Economy

September 2019 Retail Sales

Submitted by Atlas Indicators Investment Advisors on October 23rd, 2019

There wasn’t a lot to celebrate in the September 2019 Retail Sales release from the Census Bureau; however, Atlas will find a way to cheer it on later in this note. But first we must deal with the negatives. The headline is a good place to start as the overall statistic dropped 0.3 percent, giving back most of the prior period’s 0.4 percent gain.

January 2019 Chicago Fed National Activity Index

Submitted by Atlas Indicators Investment Advisors on March 3rd, 2019Economic growth slowed in January 2019 according to the latest data from the Chicago Fed National Activity Index (CFNAI). This index of 85 components dipped to minus 0.43 from after hitting +0.05 in December 2018. Since this indicator moves quite a bit each month, Atlas pay attention to the three-month moving average; it fell to 0.0 (a reading which indicates moderate growth) from 0

Where’s the Fulcrum?

Submitted by Atlas Indicators Investment Advisors on March 1st, 2019

Monetary policies executed by the Federal Open Market Committee (FOMC) are designed to fulfill our central bank’s dual mandate: full-employment and price stability. What the heck do those terms mean?

Pausing

Submitted by Atlas Indicators Investment Advisors on January 21st, 2019Gross Domestic Product Advance Estimate First Quarter 2018

Submitted by Atlas Indicators Investment Advisors on May 8th, 2018March 2018 Chicago Fed National Activity Index

Submitted by Atlas Indicators Investment Advisors on April 30th, 2018

After a strong uptick in February, the Chicago Fed National Activity Index took a bit of a breather in March 2018. This indicator, which looks at 85 components, decelerated to +0.10 versus +0.98. Adding to the tepid tone of the release, the three-month moving average slowed to +0.27 from +0.31 a month earlier.

March 2018 Retail Sales

Submitted by Atlas Indicators Investment Advisors on April 24th, 2018

Retail sales were strong in March according to the Census Bureau. This is good for an economy like ours which thrives on consumption. Sales for retail and food services increased 0.6 percent to end the first quarter of 2018. This uptick follows a disappointing February which experienced a declined of 0.1 percent.

Fourth Quarter 2017 GDP Final Revision

Submitted by Atlas Indicators Investment Advisors on April 10th, 2018Advance Gross Domestic Product 4th Quarter 2017

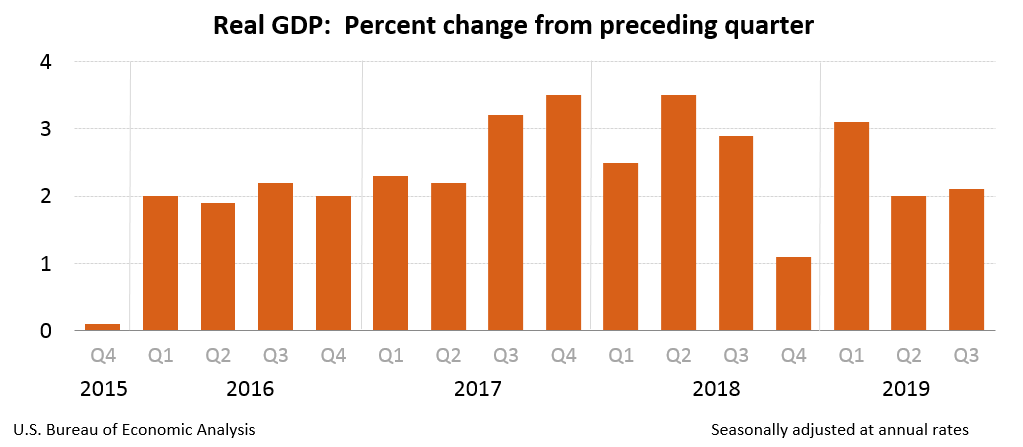

Submitted by Atlas Indicators Investment Advisors on February 6th, 2018America’s economy decelerated in the final three months of 2017 according to Gross Domestic Product (GDP) data from the Bureau of Economic Analysis (BEA). On an inflation-adjusted annualized basis, output grew by 2.6 percent from October through December. This followed improvements of 3.1 percent and 3.5 percent in the second and third quarters respectively. Despite the