Central Bank Hole

Submitted by Atlas Indicators Investment Advisors on July 30th, 2021

Scientific laws are both derived and sustained by generations of repeated observations of natural phenomena. Physical sciences are founded on the unveiling of these laws. In other words, something like chemistry or geology wasn’t invented but discovered. That doesn’t mean scientists don’t postulate about yet-to-be discovered phenomena, but until an idea is empirically proven, it’s just a theory.

One of the most well-known yet difficult to understand theories came from Albert Einstein: relativity. In short, the Ph.D. from the University of Zurich was trying to solve problems which eluded classical mechanics: the law of motion and gravitation formulated by Sir Isaac Newton. One prediction Albert Einstein made regarding black holes may just have been witnessed for the first time recently. Apparently, an astrophysicist from Stanford University witnessed light (in the form of X-rays) from behind a black hole. A quick reminder, black holes are so dense that their gravitational pull keeps anything, including light, from escaping, so seeing something directly behind a black hole seems impossible. As it turns out, the black hole is so dense, it warps space, twisting it so light sourced behind it appears in front.

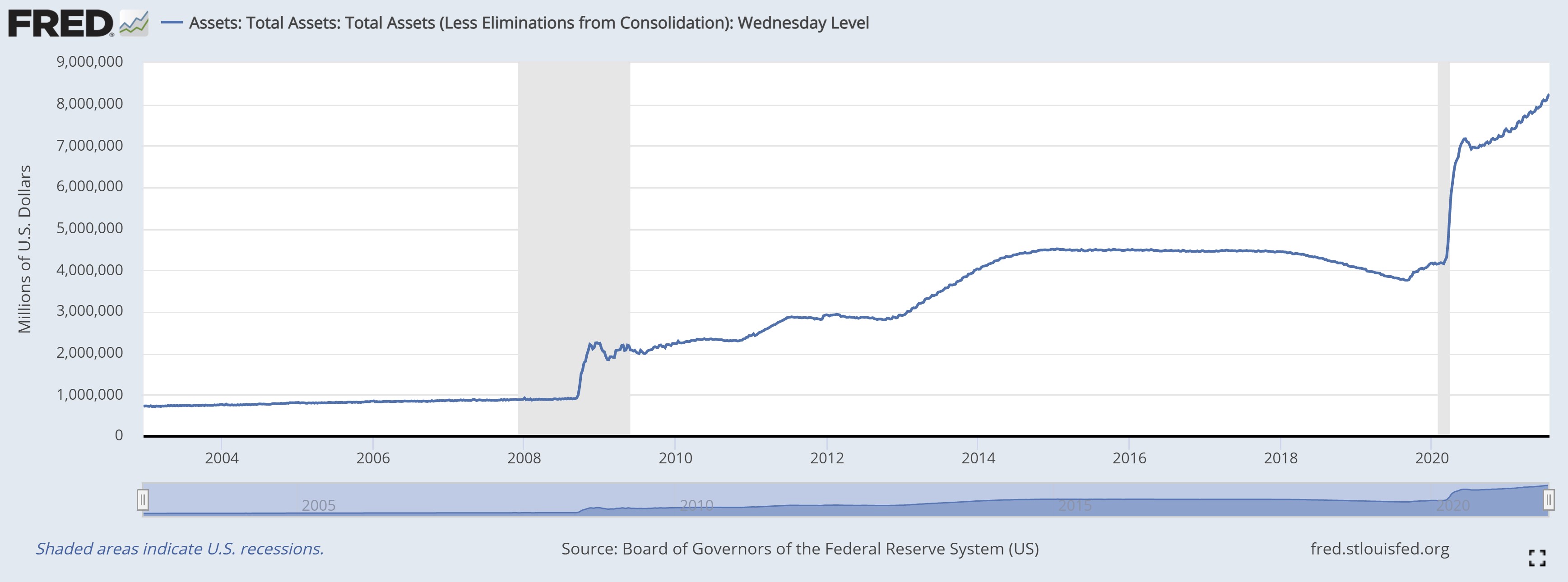

Doesn’t it remind you of central banking? A massive balance sheet warping the economic backdrop in ways for which old textbooks (and even recently updated editions) don’t account. Every month the Federal Reserve’s assets grow by $120 billion in Treasury and mortgage-backed debt. But social sciences don’t come with laws (no wonder so many misfits flock to study them!). They are strictly theoretical, in part because they study society and social relationships which are always in flux.

Back when the Federal Reserve was printing copious amounts of cash and growing its balance sheet during the Great Financial Crisis of 2008-09, concerns about inflation were running high and understandably so. One definition of inflation is too many dollars chasing too few goods, so the thought was that the newly printed dollars would make their way into the economy and hyperinflation would follow. While prices rose, they did so with much less sensitivity than many expected. Now the Fed’s balance sheet is so much bigger (see the chart above), and worries about faster-than-normal inflation are growing again.

Outcomes expected when forces are exerted on physical matter are predictable. Events at subatomic levels according to the findings in Palo Alto seem to confirm Big Al’s theory. The same cannot be said for the economy. Our central bank is exerting its influence in ways larger than ever, yet nobody knows what consequences will materialize. Atlas will continue observing the data and keeping an open mind to the spectrum of potential outcomes.