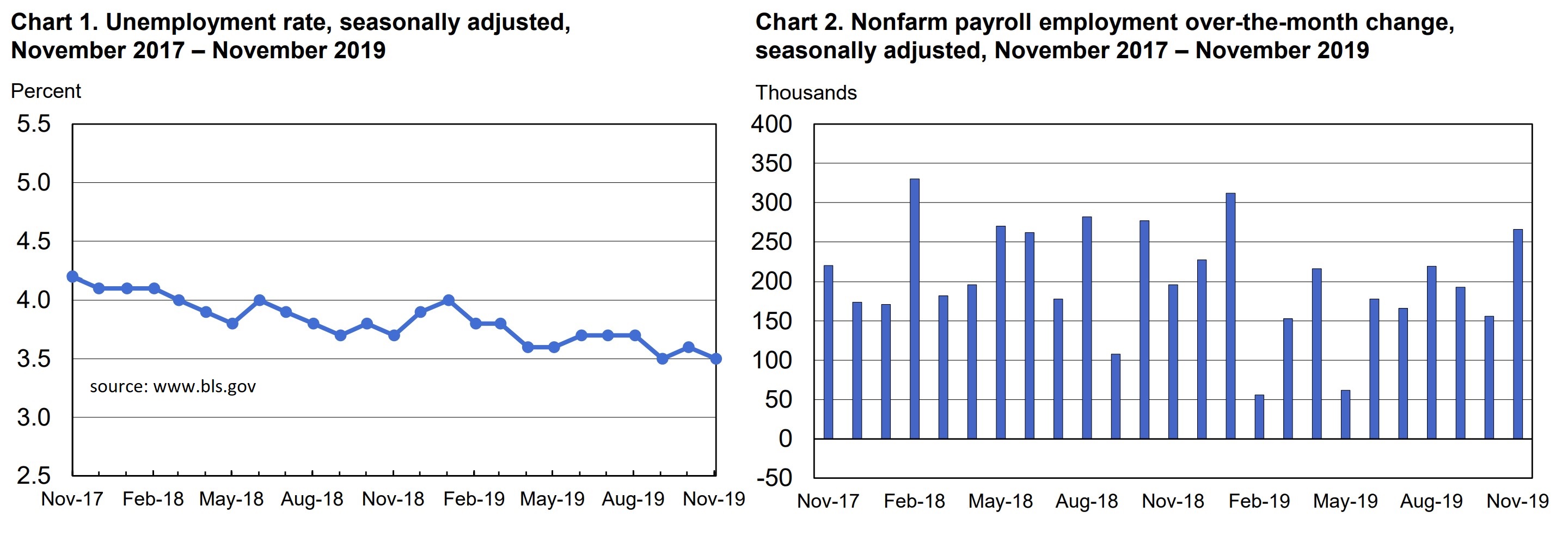

November 2019 Employment Situation

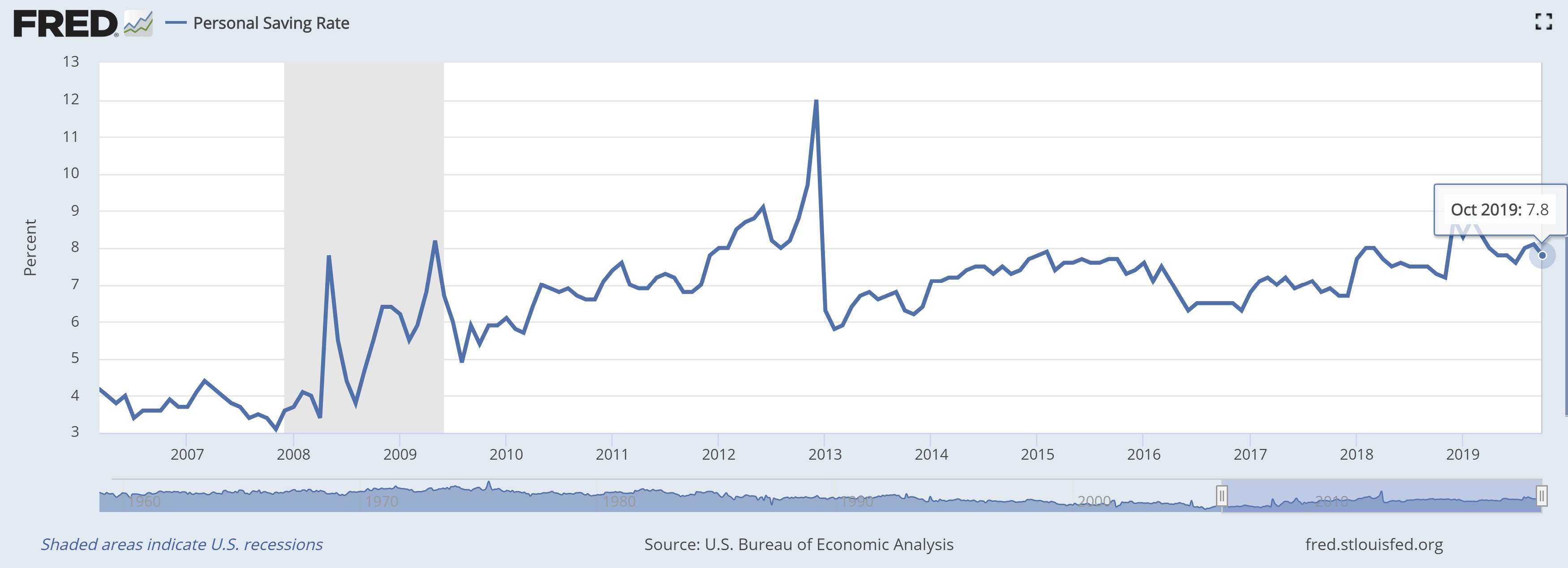

Submitted by Atlas Indicators Investment Advisors on December 12th, 2019October 2019 Income and Outlays

