Adjourned Until Next Year and Straight Lines

Submitted by Atlas Indicators Investment Advisors on December 17th, 2023

America’s central bank gathered for the final time in 2023 this week. As was widely expected, there was no change in the Fed Funds Rate. This is the rate banks charge each other for overnight lending and is set by the Federal Reserve. Votes in the halls of the Eccles Building were unanimous, something we can’t say about ballots in other halls within our nation’s capital.

Despite their decision to leave rates alone, the Federal Open Market Committee released a statement detailing potential catalysts for future changes. In the prepared remarks they mentioned, “Recent indicators suggest economic activity has slowed from its strong pace in the third quarter.” Daily readers of Atlas’ notes likely saw the overview of gross domestic product we sent out on Wednesday, showing growth improved to an annualized 5.2 percent from July through September this year. Now the team of economists at the central bank believe it will be less robust to end this year.

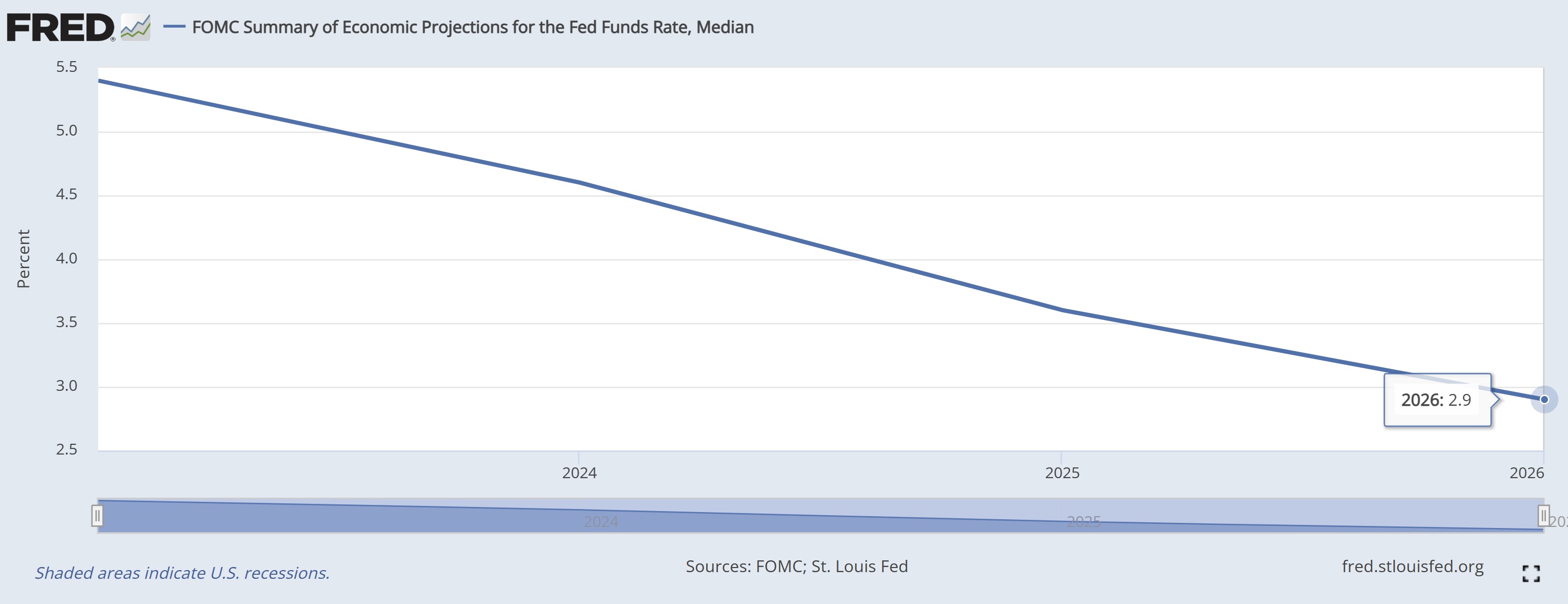

They also included their forecast from 2024 through 2026. This outlook includes their growth expectations which are between 1.4 percent and 1.9 percent during those years (pretty straight). Despite decelerating output, they don’t anticipate hitting their 2.0 percent inflation target until about the end of 2026 (a straight line down). Meanwhile, they believe unemployment will drift higher, reaching 4.1 percent next year and maintain that level through the duration of their forecast (another straight line).

Given their expectation that inflation will remain higher than desired, they seem ready to keep monetary policy relatively restrictive. They’ll continue draining liquidity out of the economy by selling Treasury securities, agency debt, and agency mortgage-backed securities on their balance sheet, thus removing cash out of the economy. They believe that “the U.S. banking system is sound and resilient.” Their assumption gives them the room to continue tightening financial and credit conditions in order to further slow economic activity, hiring, and inflation without causing worrisome levels of stress on the economy. The line above, details their straight-line forecast of their overnight policy.

Ultimately, the central bank seems committed to keeping inflation under control. The Fed once again expressed that returning inflation to 2.0 percent is its objective. Even with expectations of slower growth ahead, further reducing inflation remains their priority. That’s all well and good, but when economists use long rulers to illustrate their economic growth predictions, Atlas pays attention because rarely does something as complex as the American economy move in a straight line. If a significant enough downturn unfolds, expect large adjustments to their growth, inflation, employment, and policy forecasts.