October 2019 Consumer Price Index

Submitted by Atlas Indicators Investment Advisors on November 20th, 2019

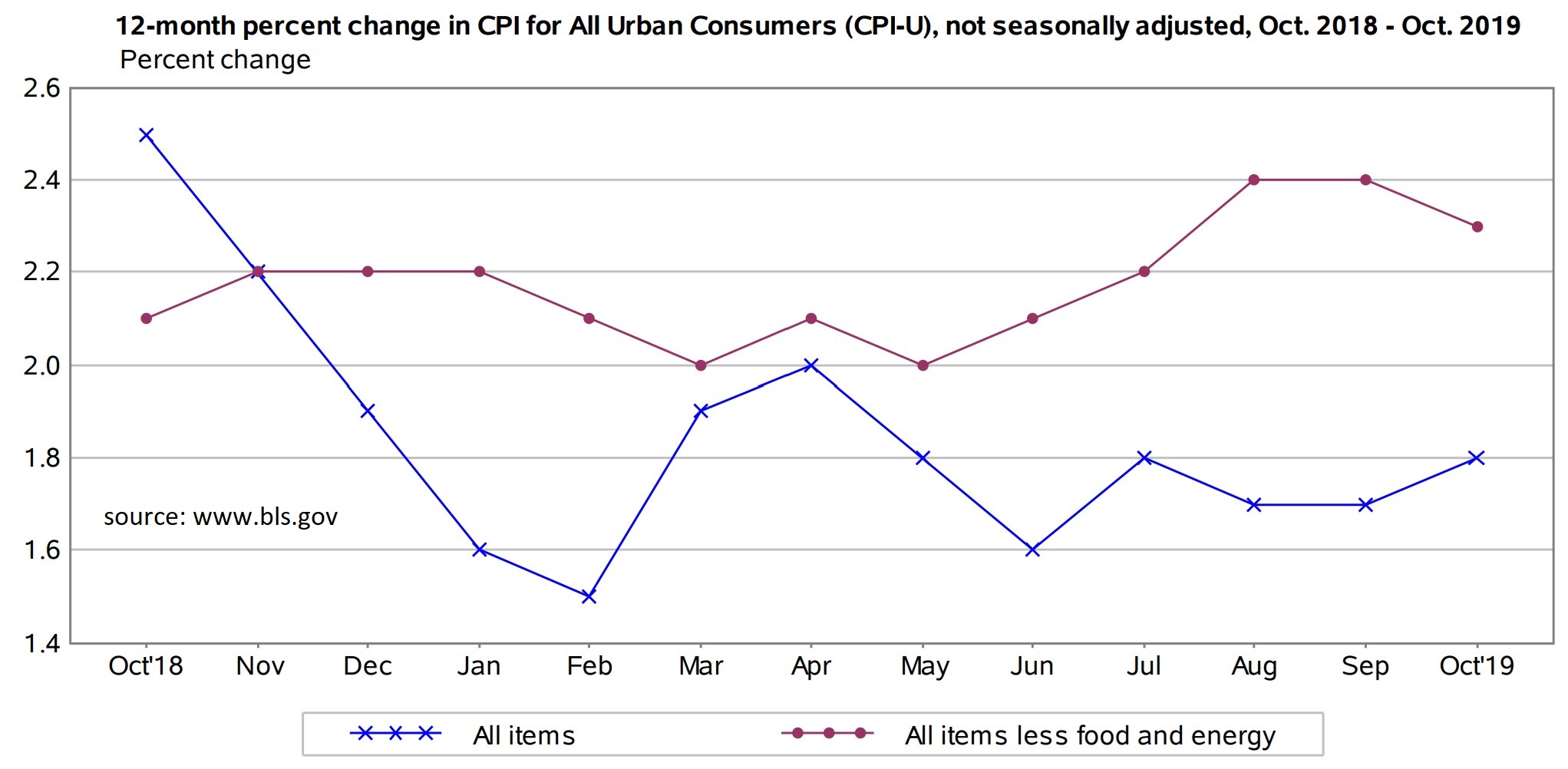

Prices continued rising in October 2019 according to the Consumer Price Index (CPI) from the Bureau of Labor Statistics. The month-over-month tally accelerated to 0.4 percent after going unchanged in September. However, this sudden uptick had only a marginal impact on the year-over-year statistic, rising to 1.8 percent from 1.7 percent. Removing food and energy, leaving core-CPI, prices gained 0.2 percent and the year-over-year figure decelerated to 2.3 percent.

Energy prices were the difference-maker between October’s headline and core tallies. Overall it was up 2.7 percent after falling in four of the prior five months. Gasoline gained 3.7 percent, fuel oil rose 0.8 percent, and natural gas was up 2.4 percent; for some perspective, gasoline and fuel oil prices are off 7.3 percent and 10.6 percent respectively on a year-over-year basis, while natural gas is up 0.2 percent.

Components within the core-CPI measure were mostly higher. Used car prices rose 1.3 percent. Medical care commodities were up 1.2 percent, and medical services increased 0.9 percent. Other upticks within the core components were more mild as shelter and transportation services each gained 0.1 percent. However, new vehicles, commodities excluding food and energy, and apparel costs all fell.

Inflation is alive and well in the consumer segment of our economy. October’s headline gain was the largest since March of this year. So far, the Federal Reserve is not overly concerned with price gains, opting to pay more attention to the pace of economic growth. The central bank is likely to remain on hold with its policy until the economy gives a clearer signal about its direction.