July 2018 Treasury Budget

Submitted by Atlas Indicators Investment Advisors on August 21st, 2018

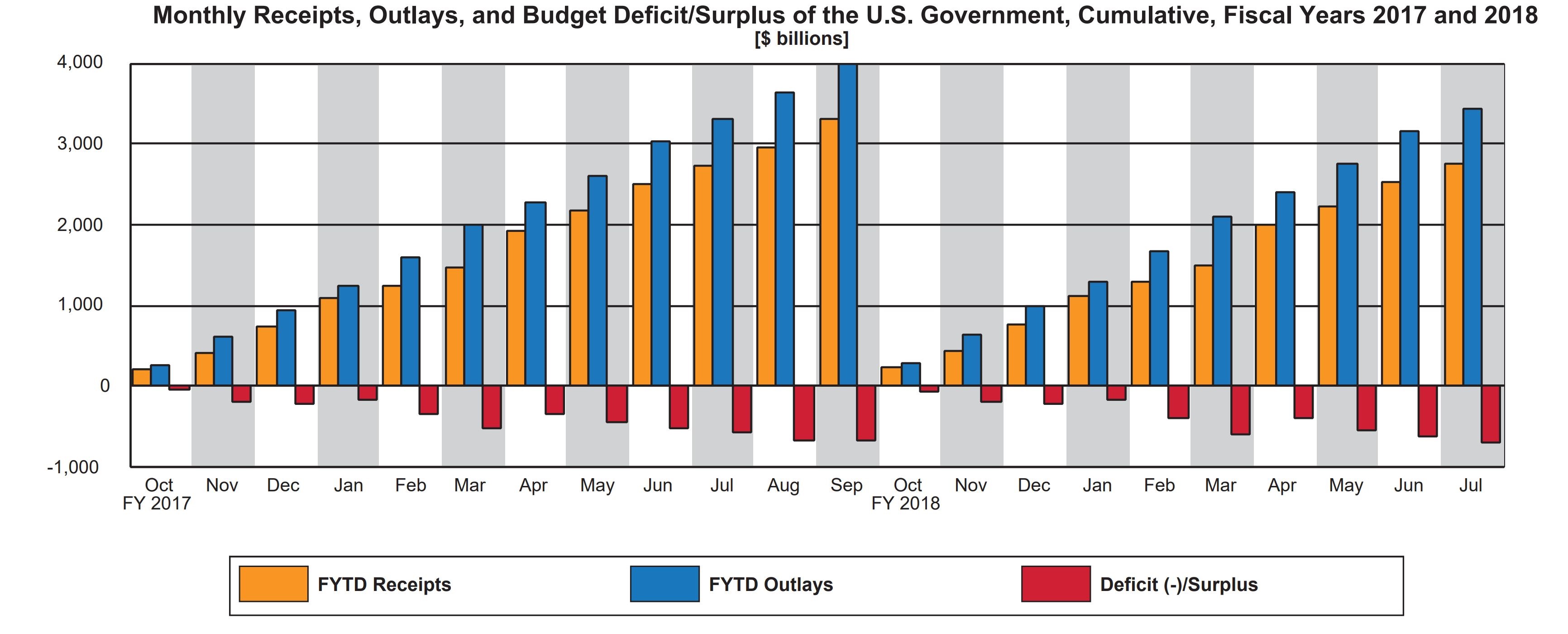

Your federal government went deeper into the hole in July 2018 according to the Treasury Department’s budget release. Spending outpaced revenues by $76.9 billion, increasing the monthly shortfall by $2.0 billion compared to June. Year-to-date, the fiscal deficit is $684.0 billion, 20.8 percent deeper than a year ago.

Revenues were much weaker in July than a month earlier. Receipts fell to $225.3 billion from $316.3 billion in June. However, revenue to the government is up 1.0 percent on a year-to-date basis. Individual income taxes are 7.8 percent higher from a year ago. Additionally, customs duties are 14.2 percent greater than in the same period of 2017. These gains are partially offset by a 28.5 percent decline in corporate taxes.

Federal spending is up 4.4 percent so far in 2018. Outlays by the Department of Agriculture (+2.3 percent), the Department of Defense (+5.8 percent), Department of Veterans Affairs (+6.0 percent), the Social Security Administration (+4.3 percent), and the Department of Health and Human Services (+3.3 percent) are some of the biggest expenses to the government and are all higher thus far in 2018. Finally, interest on the debt, the fourth greatest outlay, is up 12.3 percent versus last year; for some perspective, interest payments are now just 8.5 percent less than all military expenses this year.

America’s debt burden continued expanding in July. With two months left in the fiscal year 2018, our nation’s deficit is already larger than in all of the fiscal year 2017. According to an estimate from the Congressional Budget Office, America will begin accruing deficits greater than $1 trillion starting in 2020, and this level is expected to continue through as far as their projections go (2028). There are mixed feelings about the sustainability of our nation’s debt levels. Some argue there isn’t a limit since America’s is such a dynamic nation with the world’s reserve currency and strongest military, while others aren’t as sanguine. Admittedly, Atlas falls into the latter.