Pendulum Periodicity

Submitted by Atlas Indicators Investment Advisors on October 28th, 2021

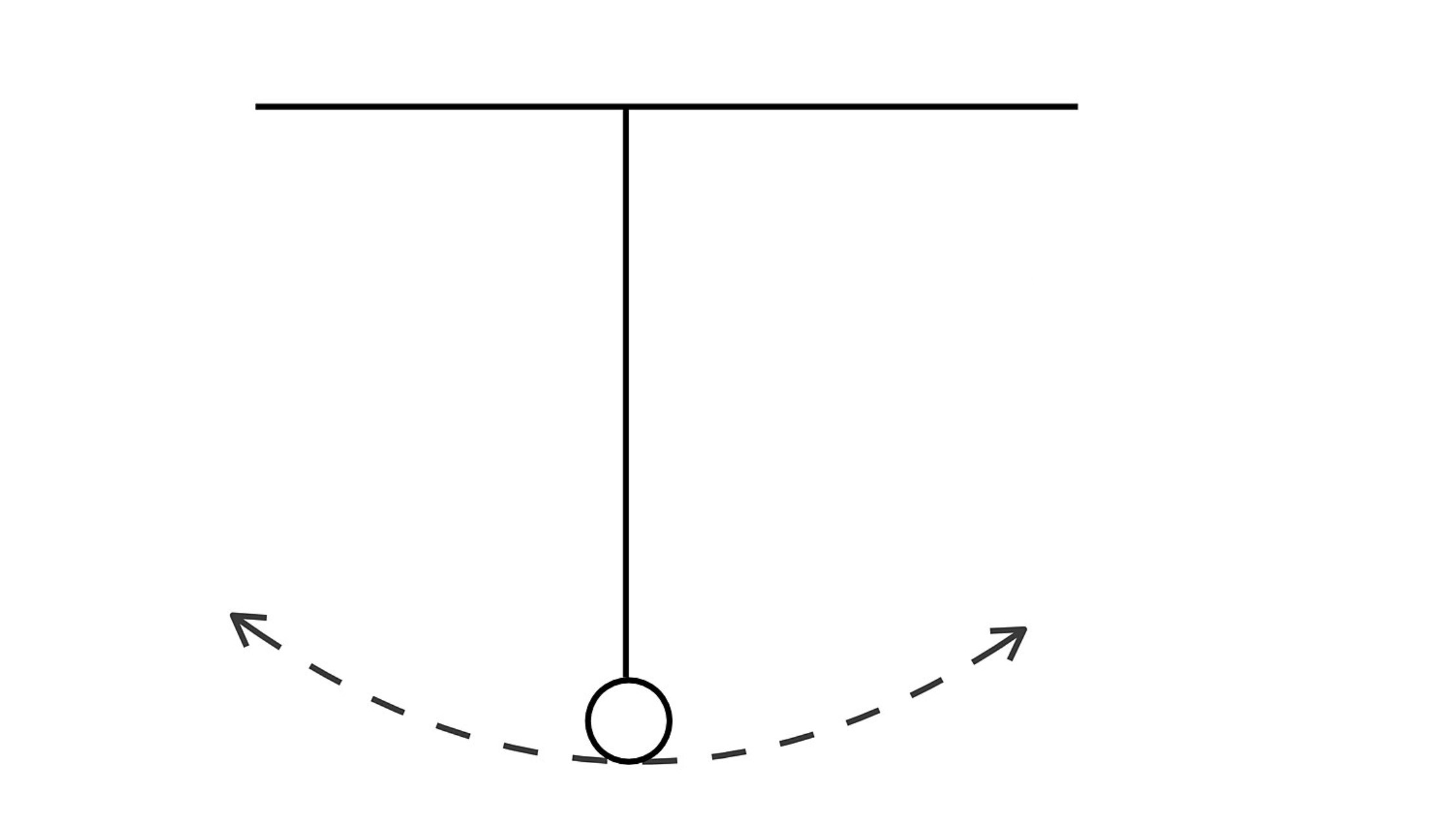

Pendulums are simple mechanical objects. They are made of just three parts: a pivot, a rod, and a bob at the end of the rod. Without an exogenous force, they spend their time sitting in equilibrium (i.e., hanging straight down). However, they get interesting once a force is exerted on the bob. You know the pattern; they move from one side to the other, in a hypnotic fashion.

A labor economy typically has a simple design. It’s comprised of labor and employers. They tend to see the world through different perspectives but are usually able to agree to work together. Every once in a while, a force might arise, which disrupts this equilibrium. We could be in the midst of such an event now, one catalyzed by the global pandemic.

Recently, the pendulum has been creeping toward the side of labor. Have you noticed headlines about strikes becoming more commonplace these days? Work stoppages have happened across a variety of industries. Industrial factories in Iowa are dealing with one now, as is one of the country’s largest cereal producers. Nurses are feeling undercompensated these days as they battle fatigue caused by the pandemic. Distilleries in Kentucky are mashing out the details of new contracts, and in typical Hollywood fashion, an eleventh-hour deal was struck keeping productions moving forward.

There are likely PhDs to be newly minted studying the causes of this shift, and there results over time. They won’t be in Newtonian Physics. Instead, sociologists and economists are likely to tackle this pendulum shift. We’re likely years away from more fully understanding the phenomenon; Atlas can’t help but think labor is undergoing a serious recalibration regarding its self-perceived worth in America.