Ertragskurve

Submitted by Atlas Indicators Investment Advisors on February 14th, 2019

In one of last week’s notes (click here to review), we brought you up to date on America’s trade (im)balance. In the note, we explained that the deficit fell but did so because America’s exports slowed less than our imports. We looked at it as a sign of global slowing. Today we’ll explore another sign of global slowing. The German yield curve.

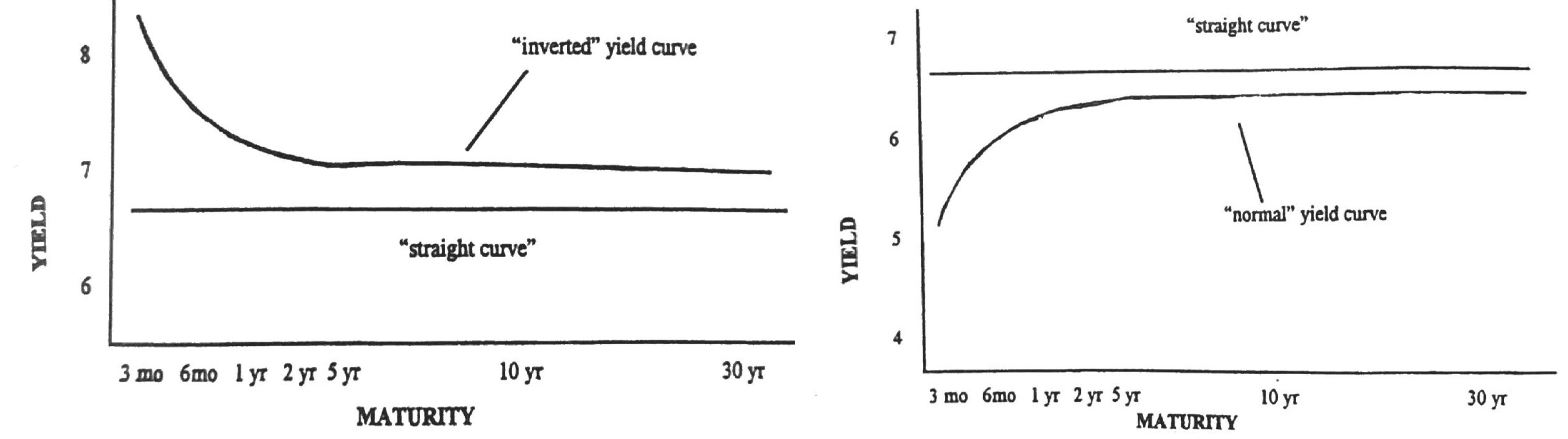

First, we’ll review the yield curve. Simply put, it is a graph showing the relationship between interest rates and time. The vertical axis represents yield while the horizontal axis is the length of time before a bond’s maturity. Generally speaking, when these two variables are plotted on the graph, rates are higher the further out their maturities are from today, forming an upward sloping line from the lower left toward the upper right-hand side. Check out J R’s stylized versions of both positive and negative yield curves above.

For years, the yield curve in Germany has included segments which were negative (imagine paying your bank to keep money in a savings account). While many rates were negative last September, the curve’s shape was upward sloping (i.e., a four-year bond would cost you less than one of a shorter maturity). That all began changing when markets around the globe were hit with a new bout of volatility starting in the late fall of last year.

Even as stock indices here in the U.S. have been behaving more orderly lately, the inverted nature of Germany’s curve has not reversed. As of this writing, owning short-term debt (e.g., maturing between now and April of next year) costs more to possess than one with a longer expiration (i.e., the curve is once again inverted).

The global economy is probably waning. We saw it in the trade data and are seeing signs of it in Germany. China is showing signs of stalling as well (read our note on it here). These are significant economies and their progress will greatly influence the growth patterns of the world along with America. We’ll keep an eye on them all and give you our take if things change in material ways.