Labor Market

Pendulum Periodicity

Submitted by Atlas Indicators Investment Advisors on October 28th, 2021Where Are They?

Submitted by Atlas Indicators Investment Advisors on April 15th, 2021Automatic Sharing

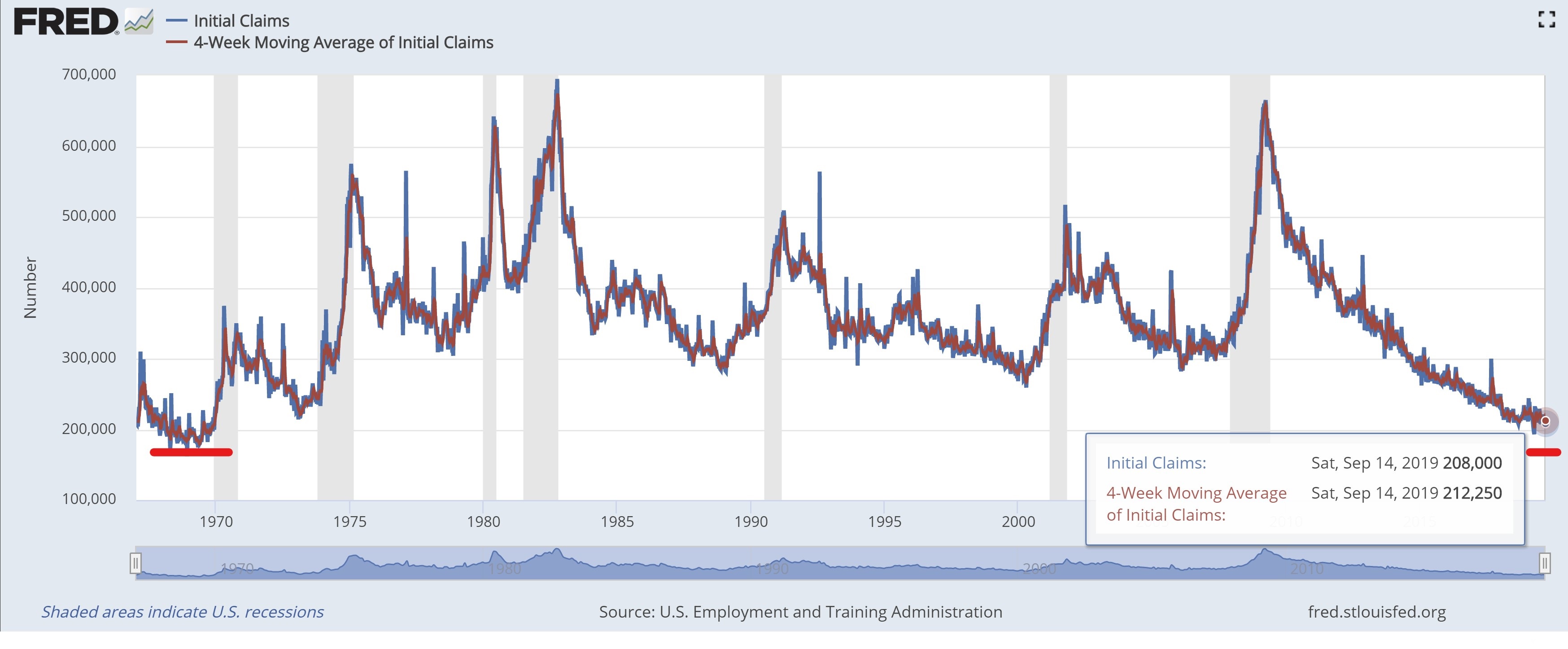

Submitted by Atlas Indicators Investment Advisors on October 3rd, 2019

Our economy is currently in the middle of its longest economic expansion ever. Sometimes it’s tough to imagine the Great Recession ended over a decade ago or that the first recession of this century started over 18 years ago. During both downturns, output was in steep decline and firms were hemorrhaging jobs by the hundreds of thousands each week (e.g., in March 2009, the net

