Curve Brawl

Submitted by Atlas Indicators Investment Advisors on June 3rd, 2019

At last Tuesday's Pie Party much of the discussion centered around the U. S, Treasury yield curve, a popular tool sometimes used to forecast recessions using the relationship between yields of various maturities. For example, if a shorter-term piece of paper like the two-year Treasury note is yielding more than the Treasury's 10-year bond, some would suggest recessionary pressures are building; if the 10-year yield is higher, then the curve is viewed as "normal."

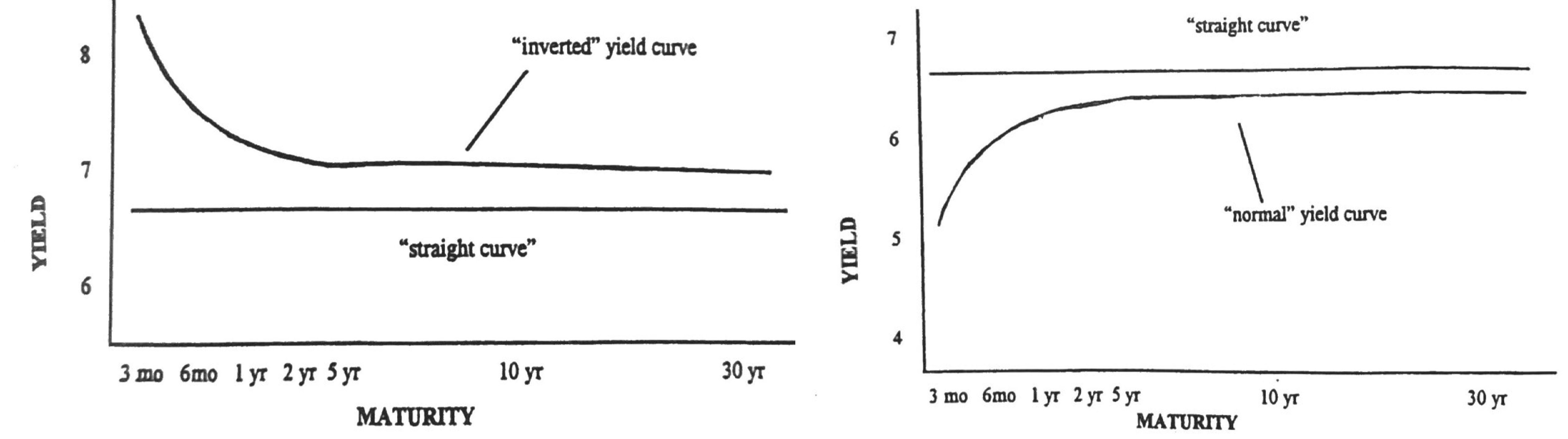

Charting the yield curve itself is fairly straightforward: after drawing a time-line on the horizontal axis of a chart ranging (typically) from three months out to 30 years, plot the yield for each selected maturity on the vertical axis. Connect the dots and see if the line climbs over time (normal) or vice-versa (inverted).

Oh, if it were only that simple! Today's financial press is in a big slap-down brawl in an attempt to define what the correct yield curve should encompass. Atlas has traditionally seen it as a comparison of the two-year versus 10-year yield. Currently that measure is still (barely) normal. But more voices are now proclaiming that the "new normal" should look at the 3-month versus 10-year curve which is now a bit negative. Interestingly, the gentleman credited with conceiving the concept itself several decades ago has recently said the 3-month yield relative to that of the 5-year note has the best predictive value, and it is decidedly negative.

So what is an investor to think? Choosing any time frame to fit your preferred narrative may be more a solipsist’s convenience than any form of hard science. But then again, economics is not a field with definite and provable answers like pure math. Atlas finds we serve you best when sticking to our knitting, employing our own proprietary algorithms, and ignoring all the tea-readers. Regardless who ends up with the best forecast (this round), we feel confident in our ability to manage market risk in any of the likely scenarios manifesting in the months and years to follow. (by J R Capps)