Employment

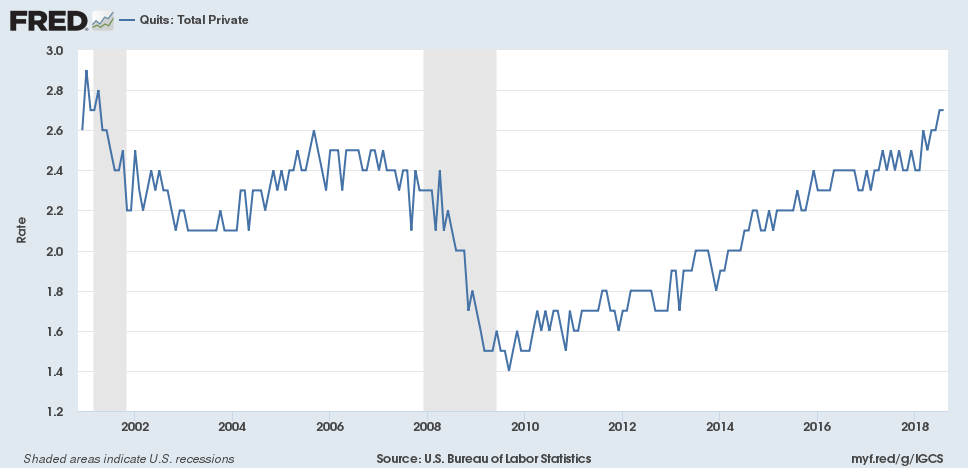

Job Hopping

Submitted by Atlas Indicators Investment Advisors on October 21st, 2018September 2018 Employment Situation

Submitted by Atlas Indicators Investment Advisors on October 21st, 2018America kept adding jobs in September 2018 according to the Bureau of Labor Statistics. Their employment situation report tallied 134,000 net new jobs in the period. Of course, this uptick is well off the average of the prior three months of over 214,000 and is the weakest gain in twelve months. However, July was revised higher by 18,000 and August received a large upward revi

August 2018 Employment Situation

Submitted by Atlas Indicators Investment Advisors on September 15th, 2018

July 2018 Unemployment

Submitted by Atlas Indicators Investment Advisors on August 6th, 2018America’s employment situation continues to be one of the most robust indicators Atlas watches. Another 157,000 net new jobs were added to the economy in July 2018 according to the Bureau of Labor Statistics. This increase came on the heels of strong releases in May and June; adding to their strength, both of these two months were upwardly revised as a combined 59,000 more job

June 2018 Employment Situation

Submitted by Atlas Indicators Investment Advisors on July 9th, 2018

April 2018 Employment Situation

Submitted by Atlas Indicators Investment Advisors on May 11th, 2018February 2018 Employment Situation

Submitted by Atlas Indicators Investment Advisors on March 11th, 2018Friday’s employment report covering February 2018 was strong. According to the Bureau of Labor Statistics, America’s economy added 313,000 net new jobs. This gain followed an upwardly revised count of 239,000 (originally 200,000) to start this year and an increase of another 15,000 for the December 2017 tally. The unemployment rate held steady at just 4.1 per

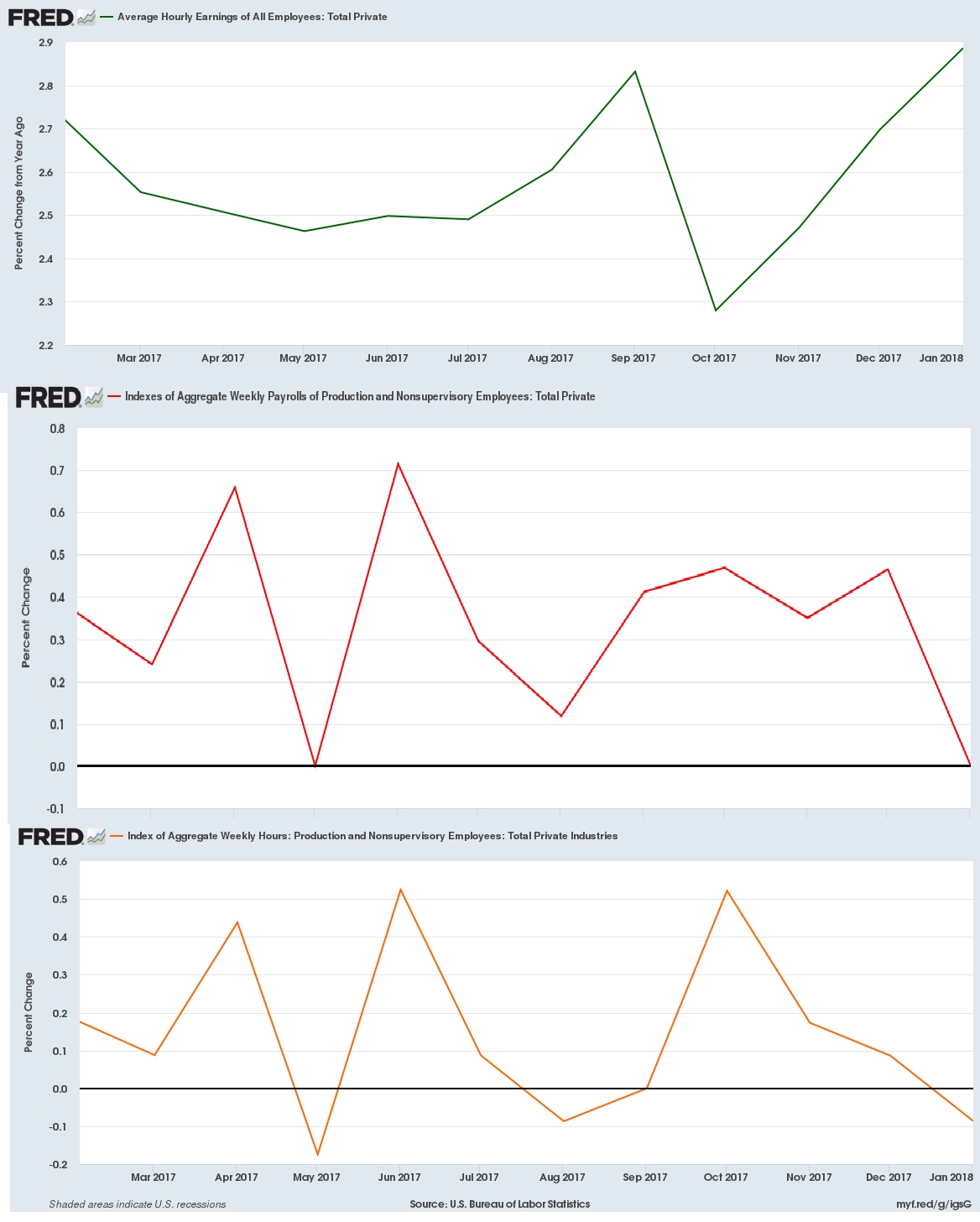

Math Magic

Submitted by Atlas Indicators Investment Advisors on February 8th, 2018

Atlas' Monday note covered the most recent employment report. If you did not have a chance to see it or want to reference it, click here. One of the more positive developments to come out of the report was an increase in average hourly earnings. This is an important statistic because it sug

December 2017 Employment Situation

Submitted by Atlas Indicators Investment Advisors on January 7th, 2018

America’s economy continued adding jobs in December 2017 according to the latest data from the Bureau of Labor Statistics (BLS). Employers hired a net 148,000 new workers as the year came to a close. Despite the monthly increase in jobs, the unemployment rate held steady at 4.1 percent as the number of available workers also rose in the period.