Doo-doo-doo-doo

Submitted by Atlas Indicators Investment Advisors on March 31st, 2023

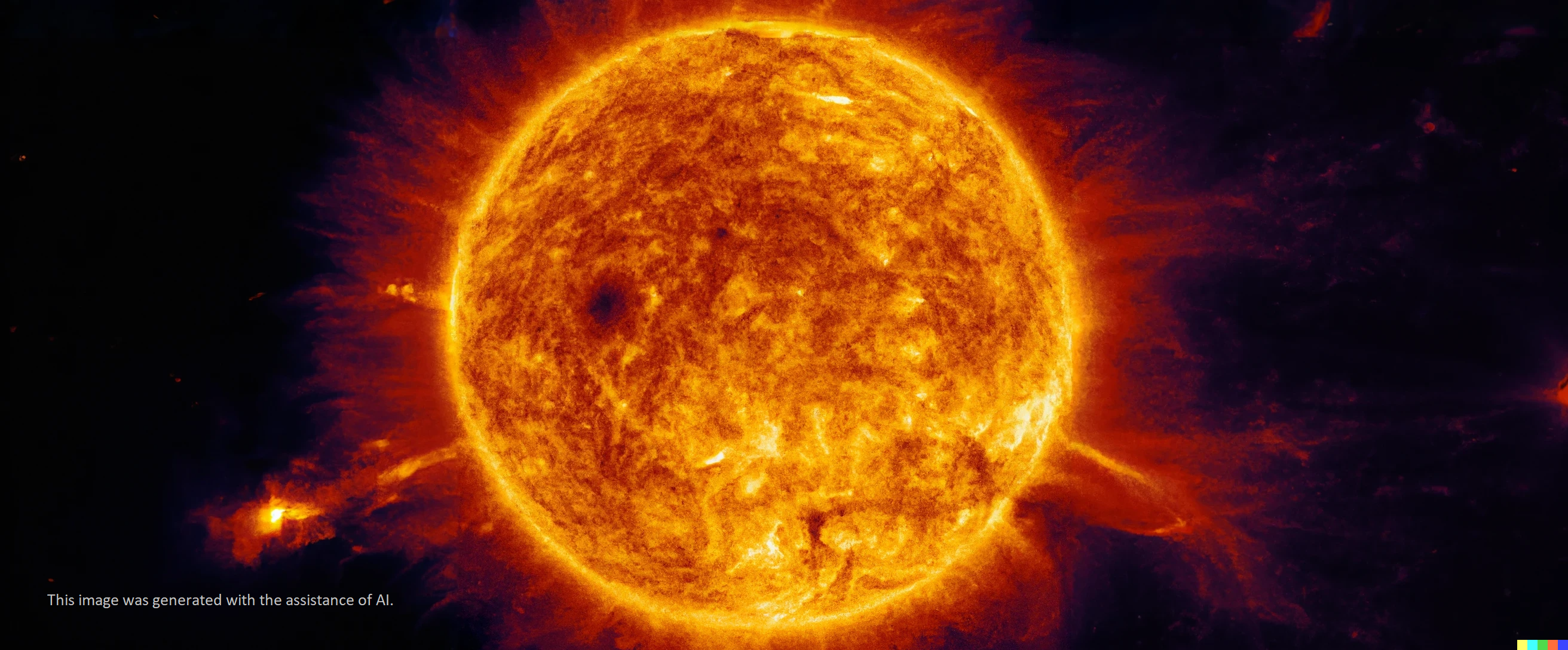

Unsure if we could use the name of a Beatles song as a title for a note to our audience, Atlas went with Doo-doo-doo-doo, but make no mistake, here comes the sun. Our planet’s original energy source is spewing solar winds our direction and a second round of them could be arriving today! Just last week scientists at NASA’s Solar Dynamic Observatory spotted a coronal hole