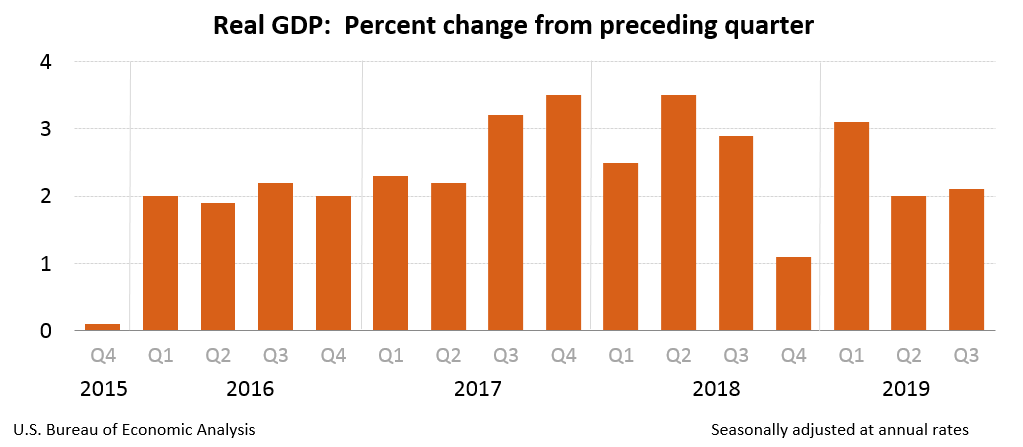

Submitted by Atlas Indicators Investment Advisors on December 12th, 2019Third Quarter 2019 Revised Estimate of Gross Domestic Product

