Shift Happens

Submitted by Atlas Indicators Investment Advisors on December 31st, 2021

(Thanks to Professor Chuck for passing on this article which inspired this morning’s note)

Paradigms are typically patterns of something. It used to be that America’s manufacturing model required warehousing of inventories, which in turn required employees to manage this supply. Taiichi Ohno, an engineer at Toyota Motor Company, changed that when he introduced a leaner production model, a system with which America’s old paradigm struggled to keep up. Eventually, firms in Detroit shifted to it to stay competitive. Like any action, paradigm shifts are subject to have unintended consequences.

Inflation pressures and supply chain issues seem to go hand in hand these days. Throw in a global pandemic which changes the purchasing habits of the world’s wealthiest consumer base and things can really go awry. Americans shifted their goods-to-service consumption ratio when places like restaurants, bars, and theaters were shuttered in the pandemic, and this relationship has not gone back to 2019 levels.

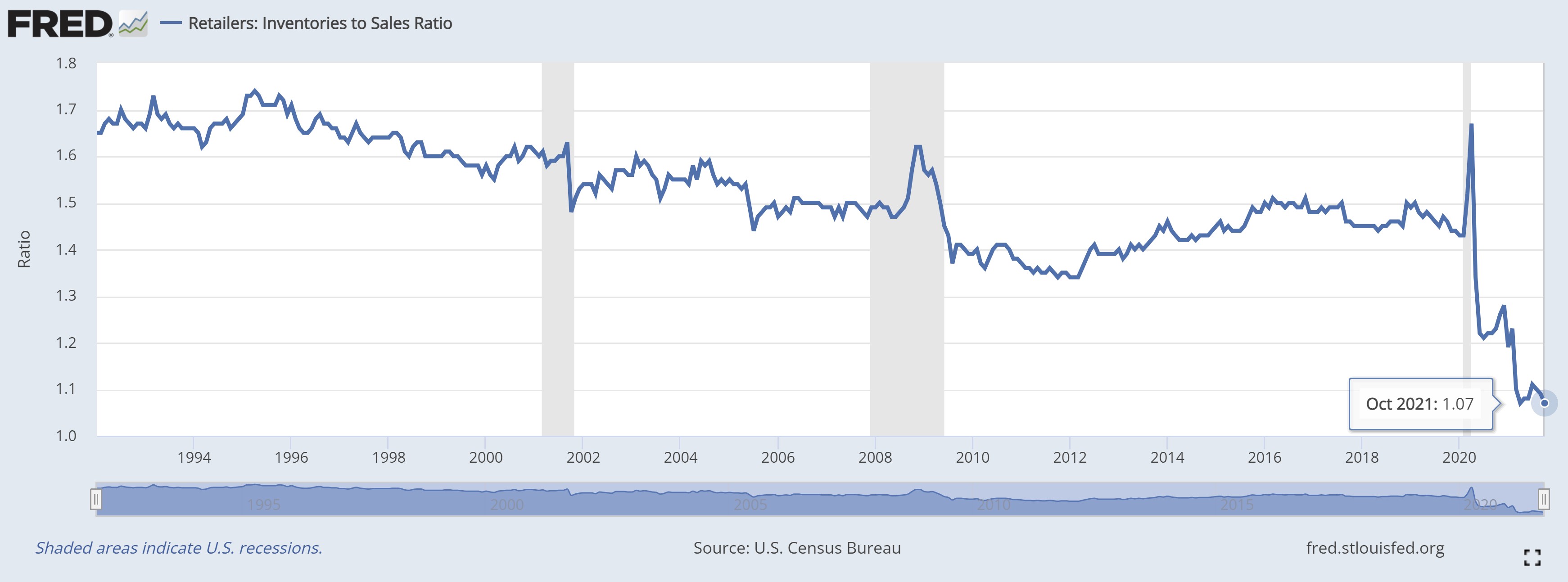

Capacity issues for ground transportation predate the coronavirus, however. Three years ago, the Transportation Topics website wrote this article which mentions truck and rail carriers facing challenges keeping up with demand as larger freight carriers bring in more goods from overseas. These seem to be symptoms of the fragile just-in-time nature of America’s supply chain, a system which seeks to eliminate waste caused by oversupply, extra workers, and storage costs. As you can see in the chart above, America’s retail inventories to sales ratio still sits at the all-time low we also saw in April of this year. Previously, companies didn’t want many items sitting in warehouses; now they can’t keep up with demand.

Shifts are happening. In our efforts toward efficiency, our economy sacrificed some resilience. Attitudes seem to be moving back toward durability. Now, global semiconductor firms have started onshoring here in America. Labor has gained some leverage as well as we’re hearing about wage hikes and even a growing number of work strikes. All of this, of course, will come with its own set of unintended consequences in the years and decades ahead.