July 2018 Institute for Supply Management

Submitted by Atlas Indicators Investment Advisors on August 16th, 2018

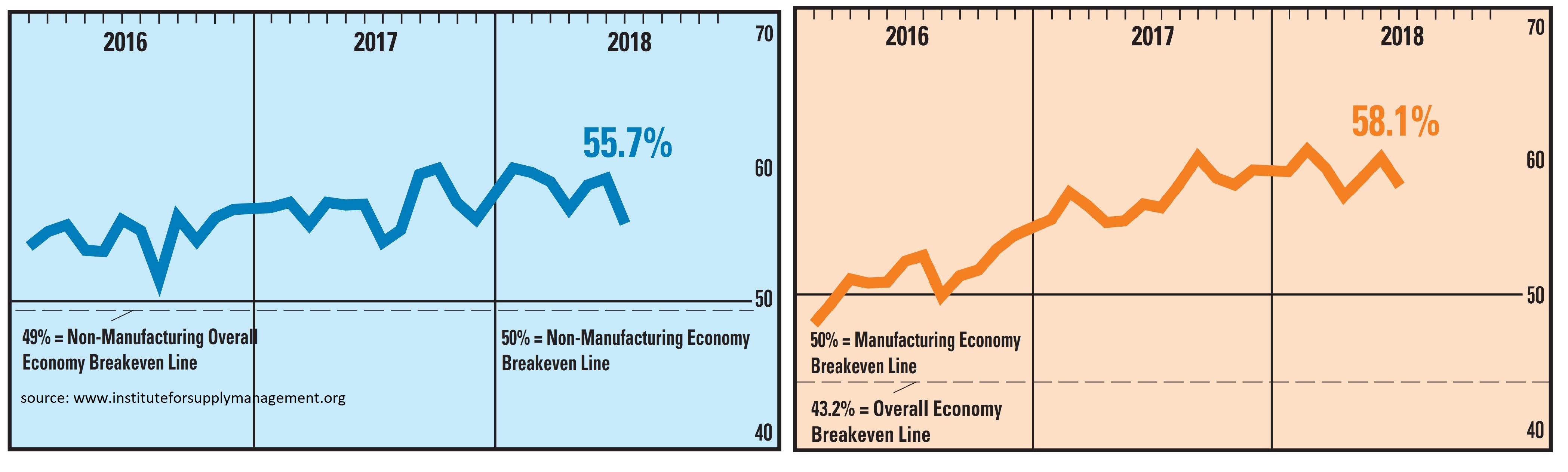

Economic output seems to have moderated in July 2018 according to the latest from the Institute for Supply Management. Both of their indices (representing manufacturing and services) pulled back from rather elevated levels as the second half of the year got underway. However, output is still growing even if it is decelerating.