Third Quarter 2019 Revised Estimate of Gross Domestic Product

Submitted by Atlas Indicators Investment Advisors on December 12th, 2019

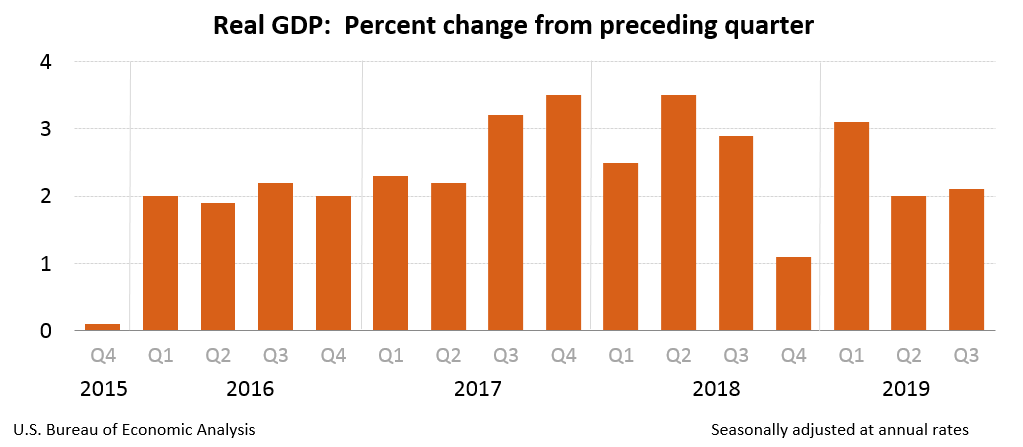

After more complete data were collected, the seasonally adjusted annualized growth rate for third quarter 2019 gross domestic product (GDP) was upwardly revised. According the Bureau of Economic Analysis, growth was 2.1 percent (originally 1.9 percent). This puts the pace of growth marginally higher than the second quarter’s pace of 2.0 percent. Areas being revised higher (even if they were lower versus the prior quarter) included gains in inventory levels, capital expenditure from businesses, and even more consumer spending. However, state and local spending, which was slower than first estimated, offset some of these gains.

This latest quarter of growth reflected improvements in several categories. The big one, consumer spending, continued moving in an upward trajectory; Americans spent more on both goods (notably durable goods like vehicles and recreational wares) as well as services. Additionally, home builders built more houses, and firms in other industries added to the supply of wares they sell. Government outlays increased also. Finally, exports improved versus the prior period as foreign buyers purchased more of the goods and serviced produced in America. However, as is often the case, other areas weren’t as strong.

On the downside, firms were less willing to invest in costly and productivity enhancing capital equipment. Companies also spent less on structures like mining exploration, shafts, and wells. Rising imports also detracted from the headline total since they subtract from the GDP equation.

No matter how you spin it, America’s output is growing. There have been other periods of faster growth, but this economy does not seem to be forecasting a recession is on the horizon. Consumers are employed and willing to spend. We’ll keep our eyes focused down the pike and alert you to any substantial pitfalls, but we don’t see any now.