November 2019 Employment Situation

Submitted by Atlas Indicators Investment Advisors on December 12th, 2019

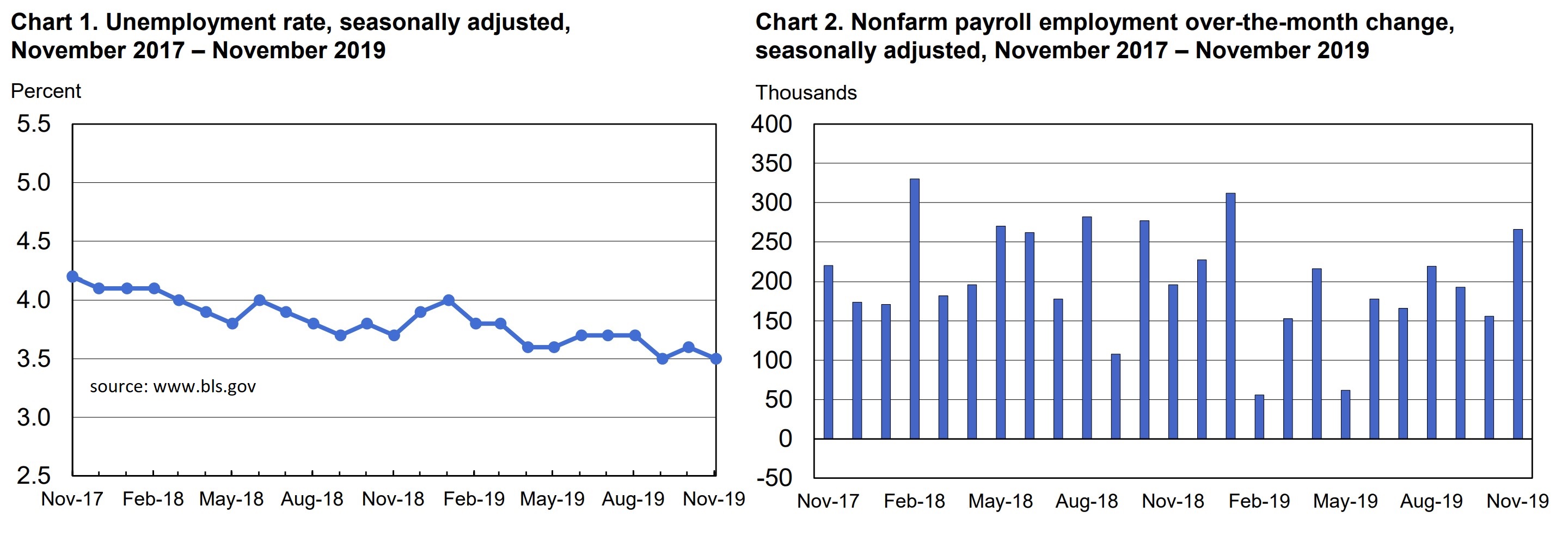

America runs on the consumer. And consumers are more potent when they have jobs. Fortunately, our nation’s labor situation has been a bright light among all the economic indicators we watch. November 2019 was no different. According to the Bureau of Labor Statistics, employers added 266,000 net new employees in the penultimate month of the year after just 156,000 (upwardly revised from 128,000) a month earlier. Additionally, the unemployment rate, arguably the most watched economic indicator, fell marginally to 3.5 percent, matching the lowest since 1969.

This report was helped by the end of a strike. As you may recall in last months employment situation note, we mentioned GM workers had just finished striking when the report was released, so they subtracted from the headline when the automaker submitted their total number of workers. That was reversed in November when the two groups agreed to terms. This resolution contributed to the 54,000 jobs added to manufacturers payrolls.

Two other procyclical segments were relatively unchanged. Retail trade added just 2,000 employees while its wholesale counterpart lost 4,300. On the other hand, education and health services added 74,000 net new employees; these segments are not as sensitive to the business cycle.

Workweek and pay statistics were mixed. The average workweek for all employees was unchanged at 34.4 hours. Average hourly earnings for all employees on private payrolls rose $0.07 to $28.29. In the past twelve months, average hourly earnings gained 3.1 percent. Accounting for the Federal Reserve’s preferred inflation measure, these employees have experienced a real wage increase of 1.5 percent.

Employment continues to be the brightest shining indicator Atlas follows. Firms are hiring, paying higher wages, and keeping the workweek level. This all adds up to additional aggregate pay which in turn should support greater consumption in the months ahead.