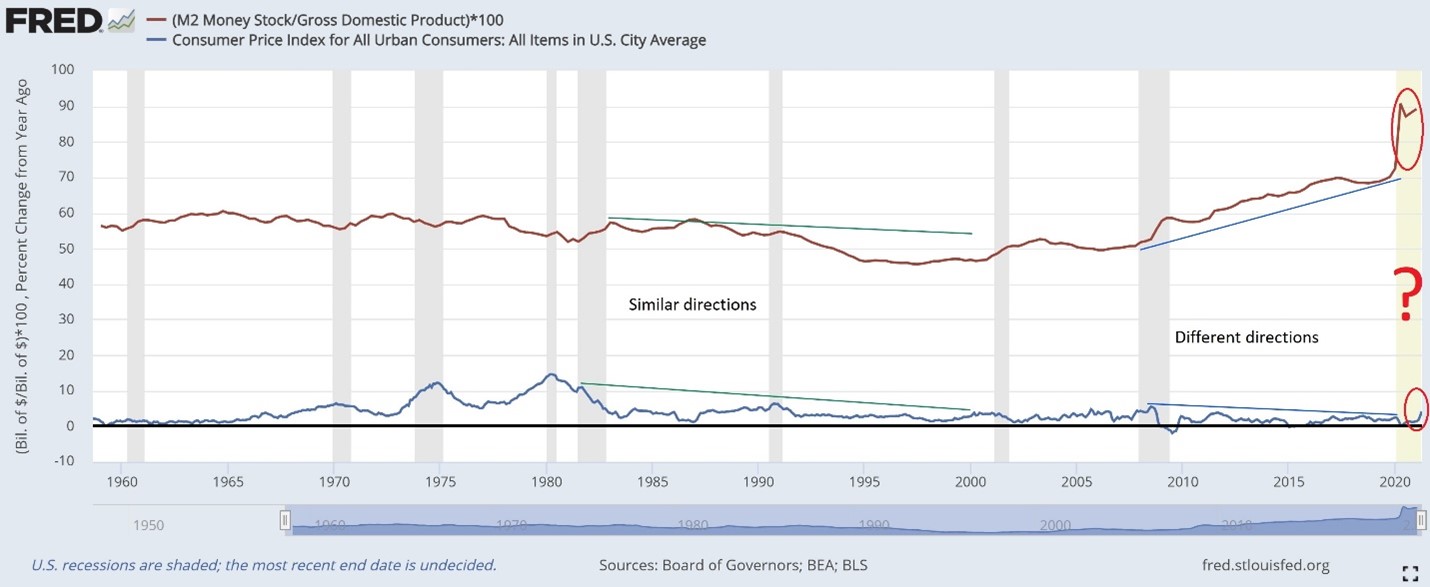

Classic Relationships

Submitted by Atlas Indicators Investment Advisors on May 28th, 2021

Classic relationships can be so romantic. They can even inform our own ideas about the successfulness of our pairings. Take Ethel and Fred Mertz. I know Lucy and Ricky are the main characters, but their neighbors really crack me up. Like Fred, I can’t tell you how many times I’ve looked for the price tag on some item my wife wants to get rid of because I thin