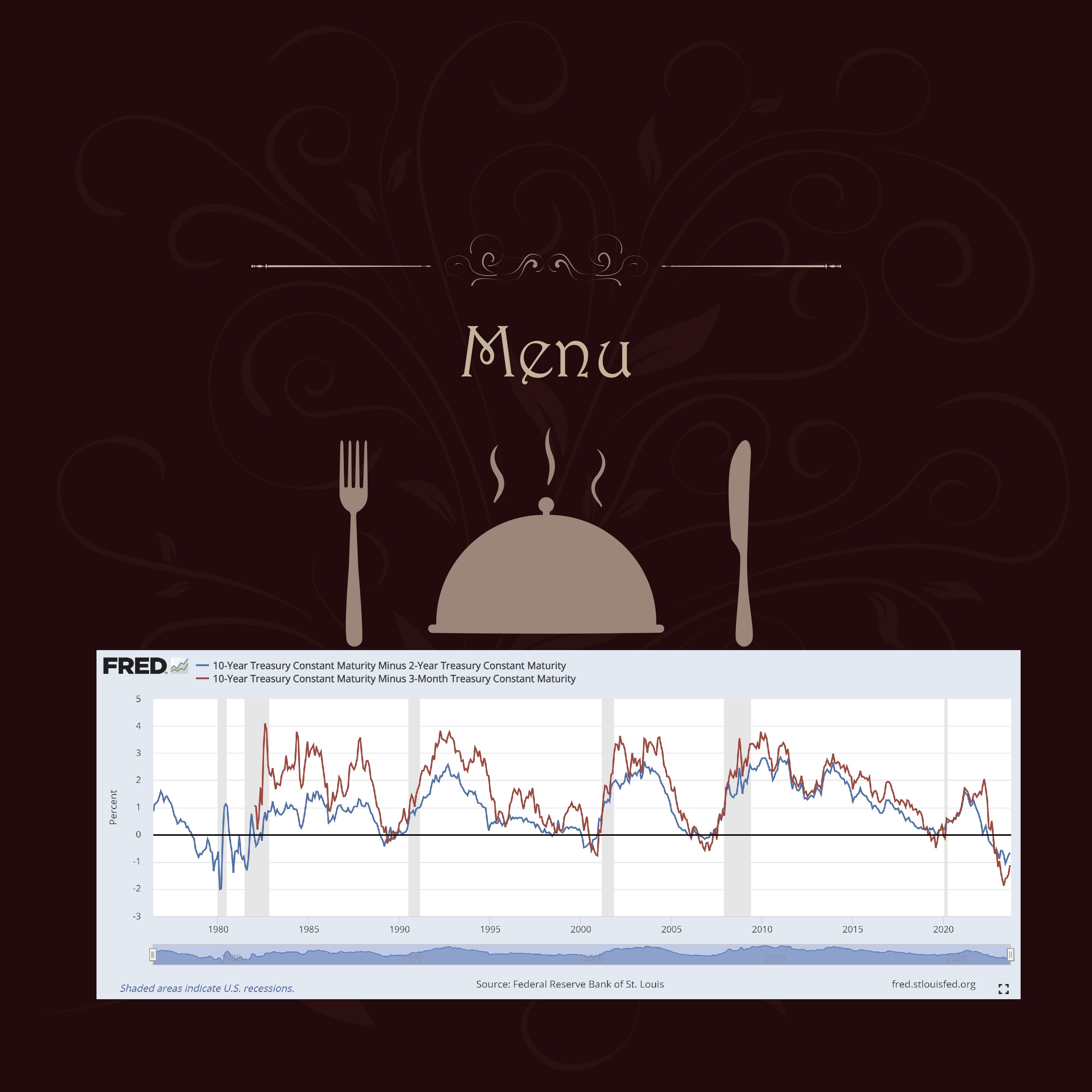

Is Recession Still on the Menu?

Submitted by Atlas Indicators Investment Advisors on September 30th, 2023

Interest rates are crucial to economic activity. They impact the costs and therefore the incentives of financing the three pillars of the American economy: consumption, investment, and government spending. Borrowing is done over various durations, from short to long. Costs of loans are typically found on a menu known as a yield curve.