December 2019 Employment Situation

Submitted by Atlas Indicators Investment Advisors on January 23rd, 2020

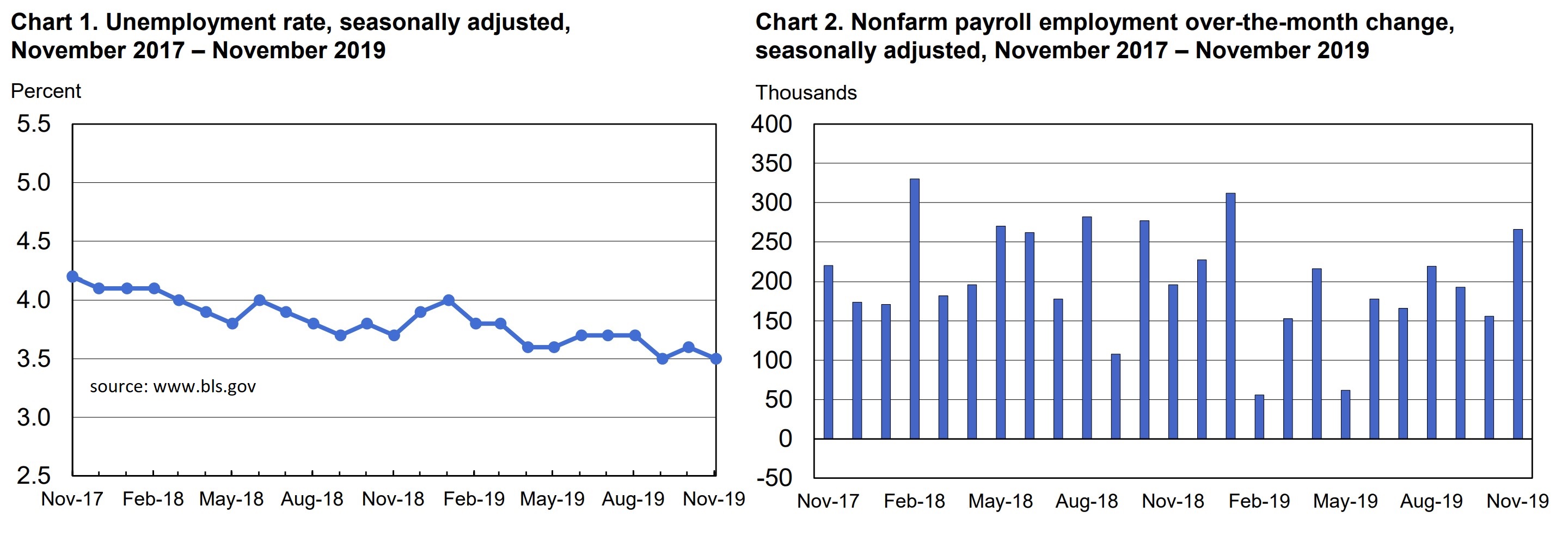

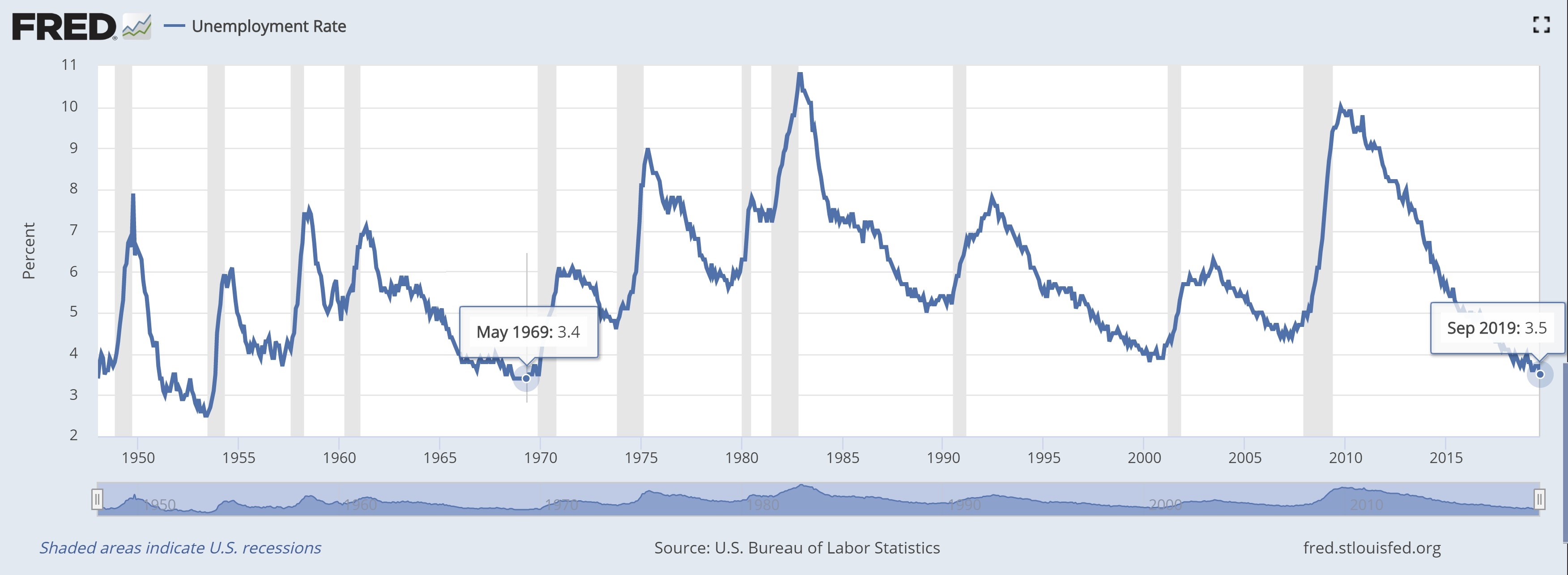

