September 2019 Employment Situation

Submitted by Atlas Indicators Investment Advisors on October 16th, 2019

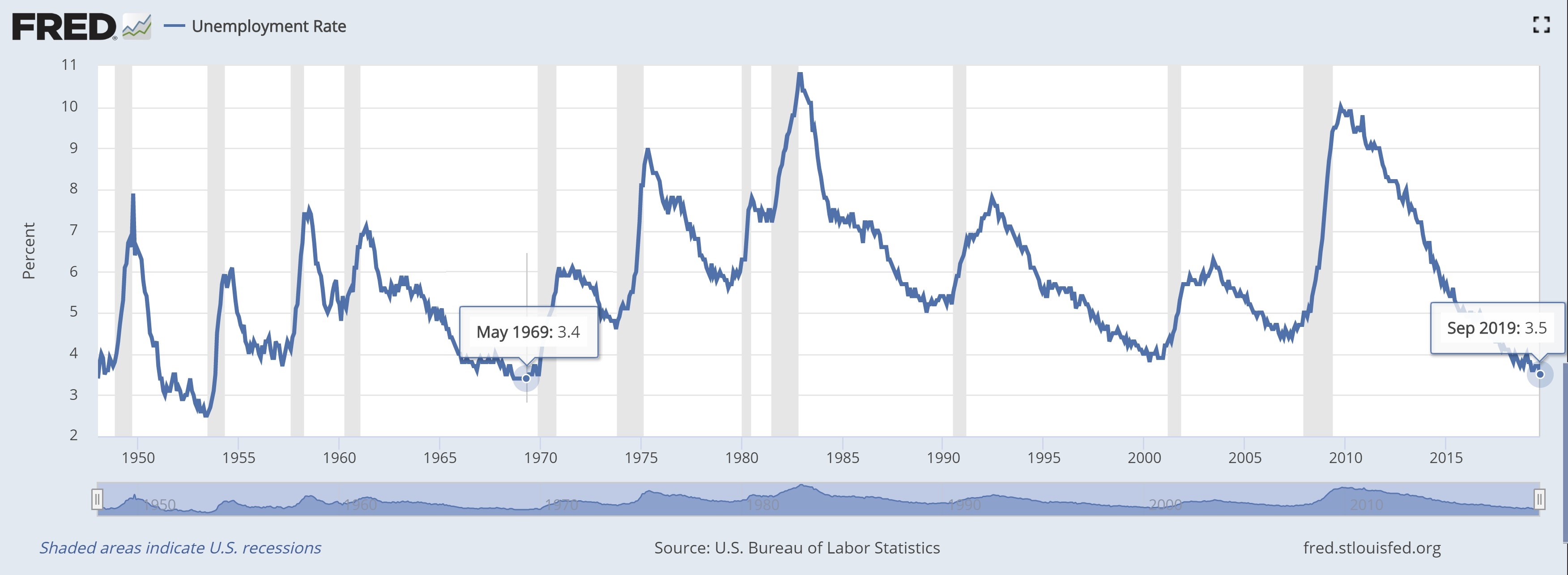

American firms continued adding jobs in September 2019 according to the Bureau of Labor Statistics. Their latest tally indicates 136,000 net new jobs were gained in the period. However, this improvement is slower than the upwardly revised tally of 168,000 (originally 130,000) in August. Despite the slowing rate of improvement, the unemployment rate fell to just 3.5 percent, the best rate in over 50 years.

Private employers led the figure higher. America’s service based economy added many jobs with a gain of 39,000 for health care and 34,000 in professional and business services. Transportation and warehousing rounded out the most robust private categories with a 16,000 increase. Additionally, government payrolls were up 22,000 to end the third quarter.

Unfortunately for some, it wasn’t all good news. Retail trade employment continued its falling payroll trend, losing 11,000 jobs. Since reaching it peak in January 2017, retail trade has shed 197,000 net jobs.

Pay and hours worked statistics were little changed in aggregate. Average hourly earnings for all employees on private payrolls dropped $0.01 to $28.09 after rising $0.11 in August. In the past year, average hourly earnings are up 2.9 percent. The average workweek held steady 34.4 hours.

America’s labor market continues to be one of the bright spots in the economy. However, it is showing signs of slowing like many other indicators we follow. Last year, our economy added an average of 223,000 jobs a month. Thus far in 2019, it has managed just 161,000. Fortunately, that’s enough to keep the unemployment rate low and falling as the nation’s demographics continue changing with more and more Baby Boomers exiting the workforce.