Laboring Through the Data

Submitted by Atlas Indicators Investment Advisors on September 21st, 2019

Each month the Bureau of Labor Statistics (BLS) puts out their Employment Situation report. Regular reader’s saw the Atlas note on it yesterday morning. This report covers two surveys: households and payrolls. Our nation’s unemployment rate is derived from the household survey. Each month the BLS lobs a call to 60,000 homes or so and asks those willing to answer about their work circumstances. The other survey looks at the number of workers on employers’ payrolls and determines how many net people were hired and fired in the period. That’s a lot of information about America’s labor market, but there’s even more out there.

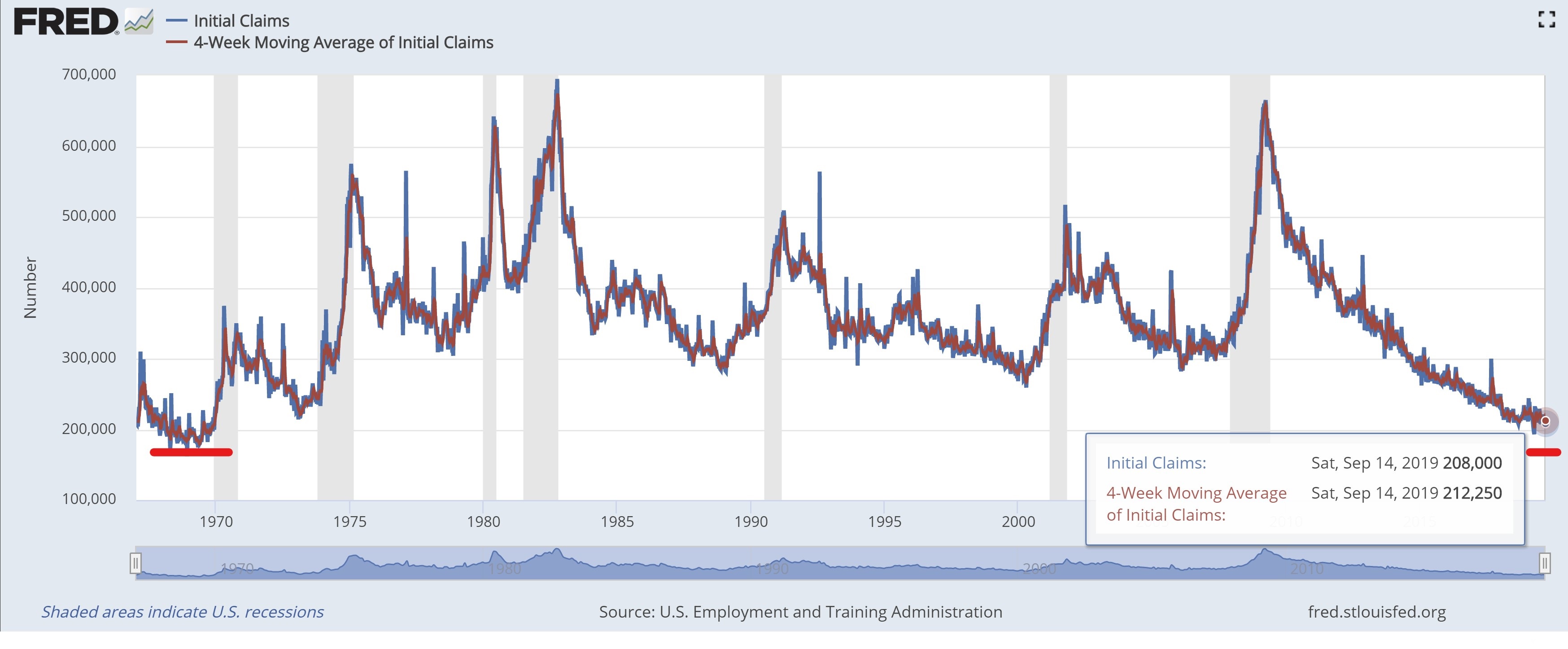

Each week the Department of Labor reports on weekly unemployment insurance claims. As you can see in the chart above, there is a pronounced downward pattern in the number of new claims. In fact, it’s been decades (see the two horizontal red lines drawn in the chart above) since the tally was lower in America, and this data is seasonally adjusted but not adjusted for population growth, so these levels are really low. Americans are working. But what about those that aren’t happy with their jobs?

There’s a statistic for those fed up with their employer. In another report from the BLS called Job Opening and Labor Turnover Survey (aka JOLTS ), they offer data on those quitting their jobs. Quits typically represent those willing to leave a job behind, so they act as a measure of workers’ willingness and even ability to separate from an employer. The most recent data we have came out a few days ago and gives us a look at July 2019 when quits reached an all-time high of 3.6 million. In short, Americans feel more comfortable in their ability to find another employer than possibly ever.

For an economy as dependent on consumers as America, a confident labor force is important. Yes, our nation’s current economic situation is not perfect (e.g., Atlas would like to see more capital investment from businesses), but there is still plenty of good coming out of the consumer side of things. Another economic contraction will arrive one day, but we cannot see it rumbling down the pike just yet.