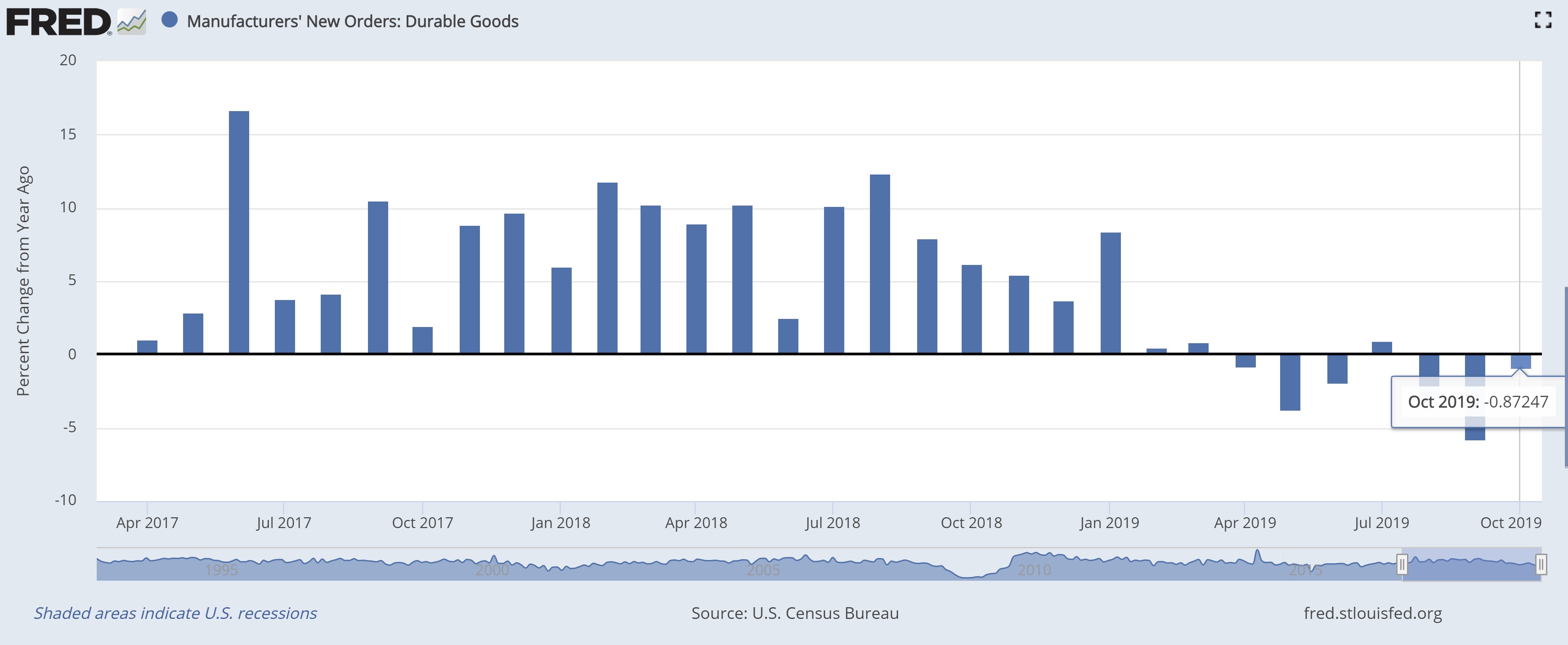

Submitted by Atlas Indicators Investment Advisors on December 12th, 2019October 2019 Durable Goods Orders

Submitted by Atlas Indicators Investment Advisors on December 12th, 2019

Durable goods orders made back some of their prior losses in October 2019 according to the Census Bureau. After declining a downwardly revised 1.4 percent in September (originally minus 1.1 percent), they increased 0.6 percent. Unfortunately, this latest uptick was not enough to push the year-over-year statistic into positive territory. As you can see in the chart above, it ha

Wonderful Wizard of Wall Street

Submitted by Atlas Indicators Investment Advisors on December 5th, 2019

The Land of Oz was ruled by The Wizard of Oz in the children’s novel from 1900, The Wizard of Oz by L. Frank Baum. His subjects held the mysterious man in high regard. Dorothy and her friends even traveled to Emerald City, the capital of Oz, because they were certain he was the only person capable of solving their issues.