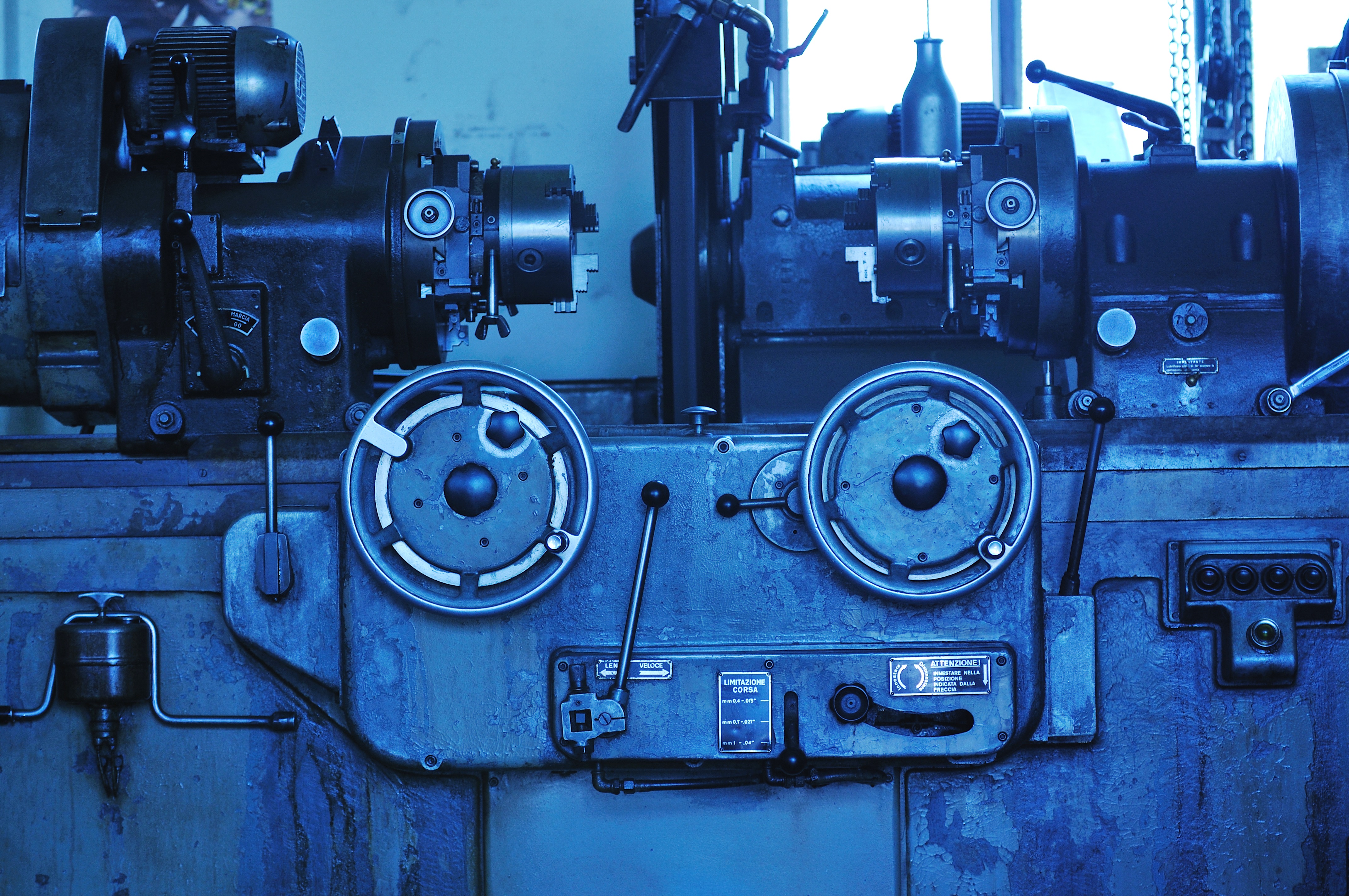

October 2017 Industrial Production

Submitted by Atlas Indicators Investment Advisors on November 17th, 2017

America’s output of physically made goods continued growing in October 2017 according to the latest data from the Federal Reserve’s measure of Industrial Production. After two months of suppression caused by Hurricanes Harvey and Irma, this cyclically sensitive indicator maintains its positive trend. Notwithstanding the upward trajectory of the headline tally, details were mixed.

Two of the three major industry groups moved higher. Manufacturing, the largest of the three, jumped 1.3 percent following an increase of 0.4 percent in September. Nondurable producers led manufacturing output as the more ephemeral goods soared 2.3 percent; returning to a more normal schedule after major slowdowns due to the hurricanes, the level of chemical production increased 5.8 percent, while petroleum and coal products improved 4.0 percent. Additionally, durable goods managed a respectable 0.4 percent uptick. Utilities were the other major industry group with a positive contribution, growing 2.0 percent as the final quarter of the year got underway. Finally, mining output dropped 1.3 percent, reflecting reductions in all of its major components.

Capacity utilization remains below its long-term trend despite an uptick in October. Our nation used 77.0 percent of its potential in the period. This is still 2.0 percentage points below the average from 1972 through 2016. In theory, the relatively low level suggests the economy could increase its output of physically made goods without creating a material change in inflation.

Industrial production is another indicator demonstrating the upward trajectory of our economy. More specifically, manufacturing remains robust. While this industry group does not employ as many people as in prior generations, it remains an important foundation of the nation. It is sensitive to the contours of the business cycle and maintained a positive slope as the fourth quarter of 2017 got underway.