October 2019

September 2019 Retail Sales

Submitted by Atlas Indicators Investment Advisors on October 23rd, 2019

There wasn’t a lot to celebrate in the September 2019 Retail Sales release from the Census Bureau; however, Atlas will find a way to cheer it on later in this note. But first we must deal with the negatives. The headline is a good place to start as the overall statistic dropped 0.3 percent, giving back most of the prior period’s 0.4 percent gain.

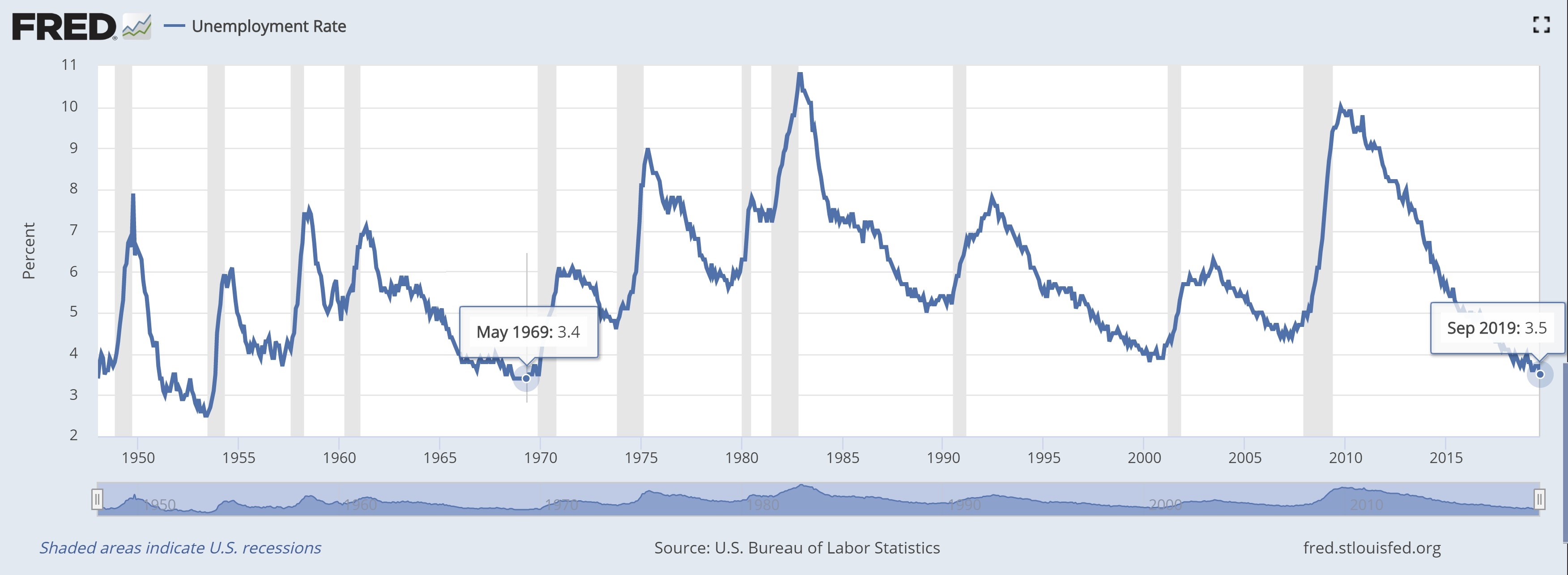

September 2019 Employment Situation

Submitted by Atlas Indicators Investment Advisors on October 16th, 2019

American firms continued adding jobs in September 2019 according to the Bureau of Labor Statistics. Their latest tally indicates 136,000 net new jobs were gained in the period. However, this improvement is slower than the upwardly revised tally of 168,000 (originally 130,000) in August. Despite the slowing rate of improvement, the unemployment rate fell to just 3.5 percent, th

We Are the Champions

Submitted by Atlas Indicators Investment Advisors on October 10th, 2019

Did you hear the good news? The Los Angeles Lakers played a fantastic first half of their opening pre-season game! Anthony Davis, their new power forward, scored 22 points, and future Hall of Famer Lebron James added 15 himself. While this first half was an encouraging 24 minutes of basketball, it doesn’t count toward the season’s tally, so plans for a championship

Automatic Sharing

Submitted by Atlas Indicators Investment Advisors on October 3rd, 2019

Our economy is currently in the middle of its longest economic expansion ever. Sometimes it’s tough to imagine the Great Recession ended over a decade ago or that the first recession of this century started over 18 years ago. During both downturns, output was in steep decline and firms were hemorrhaging jobs by the hundreds of thousands each week (e.g., in March 2009, the net