Mom and Pop, Not Pawn Shop

Submitted by Atlas Indicators Investment Advisors on April 29th, 2025

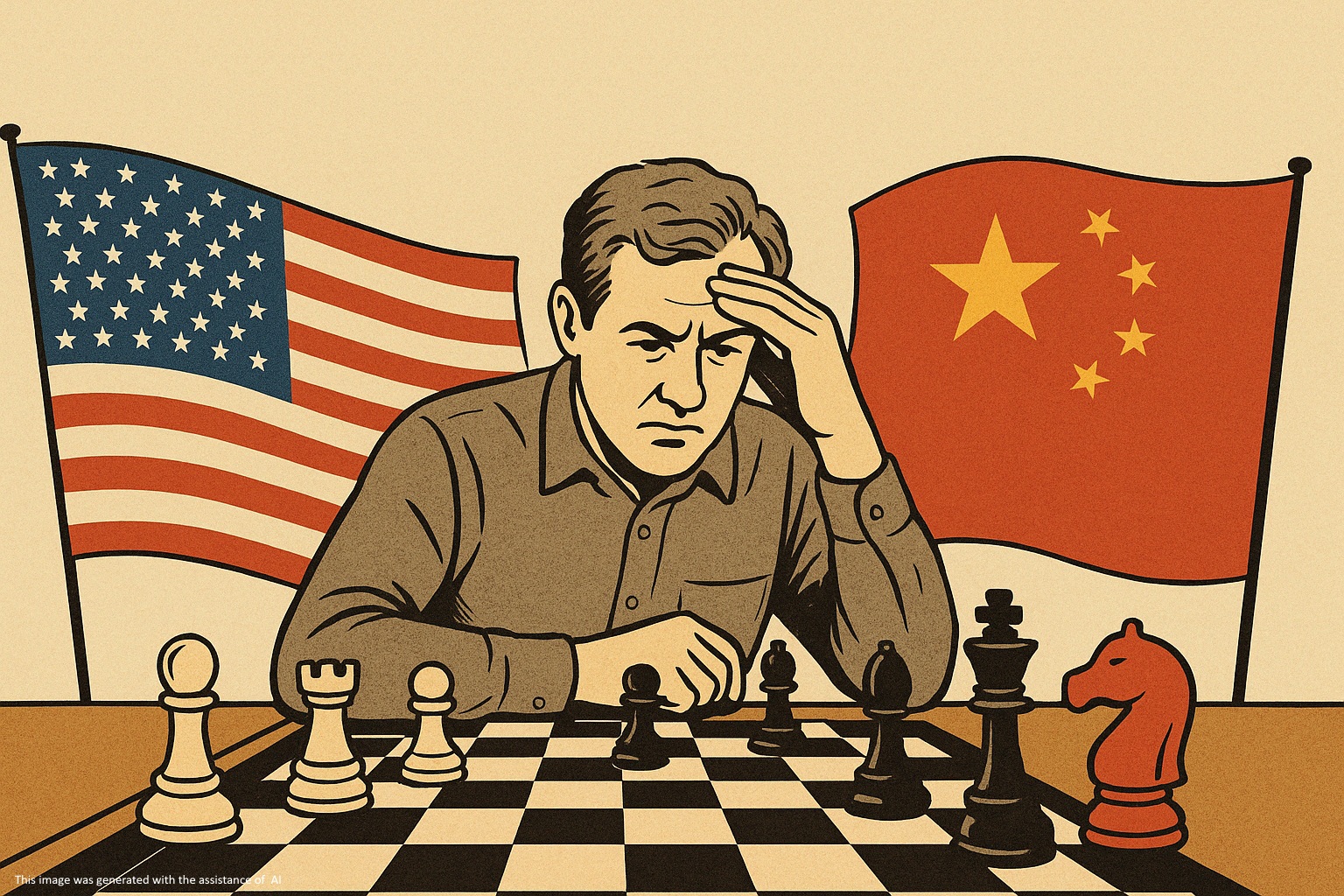

In chess, success often depends on anticipating several moves ahead while adapting to changing circumstances. Similarly, American businesses must balance short-term tactics with long-term strategies. Not only are these firms competing with changing supply and demand, but policymakers can also rearrange the board, requiring businesses to change strategies at the drop of a hat (or tariff).

American businesses today find themselves in a chess match of unprecedented complexity, navigating the volatile board of a global trade war. Each move comes with consequences such as absorbing costs, raising prices, or reconfiguring supply chains.

Like the opening phase of a chess game, businesses must position themselves strategically to withstand the immediate impacts of tariffs. For companies dependent on imports like board games, textiles or electronics, the steep duties (some as high as 125 percent) might be akin to losing key pieces early in the game. These businesses face a dilemma: raise prices and risk alienating customers, or absorb costs and weaken their defenses (profit margins). Smaller enterprises are particularly vulnerable, as their limited resources make it harder to recover from any initial sacrifices.

For a company, supply chain stability is like having control of the board’s center (remember how hard it got during COVID?). The increased unpredictability of tariff policies can be likened to an opponent suddenly shifting to unfamiliar strategies mid-game, forcing companies to react to unexpected increases, sometimes on shipments already en route. Attempts to pivot, such as sourcing materials domestically, may prove unfeasible due to higher costs or limited capacity, leaving many businesses with few viable moves. A lack of stability could undermine their long-term viability.

The broader economic consequences of prolonged tariffs resemble the endgame in chess, the phase where every move carries heightened significance. Retaliatory actions from trading partners like China or the European Union may further limit market access and increase export costs for U.S. companies. This could lead to inflation and reduced consumer spending, threatening individual businesses in particular. For small and medium-sized enterprises, this stage is especially difficult as they are likely playing with less maneuverability than their larger counterparts. In the end, the risks of being cornered into downsizing or closure are rising, possibly forcing them into a checkmate scenario.