Not Dry Yet

Submitted by Atlas Indicators Investment Advisors on December 8th, 2023

Droughts can be devastating. Avocado farmers in Southern Spain are dealing with a difficult one now. The change is so dramatic that according to this Bloomberg article, one 86-year-old farmer has decided to take down 2,500 trees, now using them as mulch for his next crop: mangos. California benefited from a particularly wet winter/spring recently, leaving it virtually drought free. But as you can see in the map here, other parts of the country are suffering through a parched period.

Inflation can parch an economy. When the costs of goods and services grow faster than incomes, the quantity of consumption falls. It’s like the avocado growers in Spain seeing their crops fall by 60 percent in one year. When such conditions develop, consumers can rely on savings to supplement their earnings to maintain consumption; it is kind of like a reservoir might provide for a grower in a drought. But like a pool of water without precipitation, savings can only last so long without being replenished.

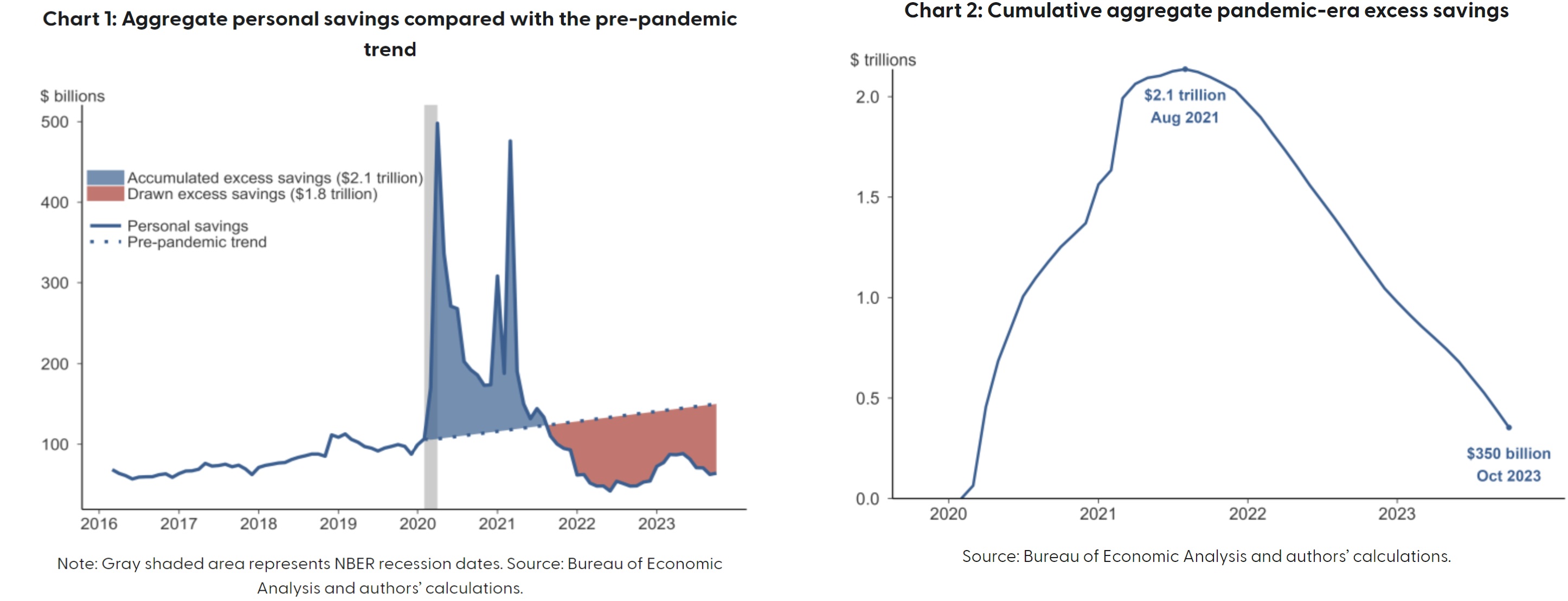

You may recall this note from Atlas back in September which reviewed the San Francisco Federal Reserve Bank’s estimate of excess savings. These are assets the central bank branch believes consumers have on hand as a result of the stimulus money sent in response to the pandemic. At the time, they believed the reservoir of cash would be depleted by the start of this quarter (Q4 2023). Recently, they made some adjustments to their findings. Using more complete data from the Bureau of Economic Analysis, Federal Reserve researchers now believe the excess savings will last into the first half of 2024. For your convenience, the San Francsico Branch has created this webpage to track the spenddown monthly.

Droughts are only reversed when rainfall resumes in an ample quantity. Inflation is different. Except under the worst of circumstance inflation doesn’t go away, at best it just worsens at a decreasing rate. For now, the economy seems adequately supported by the supplements from spending down savings. That won’t last forever. It remains to be seen if consumption can remain as robust as its recent trend or if a new pattern will develop in the quarters ahead.