Priced for Perfection

Submitted by Atlas Indicators Investment Advisors on March 31st, 2024

Don’t you remember a time when the year 2000 sounded like far into the future? Now we’re nearly a quarter century past it, so let’s think about another year that feels distant: 2054. This is no arbitrary date chosen by Atlas. No. It’s an arbitrary date selected by the Congressional Budget Office (CBO). They just released their March 2024 Long-Term Budget Outlook, and it extends out thirty years.

This release attempts to project fiscal and economic conditions for the next three decades but does so with a few unrealistic presumptions. Perhaps unrealistic is an unfair characterization since they do not have a crystal ball, but they make their forecast assuming there will be no shocks like wars or something as simple as a recession. When was the last time you can recall America not being involved in some sort of conflict?

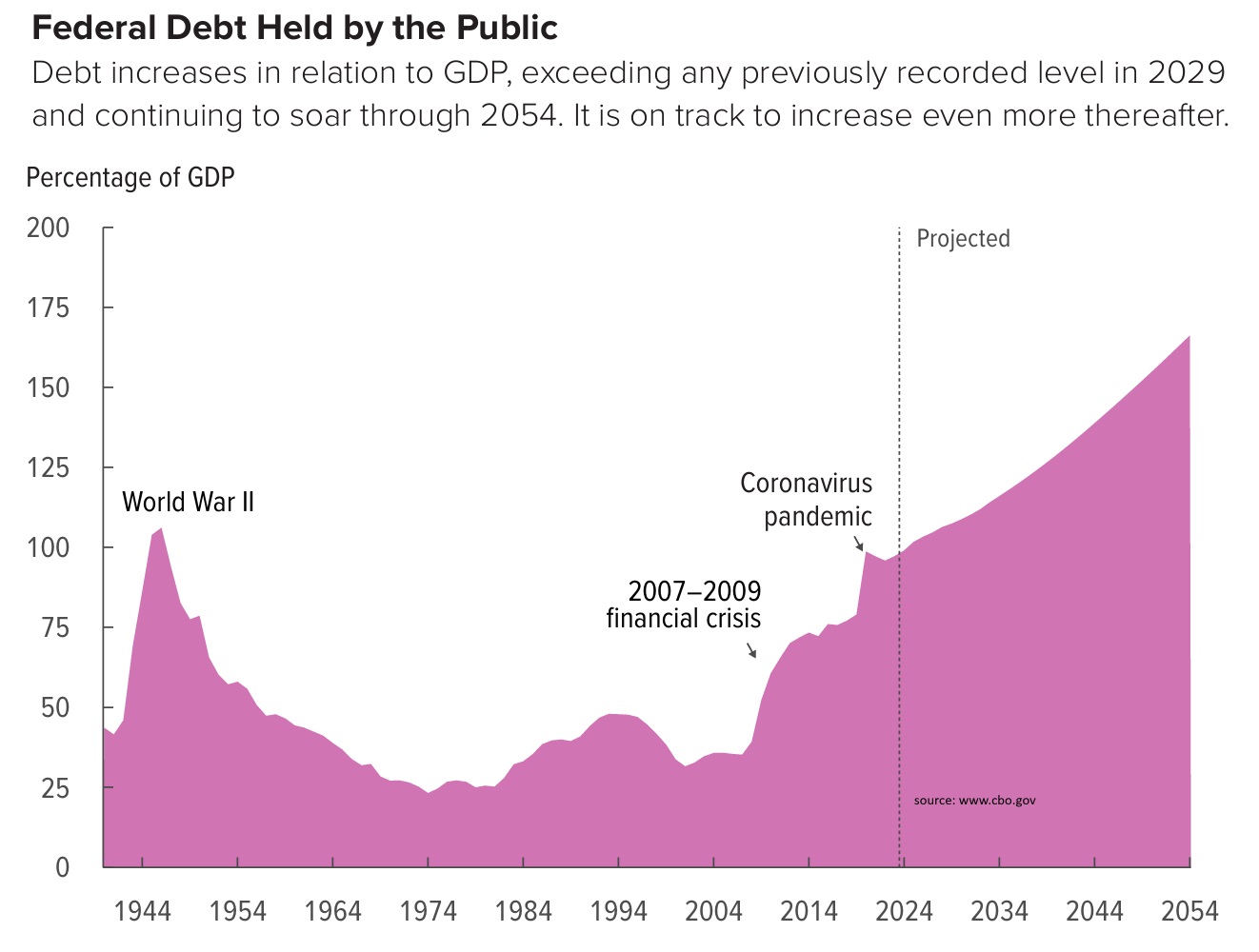

A shockless future is the not the most shocking thing in the report. Instead, it is the level of debt America is likely to owe even if the future unfolds with perfection. Despite making the heroic assumption of no bumps in the road, the CBO anticipates America’s deficit growing to 8.5 percent of gross domestic product (GDP) in 2054, up from roughly 5.6 percent this year. Over the next 30 years, they believe deficits will average 6.7 percent, a full 3.0 percentage points higher than the mean of the last 50 years. In just five years (2029) they expect the debt held by the public will reach 107 percent of GDP, passing the previous record set just after World War II. And remember this presumes no conflicts or recessions.

The CBO's report, with its unblemished vision of the future, stands as a testament to the limitations of predictions. Knowing the time and magnitudes of shocks is impossible. But that doesn't mean we shouldn't provision for them. Nor does it suggest we should live stressed by their arrival. Instead, Atlas prefers embracing the uncertainty, remaining flexible and adaptable as imperfections are revealed in real-time.