The Trolley Rule

Submitted by Atlas Indicators Investment Advisors on July 28th, 2022

Technologist are busy creating machines capable of making human-like decisions in an instant. Self-driving cars are probably the most obvious example. In 2014 researchers at the MIT Media Lab introduced the Moral Machine, a website to crowdsource individuals’ decisions on how self-driving cars should prioritize lives in accident scenarios (e.g., how should it react when faced with hitting a child versus a small group of adults). You might recall the trolley problem, an ethical thought experiment from the 1970s. It’s like that, only a machine using a complex set of rules rather than a human must decide. In short, these decisions have consequences (see for yourself here).

Another body charged with making consequential decisions is the Federal Reserve. This group has been given the task by Congress to do what it can to keep price growth contained and employment levels high. Theoretically, these goals run contrary to each other but that hasn’t been much of an issue since the turn of the century. That is, inflation has been relatively tame and outside of financial crises and global pandemics, employment robust. Things have changed recently. Inflation is much higher than the central bank’s target of 2.0 percent on a year-over-year trend. Perhaps they could outsource decision making to some artificial intelligence (AI).

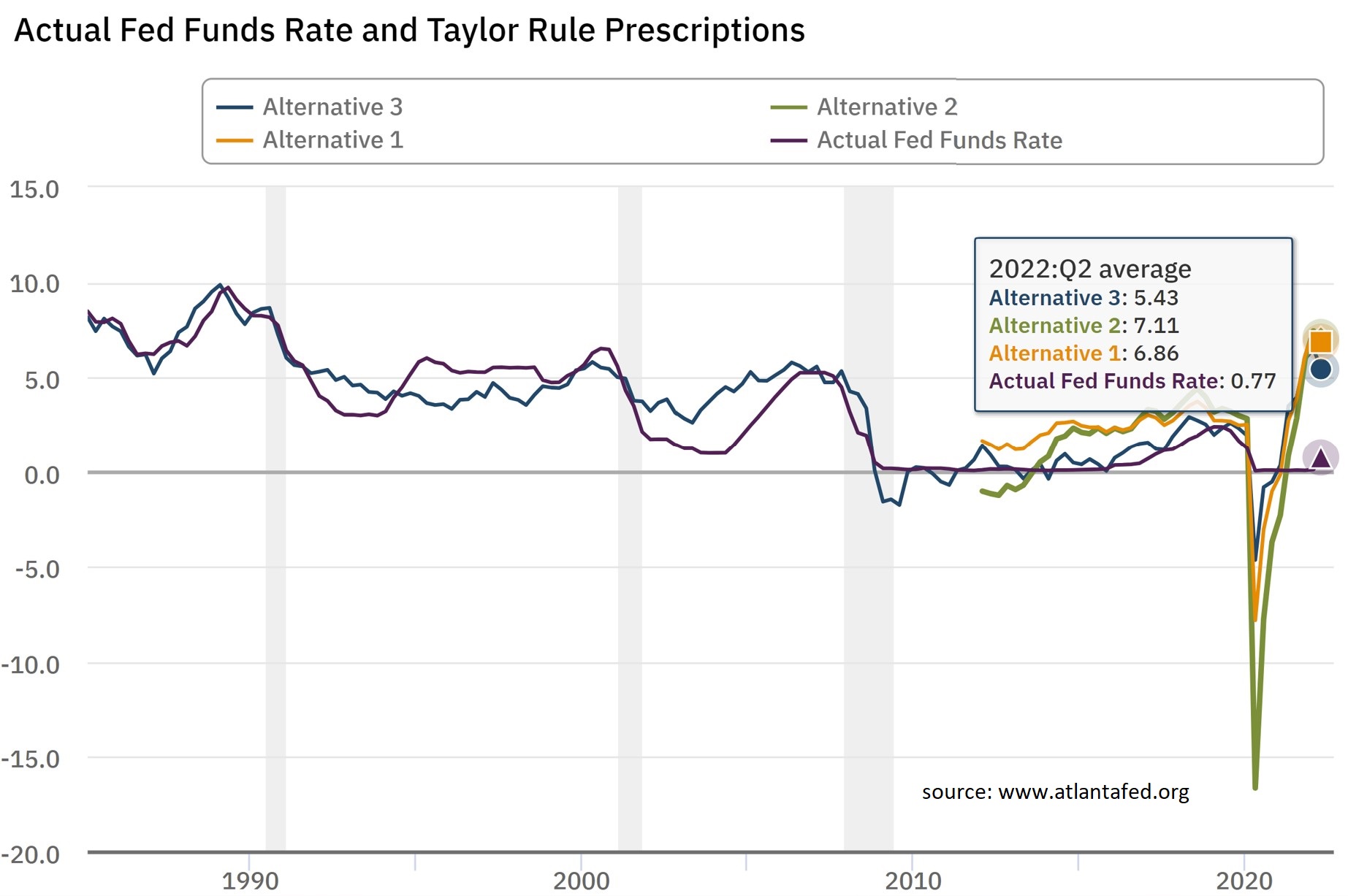

While it doesn’t qualify as AI, there is a rules-based theory on monetary policy with which central bankers are well acquainted. It’s known as the Taylor Rule and was created by John Taylor in 1993 as a rule of thumb for guiding monetary policy. It uses the Fed’s target for inflation and economic growth relative to the actual figures for both. As you can see above, the actual Fed Funds Rate is well below the three rule-based scenarios offered by the Federal Reserve’s Atlanta Branch. Scenario 3 happens to represent the original Taylor Rule, calling a 5.44 percent Fed Funds Rate, strongly suggesting the centra bank must continue raising rates aggressively.

Rules are helpful in decision making. Unfortunately, they cannot guarantee an optimal outcome. What if the person hit by a car just solved for cold fusion and the baby was destined to be a malicious killer? If the central bank hiked rates to levels indicated by the Taylor rule, it isn’t difficult to imagine a number of potential difficulties which could ensue. Like a trolly operator at the switch deciding between two suboptimal outcomes, the Federal Reserve is being forced to choose.