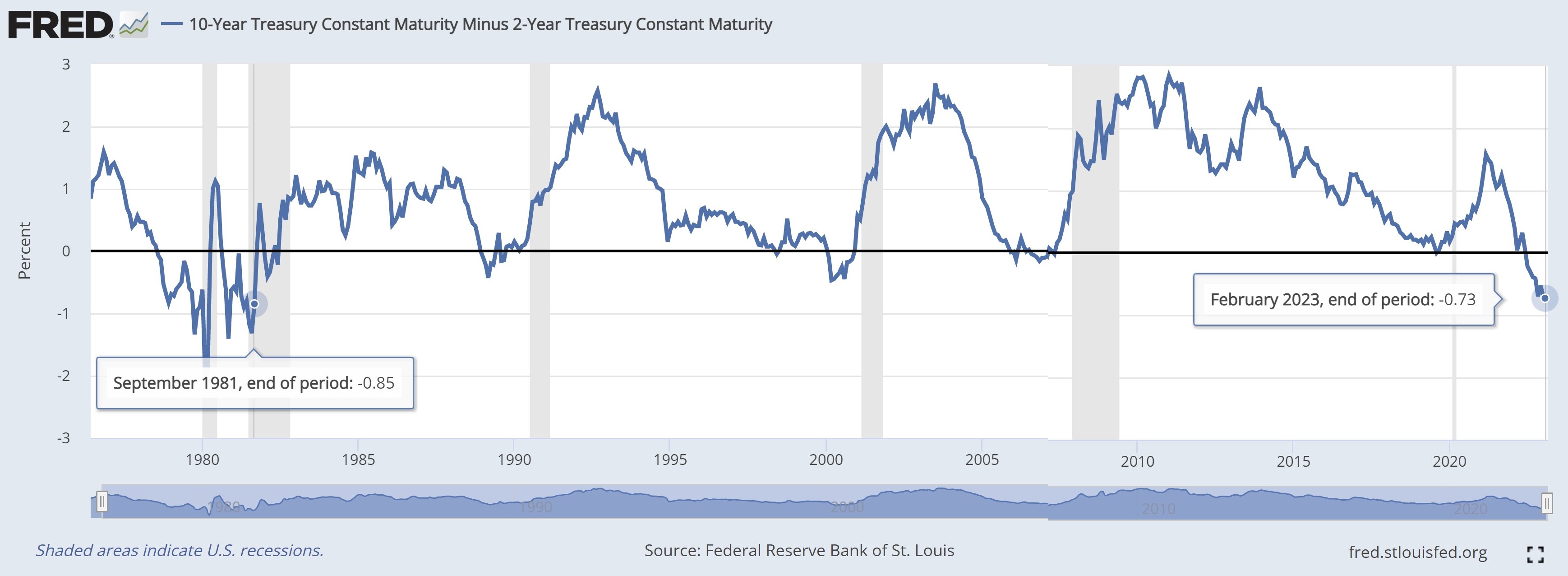

Misleading Indicators

Submitted by Atlas Indicators Investment Advisors on February 23rd, 2023

Economic indicators come is three varieties, differentiated by their timing. Some offer an insight into the future. We call these leading indicators; for instance, new orders data help us see a bit over the horizon. Others tell us more about the here and now; these are coincident indicators like industrial production or personal income. Finally, there are lagging indicat