Cycles of Life

Submitted by Atlas Indicators Investment Advisors on December 28th, 2023A person's daily life is influenced by a complex interplay of various cycles.

A person's daily life is influenced by a complex interplay of various cycles.

Santa Claus is coming to town. He is spreading both joy and generosity as the year winds down. But the jolly fellow offers more than just good feelings.

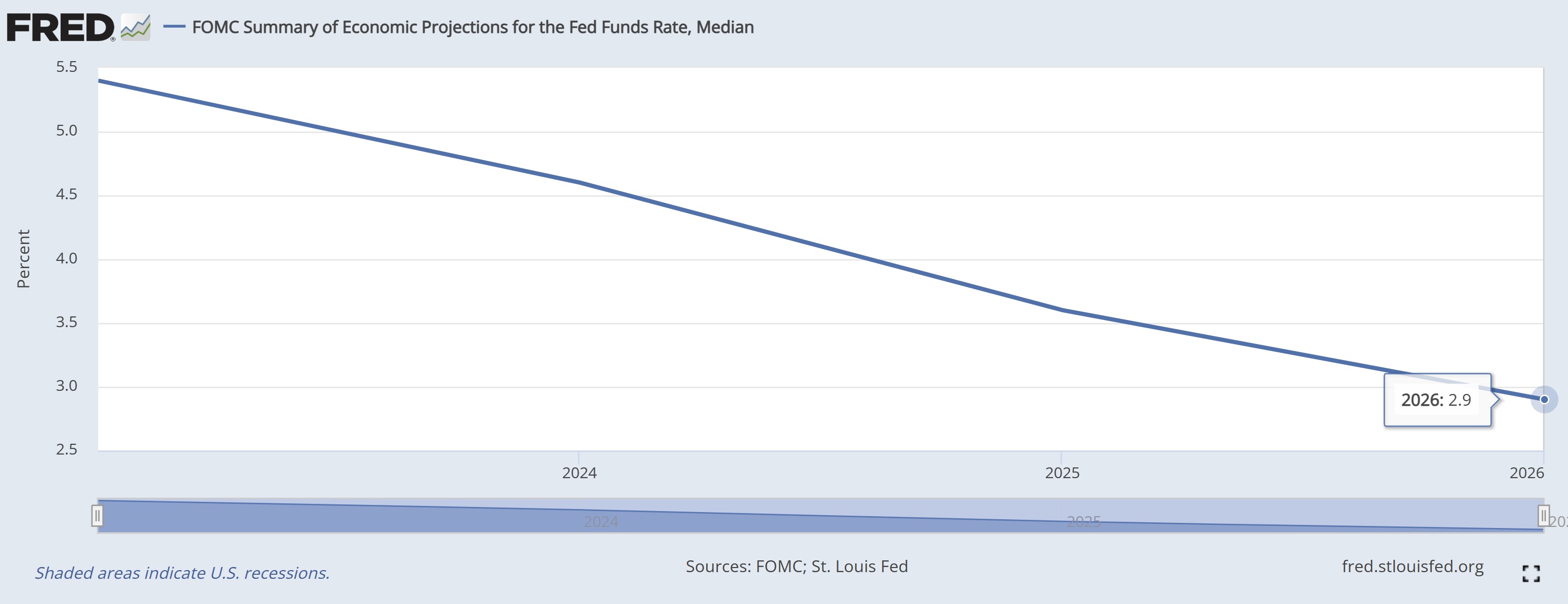

America’s central bank gathered for the final time in 2023 this week. As was widely expected, there was no change in the Fed Funds Rate. This is the rate banks charge each other for overnight lending and is set by the Federal Reserve. Votes in the halls of the Eccles Building were unanimous, something we can’t say about ballots in other halls within our nation&rsqu

Droughts can be devastating. Avocado farmers in Southern Spain are dealing with a difficult one now. The change is so dramatic that according to this Bloomberg article, one 86-year-old farmer has decided to take down 2,500 trees, now using th