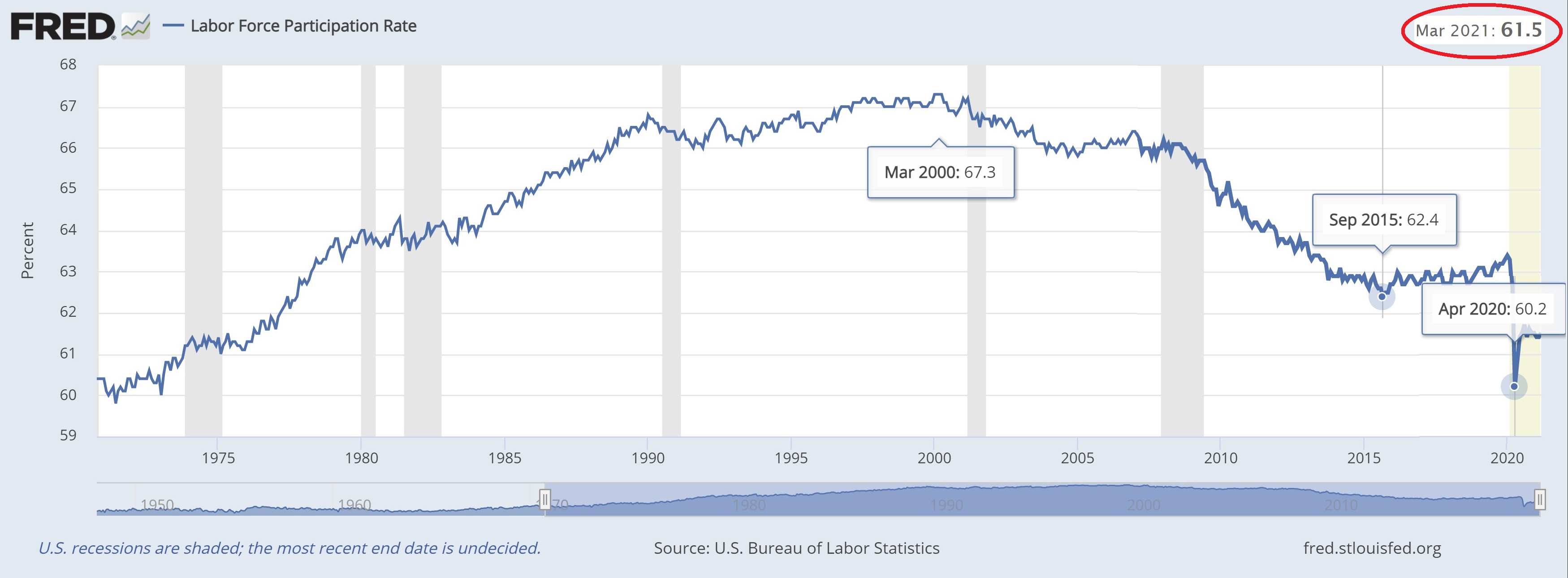

Laboring Through the Data

Submitted by Atlas Indicators Investment Advisors on September 21st, 2019

Each month the Bureau of Labor Statistics (BLS) puts out their Employment Situation report. Regular reader’s saw the Atlas note on it yesterday morning. This report covers two surveys: households and payrolls. Our nation’s unemployment rate is derived from the household survey. Each month the BLS lobs a call to 60,000 homes or so and asks those willing to ans

