October 2019 Durable Goods Orders

Submitted by Atlas Indicators Investment Advisors on December 12th, 2019

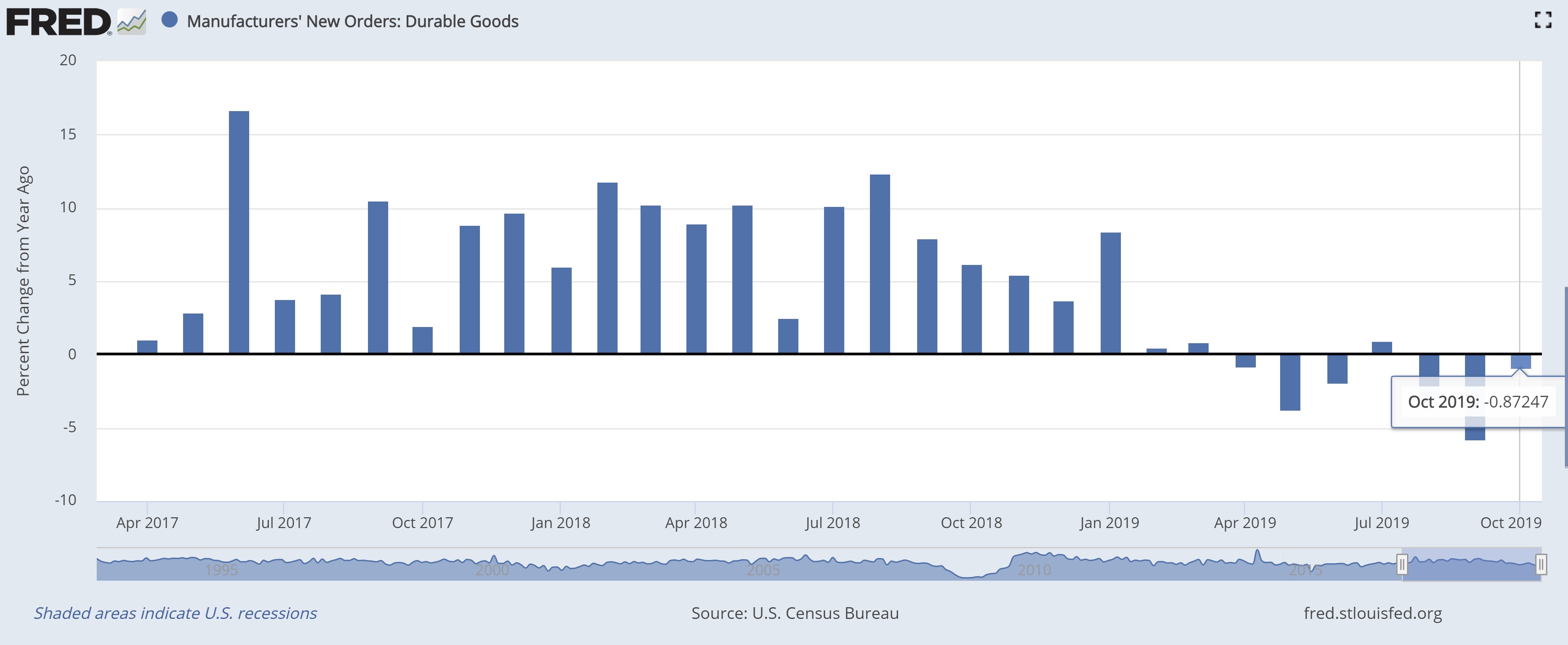

Durable goods orders made back some of their prior losses in October 2019 according to the Census Bureau. After declining a downwardly revised 1.4 percent in September (originally minus 1.1 percent), they increased 0.6 percent. Unfortunately, this latest uptick was not enough to push the year-over-year statistic into positive territory. As you can see in the chart above, it has struggled to trend higher lately. Despite some weakness at the headline level, there was some good news within the report.

One of Atlas’ favorite indicator of business confidence is within this release, and it improved. Nondefense capital goods orders excluding aircraft rose 1.2 percent and are now up 0.9 percent in the past year. October’s uptick nearly offsets the declines in the prior two months. This subset of the headline is useful because it strips out military spending, which can occur without regard to the business cycle, and aircrafts because they are large one-time purchases that skew the data for a couple of months, making one month look great and the next awful. Businesses haven’t given up on their expectations to profit from capital expenditures.

Durable goods aren’t the hottest indicator for the economy right now (that honor probably goes to employment), but its weakness isn’t pronounced enough to cause alarm; continued capital outlays by firms are helping. Our economy is driven by consumers and can withstand bouts of slower factory output. America remains within the virtuous portion of the business cycle.