June 2019 Employment Situation

Submitted by Atlas Indicators Investment Advisors on July 6th, 2019

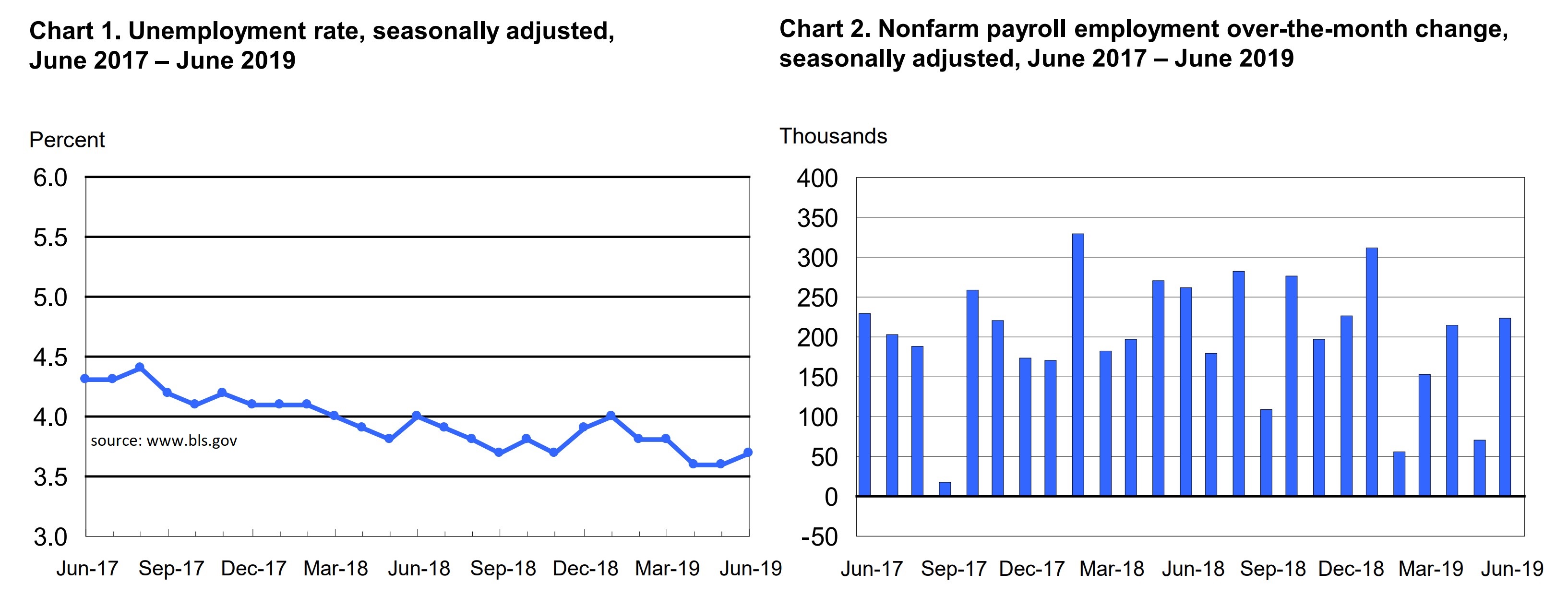

America’s economy added 224,000 net new jobs in June according to the Bureau of Labor Statistics. This latest change to the employment situation was a dramatic uptick from the downwardly revised count of just 72,000 (originally 75,000) in May. Although the unemployment rate ticked up marginally to 3.7 percent, this release was largely positive.

Hiring was widespread. Professional and business service firms added 51,000 jobs. Health care payrolls received a clean bill of health, rising 35,000. Transportation and warehousing companies moved ahead 24,000 jobs. Construction firms built on earlier foundations, contributing 21,000 hires. Factory jobs moved up 17,000 after remaining relatively stagnate in the prior four months. Finally, mining, wholesale trade, retail trade, information, financial activities, leisure and hospitality, and government hiring was little changed in the period.

Other widely watched data within in the report skewed mostly positive. The average hourly wage rose $0.06 in June. This uptick comes on the heels of May’s $0.09 gain. Over the past twelve months, average hourly wages have gained 3.1 percent. The average workweek was unchanged at 34.4 hours. However, at 40.7 hours, workers in manufacturing enjoyed an additional six minutes a week on the job.

Labor force participation figures were interesting. The overall average increased marginally to 62.9 percent and is unchanged in the past twelve months. However, details beneath this count reveal mixed underlying trends. For men age 25-54, the tally is down to 88.7 percent and is now off from 89.5 percent in March; but women in the same age bracket reached 75.9 percent, a tally now approaching a 12-year high.

America’s economy continues advancing. Employers added jobs at a pace that was faster than the year-to-date average of 172,000. Atlas is pleased with the way hiring bounced back after a month of weakness and currently puts this indicator on the positive side of the T-Chart.