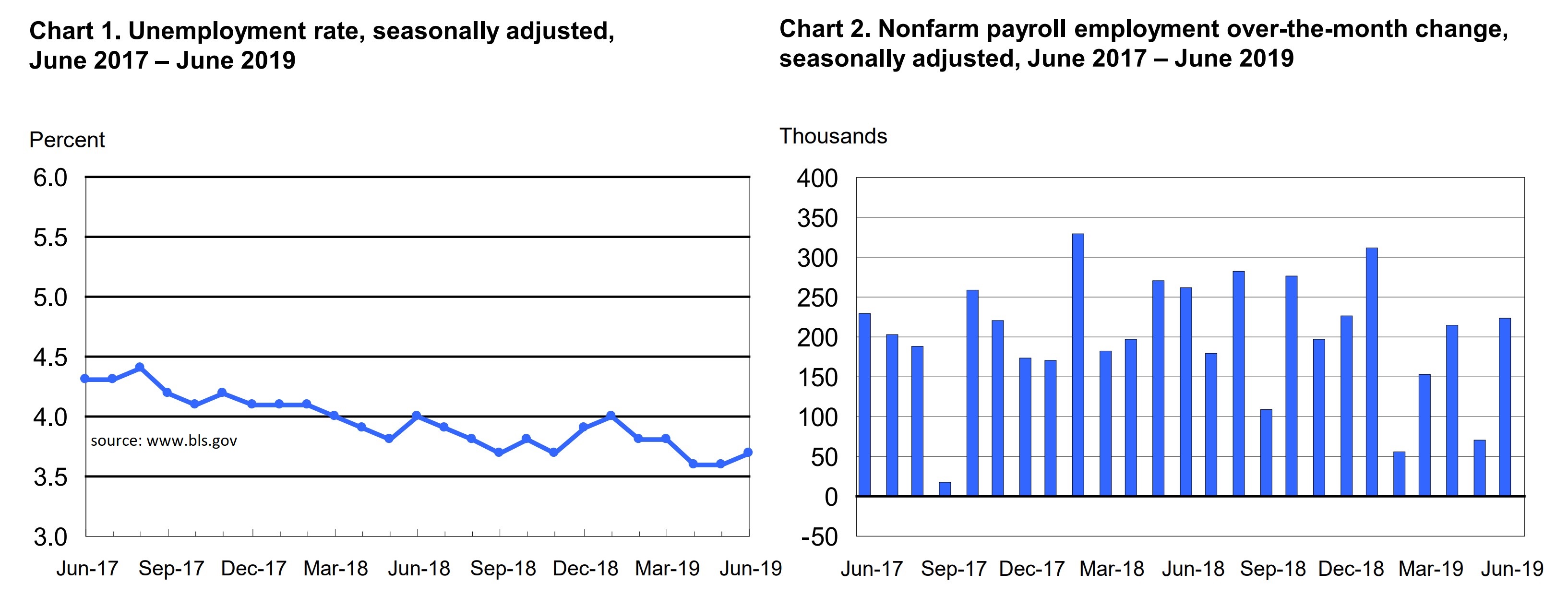

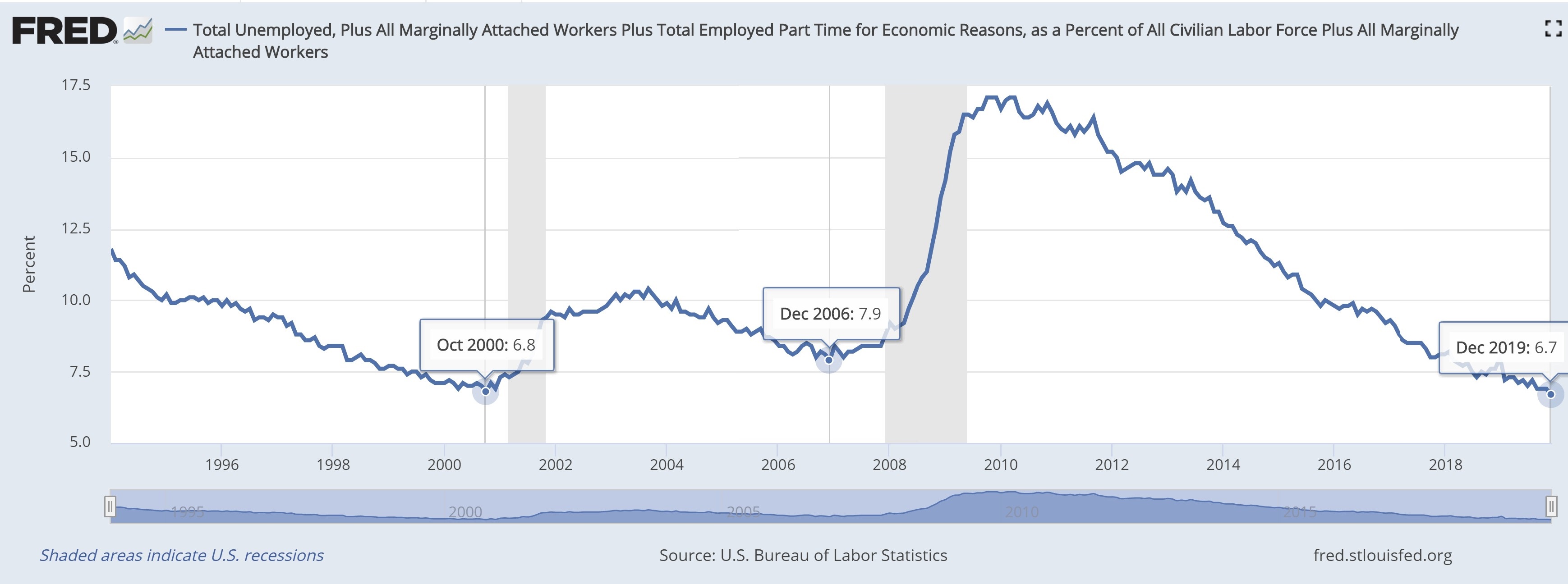

America’s labor situation has been one of the economy’s highlights since it began recovering after the Great Recession. Last year (2019) ended the decade by adding 2.11 million net new jobs, including December’s uptick of 145,000 according the Bureau of Labor Statistics (BLS). The unemployment rate held steady at 3.5 percent.