Weeks Happen

Submitted by Atlas Indicators Investment Advisors on March 26th, 2020

“There are decades where nothing happens; and there are weeks where decades happen” - Vladimir Ilyich Ulyanov

The sentiment of the quote above has been rattling around in my brain for about a week. I was paraphrasing it and kept telling myself to search for it. When I did, I was surprised to find it attributed to Vladimir Lenin about 100 years ago. Nevertheless, it seems apropos for the current state of global affairs.

March 2020 is nearly over, and like Comrade Lenin, it will be one for the history books. Markets entered bear status (defined as a decline of 20 percent or greater from a peak) faster than ever before. In an emergency cut on a Sunday, our Federal Reserve dropped the overnight interest rate to virtually zero once again. Short-term U.S. government bonds began trading with negative rates in March. Congress is putting the finishing touches on an economic stimulus plan worth over $2.0 trillion! After the checks arrive, I’m sure we’ll all take time to read the bill. Just be sure to deposit your check with Atlas. :)

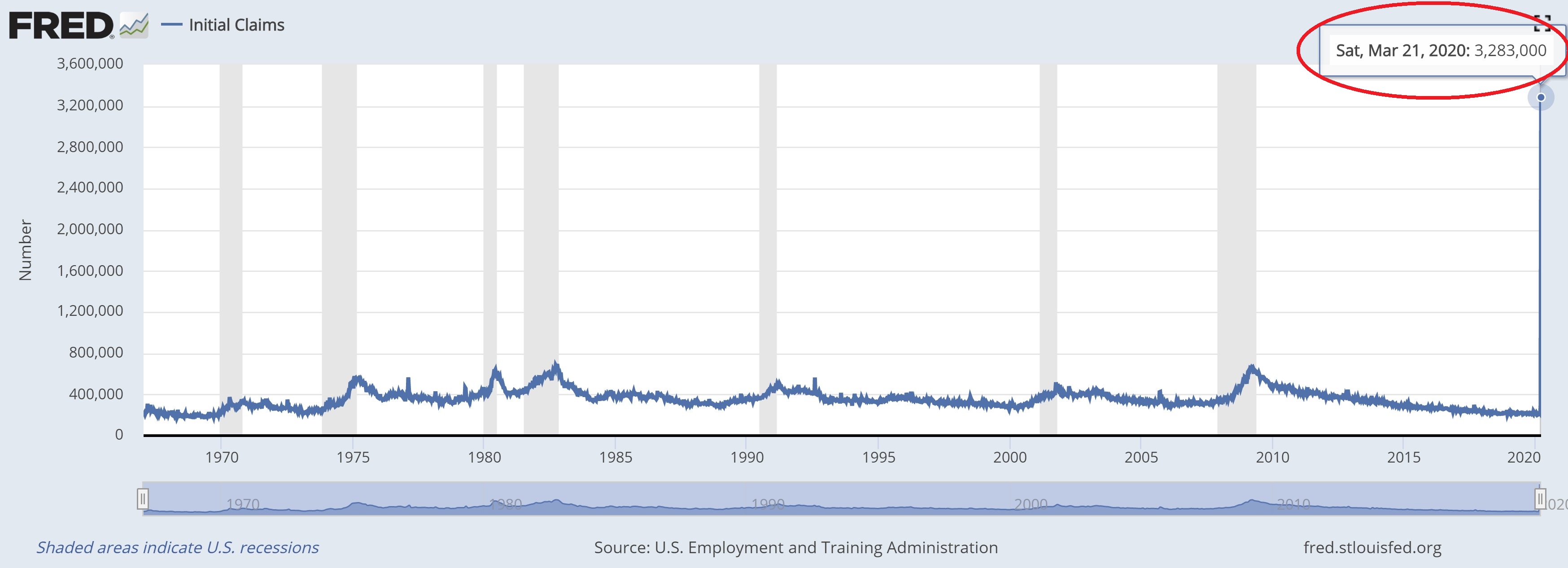

Those checks and other offerings in the legislation are likely to help many Americans. For instance, a new record (another for the history books) for jobless claims was established yesterday. Initial claims for state unemployment benefits jumped to 3.283 million in the week ending March 21st. This is the largest weekly gain since it started being recorded in 1967. By some estimates, this week worth of data could cause a nearly two percentage point jump in the national unemployment rate (most recently tallied at 3.5 percent in February). We’ll get data on this indicator next Friday.

News and markets are moving swiftly. Atlas has been extreme markets before. We started right in the thick of the last financial crisis. Experience helps keep things calm here. Let me know if I can be of any help to you, your family, friends, or colleagues.