May 2019 Employment

Submitted by Atlas Indicators Investment Advisors on June 9th, 2019

August 2018 Employment Situation

Submitted by Atlas Indicators Investment Advisors on September 15th, 2018

Limits

Submitted by Atlas Indicators Investment Advisors on April 26th, 2018Math Magic

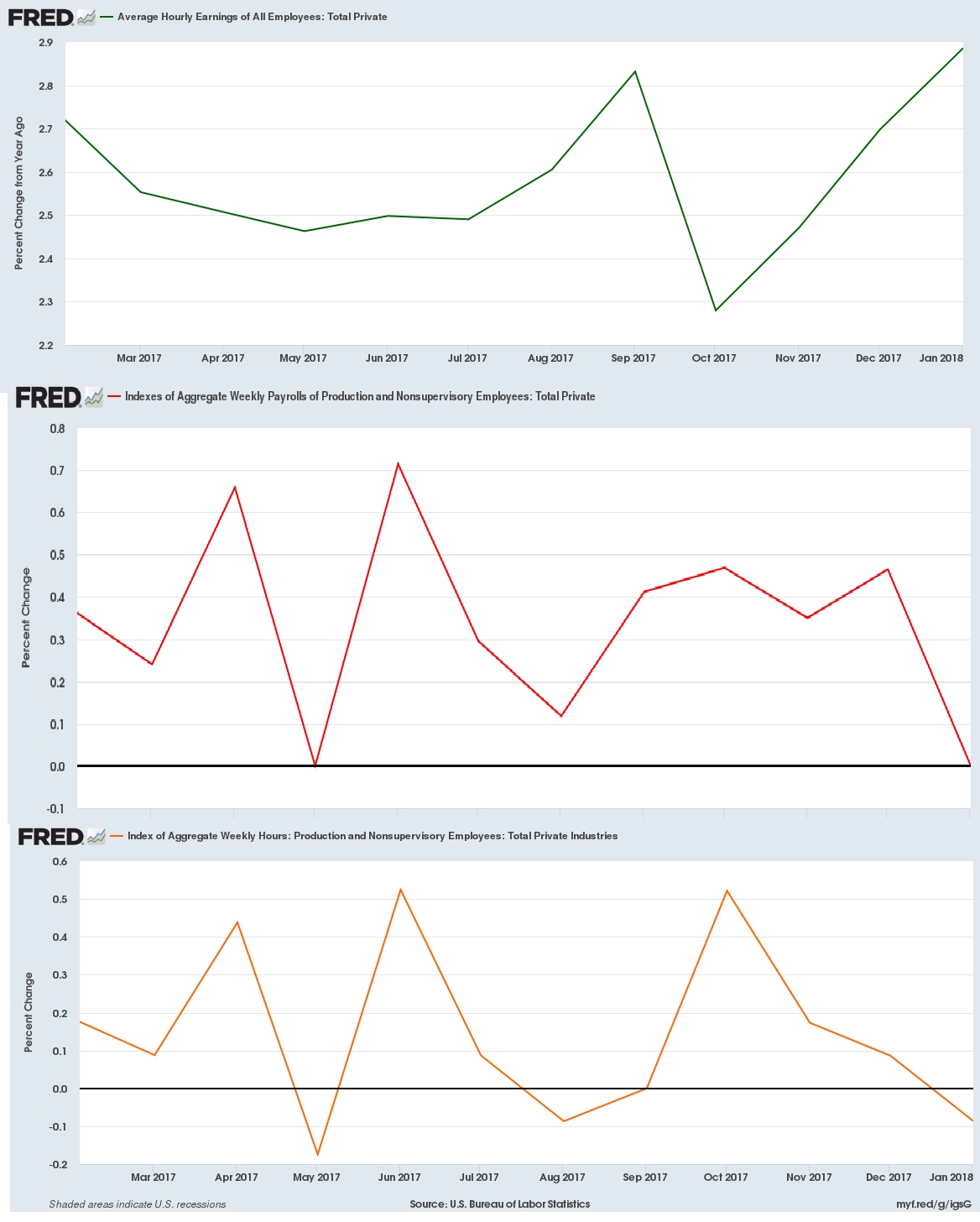

Submitted by Atlas Indicators Investment Advisors on February 8th, 2018

Atlas' Monday note covered the most recent employment report. If you did not have a chance to see it or want to reference it, click here. One of the more positive developments to come out of the report was an increase in average hourly earnings. This is an important statistic because it sug

November 2017 Employment Situation

Submitted by Atlas Indicators Investment Advisors on December 10th, 2017

America’s labor market remained strong during November 2017 according to data from the Bureau of Labor Statistics. After adding 244,000 in October (downwardly revised from 268,000), employers increased payrolls by 228,000 in the penultimate month of the year. Our nation’s unemployment rate held steady at 4.1 percent, tied the lowest level since December 2000.